The Royal Bank of Canada (RBC) topped the list of big Canadian banks in serving the Retirement needs of Canadians, according to a new DALBAR study released this month. A first of its kind, the study — released on Feb. 5th and covered in the trade press — sought to assess how the Big 5 handled Retirement conversations through its retail branch network. It also rounded out the study with research on smaller banks, credit unions and regional financial institutions: 1,800 Canadians were polled, all with ten years or less until Retirement. 57% were males and and 74% had portfolios in excess of $100,000.

In this press release, DALBAR said “Retirement is an ever-growing concern for many Canadians, with increasing life expectancies, diminishing pensions, and a rising cost of living: the retirement nest egg has become more important than ever.”

Well, you’ll get no argument from me on that score, now that I’ve personally started to draw down on my own little nest egg. (Our family uses both RBC and TD, both for banking and through their online brokerage divisions. That’s typical, by the way: 29% of those polled had retirement money with more than one institution.)

“RBC representatives used their experience and expertise to ease client fears, imparted useful knowledge about closing retirement shortfalls, and made the client feel it was a financial coaching experience instead of a transactional one,” DALBAR said. To me, the significant phrase their was “financial coaching experience instead of a transactional one.” Clients rated their experience with RBC to be one of “financial coaching” 70% of the time, higher than the 53% rate at the other big banks.

Only 50% of bank reps introduced the benefits of proper financial planning, although 82% of clients were promised a financial plan. Only 44% of the meeting featured itineraries. And while CIBC, RBC and National Bank led in offering followup meetings with 90% or more of clients, Scotiabank (number 2 overall) led in talking about digital retirement tools at 80% of meetings.

DALBAR vice president Anita Lo said many Canadians realize that government safety nets alone (i.e. CPP/OAS/GIS) are not enough to support healthy retirement lifestyles, so “this is the time for the banks to shine in helping Canadians plan for retirement.”

No surprise that when it comes to Retirement (and I’d argue just about everything else), Canadians prefer speaking to a real person for financial advice instead of relying on online information: DALBAR cited a CIBC study that found that’s the case for 70% of us.

Wide variance in placement of CFPs and PFPs before clients

Staffing with personnel with key financial designations is obviously a plus. DALBAR found RBC places staff with either the CFP or PFP designation 83% of the time for client conversations about Retirement, compared to just 40 across financial institutions generally.

Among the remaining big banks, BMO was the runner-up in placing CFPs or PFPs in front of clients, at 43%, followed by TD at 30%, Scotiabank at 20% and CIBC at 13%.

The top six areas of interest in the poll were: Debt & Budgeting; Retirement lifestyle; Sources of income; Time until Retirement; Savings; and Pension Plans. Clients felt that Savings and Income were the most sufficiently covered and Retirement lifestyle was the least sufficiently addressed. Among the big Five, Scotiabank handled Retirement lifestyle the best, followed by BMO, RBC, CIBC and in fifth was TD on that category.

Time actually spent with clients at meetings about Retirement was also viewed as important. 91% of the time more than an hour was spent, but 80% were just 45 minutes to an hour; 70% a half hour to 45 minutes; and 29% were less than a half hour. Most clients felt half an hour was insufficient to address their concerns.

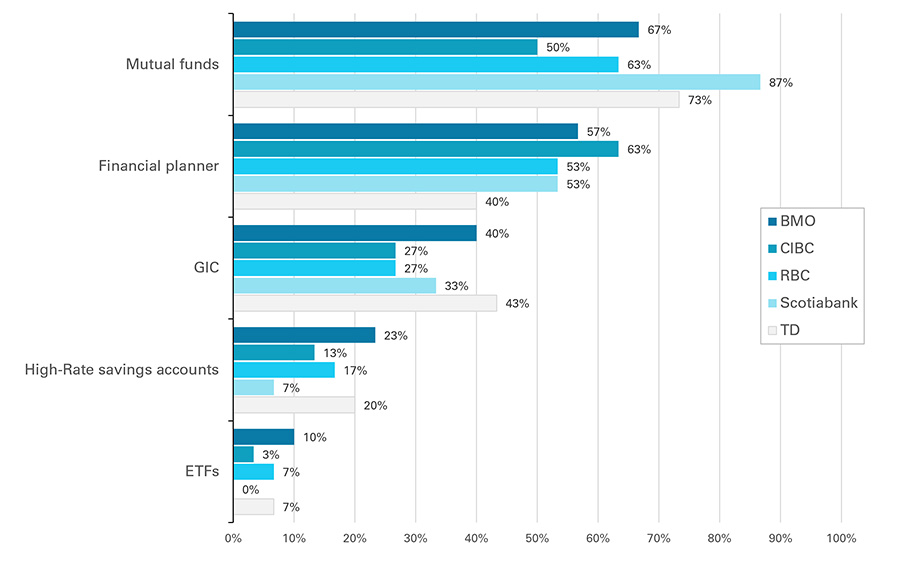

Mutual funds still dominant conversations

Given the target audience of near-retirees with $100,000 I was surprised that DALBAR found mutual funds still play a dominant role in retirement discussions: they were discussed in two thirds (68%) of all meetings. “Despite the increasing interest in low expense ETFs, they understandably remain an obscure topic for all but a few representatives,” the study says. ETFs were discussed in only 6% if cases.

Given the target audience of near-retirees with $100,000 I was surprised that DALBAR found mutual funds still play a dominant role in retirement discussions: they were discussed in two thirds (68%) of all meetings. “Despite the increasing interest in low expense ETFs, they understandably remain an obscure topic for all but a few representatives,” the study says. ETFs were discussed in only 6% if cases.

ETFs were most discussed at BMO, which you’d expect given the BMO ETFs leadership position: in about 10% of cases, compared to 7% at RBC and TD; 3% at CIBC and not at all at Scotiabank. Scotiabank led the Big 5 in mutual fund conversations, which came up 87% of the time.

I guess I could make a crack here about whose Retirement such representatives are really concerned with but I’ll bite my tongue.

The two most popular topics were, as you’d expect, TFSAs and RRSPs, almost tied at 81% and 80% respectively. GICs were discussed about a third of the time, Systematic Investment Plans 20% of the time and High-rate Savings Accounts 16% of the time.