My latest Financial Post column looks at how Millennials and other young people can create a million-dollar retirement fund if they start contributing $6,000 to a Tax-free Savings Account (TFSA) the moment they turn 18. You can find the full column online by clicking on the highlighted text: The Road to the million-dollar TFSA is getting shorter for Millennials. It’s also in the print edition of Wed., Feb. 26th, under the headline “The road to saving $1 m for millennials: TFSA likely the best way to start.” (page FP3).

I’ve always been enthusiastic about the TFSA since it was first possible to contribute money to them in January 2009. My wife and I, as well as our daughter till recently have contributed the maximum to them from the get-go, always early in January to maximize the power of tax-free compounding. All three accounts have done very well. (I won’t reveal the balances but they’re consistent with heavy equity exposure through most of the bull market we appear to have been in at least until this week.)

Suffice it to say that our daughter’s TFSA has done better than ours, despite her not having contributed in the last two years because she has been working out of the country. She insisted in owning most of the FANG stocks (including Apple) and even Tesla, which was underwater until very recently but began to make headway in recent months.

It’s purely by chance that having been born in 1991, our daughter became 18 just in time for her first TFSA contribution, which naturally we funded in the early years. We viewed this as maximizing our wealth and minimizing taxes for the family as a whole.

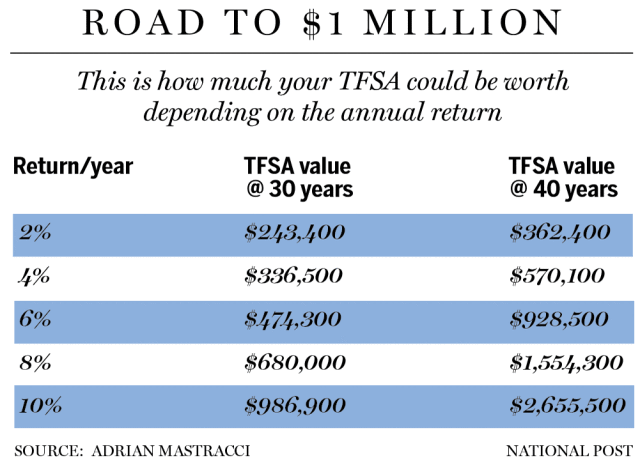

And that’s exactly the thrust of the FP article, which cites several experts who will be familiar to most readers of the Hub: Aaron Hector of Doherty & Bryant Financial Strategies, Matthew Ardrey of TriDelta Financial, Adrian Mastracci of Lycos Asset Management. Mastracci created the chart below that appeared in the FP story:

There was also valuable input from BMO Private Wealth’s Sylvain Brisebois, who created a spreadsheet to estimate the impact of missing contributions in early years. If you can’t start until 25, a six per cent return generates $1,049,000 by age 65, $600,000 less than the $1.63 million earned with the extra $42,000 you’d have saved and compounded starting at 18. Another scenario is contributing for seven years between 18 and 25, then using it to buy a home. Assuming no more contributions the next 10 years and resuming $6,000 contributions at 36, by age 65 you’d have $829,000. Brisebois also created a scenario where you only contribute $3,000 a year, which generates $815,000.

As we experienced in our family, a long time horizon favours Millennials, who can afford to take a little more risk in return for stronger returns. That in turn translates into either a bigger nest egg 40 to 45 years from now, or it means you can get to the magic $1 million mark 5 or even 10 years ahead of schedule. Of course, if you’re even younger than a Millennial (technically they must be age 24 in 2020 to qualify) so much the better, and all these principles apply equally to Generations X, Y or Z.

For that matter, as I have often written, TFSAs are equally attractive for those already in Retirement. Unlike RRSPs, you can keep contributing to your TFSA long into old age: I had a friend who proudly told me she was still contributing after she turned 100!

Mind you, after the Coronavirus fears of the past week, who can really say? Not so good for aging Baby Boomers and retirees but of course if you’re a Millennial any young person with multi-decade time horizons, it should be viewed as good news when stocks go on sale.