My latest Financial Post column looks at a few retirement income planning software packages that help would-be retirees and semi-retirees plan how to start drawing down from various income sources: Click on the highlighted text to retrieve the full article: How you draw down your retirement savings could save you thousands: this program proves it.

My latest Financial Post column looks at a few retirement income planning software packages that help would-be retirees and semi-retirees plan how to start drawing down from various income sources: Click on the highlighted text to retrieve the full article: How you draw down your retirement savings could save you thousands: this program proves it.

There may be as many as 26 distinct sources of income a retired couple may encounter, estimates Ian Moyer, a 40-year veteran of the financial industry and creator of the Cascades program described in the article.

When he started to plan for his own decumulation adventure, five years ago, he felt there was very little planning software out there that was both comprehensive and easy to use. So, he hired a computer programmer and created his own package, now called Cascades.

While the main focus of the FP article is on Cascades, (available to financial advisors for $1,000 a year; do it yourself investors can negotiate a price directly), the article also references a couple of other programs we have looked at previously here on the Hub: Doug Dahmer’s Retirement Navigator and BetterMoneyChoices.com, the latter currently nearing the end of beta testing.

Dahmer has been writing guest blogs on decumulation here at the Hub almost since this site’s founding in 2014. See for example his most recent one, or the similar articles flagged at the bottom: Top 10 Rules for Successful Retirement Income Planning.

Dahmer says he’s pleased that others are waking up to the need for tax planning in the drawdown years: “Cascades provides a very good, easy-to-use introduction to these concepts.”

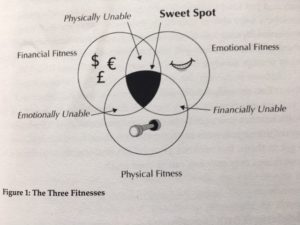

Planning for peaks and valleys in spending

However, Dahmer would like an approach that doesn’t assume yearly spending remains relatively static: his Better Money Choices(available on line for $108 a year) allows for the “peaks and valleys” of spending as retirees pass through their Go-go to their slow-go and finally their “no-go” years. Most retirees have to plan for sporadic large purchases like renovations or replacement of roofs or furnaces, plus of course vacations with widely varying price tags. Each spending peak represents a tax challenge, while the valleys are where the tax planning opportunities exist. Dahmer likens Better Money Choices to a gym monthly membership and Retirement Navigator to a personal trainer.

Personally, I found going through both firm’s programs a fascinating exercise, very much like putting together a jig saw puzzle. For me, Better Money Choices helps you visualize the final picture you’re trying to assemble, showing how much money you’ll need and when you’ll need it. Cascades provides vivid yearly snapshots of your year-by-year progress in putting the pieces together.