My latest MoneySense Retired Money column is the second part of an in-depth-look at the deadline those with RRSPs don’t want to miss once they turn 71. Part 1 appeared in March and can be found here.

My latest MoneySense Retired Money column is the second part of an in-depth-look at the deadline those with RRSPs don’t want to miss once they turn 71. Part 1 appeared in March and can be found here.

The full new column can be found by clicking on the highlighted headline here: RRSP to RRIF, and LIRA to LIF: How it all gets done.

For convenience, here are some highlights:

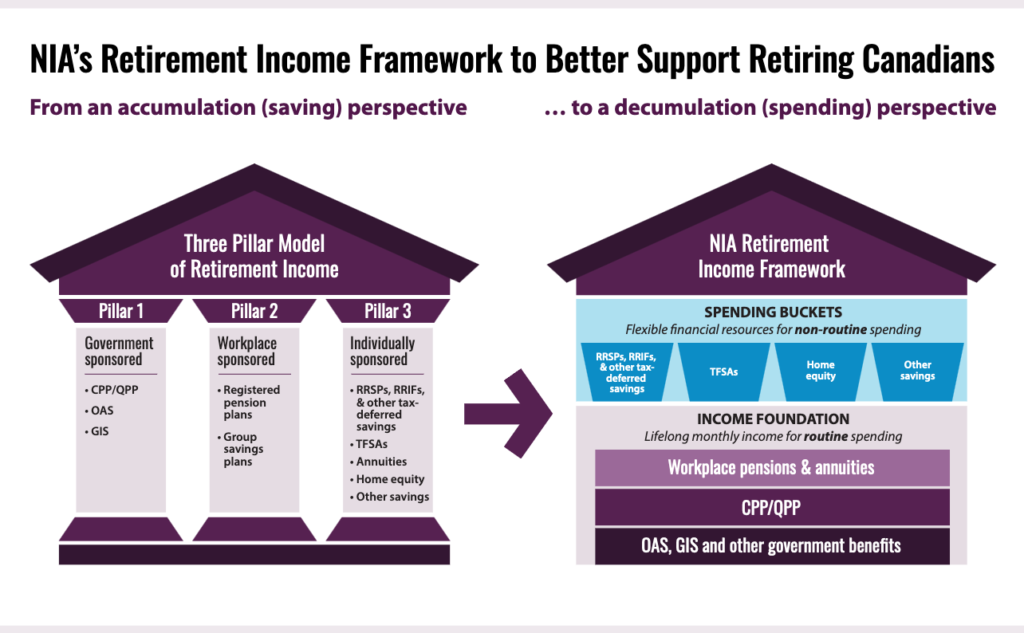

The first column looked at the necessity of winding up RRSPs by the end of the year you turn 71: a topic that becomes increasingly compelling as the deadline approaches. This followup column looks at two related topics: the similar deadline of LIRA-to-LIF conversions and the alternative of full or partial annuitization.

LIRAs are Locked-in Retirement Accounts and analogous to RRSPs, albeit with different rules. They usually originate from some employer pension to which you once contributed in a former job. To protect you from yourself you can’t extract funds in your younger years unless you qualify for a few needs-based exceptions. LIFs are Life Income Funds, in effect the annuities LIRAs are obliged to become, also at the end of your 71st year.

The full MoneySense column looks at our personal experience in converting my wife’s LIRA to a LIF, aided by Rona Birenbaum, founder of Caring for Clients. Note that the timing of the conversion is NOT affected by having a younger spouse: that only affects the annual minimum withdrawal calculus.

In my case, having turned 71 early this April, I have until the end of this year (2024) to convert my RRSP to a RRIF. The first required minimum withdrawal must occur in 2025: by the end of 2025 I must have withdrawn the annual minimum.

You can choose RRIF payment frequencies: usually monthly, quarterly, semi annually or once a year: you just have to specify which date. I imagine we’ll go monthly.

Currently, our retirement accounts are held at the discount brokerage unit of a Canadian bank, although we use a second discount broker for some non-registered holdings. While the LIRA will be the basis of an annuity provided by an insurer selected by Caring for Clients, most of our RRSPs will likely become RRIFs, probably by November of this year. Our hope is that we will keep largely the same investments as are being held now and administer them ourselves, with an eye to maintaining enough cash to meet our monthly withdrawal targets.

Self-directed RRIFs

The new vehicle will bear a familiar name for those with self-directed RRSPs: it’s a Self-directed RRIF. At our bank, it was a simple matter of entering the RRSP and finding the link to convert it to a self-directed RRIF. Once there, you tick boxes on when you want the money, withdrawal frequency and (optionally) choose a tax withholding rate. You can also specify that your withdrawals will be based on your spouse’s age, assuming they are younger.

You can of course also go through a similar process with any financial institution’s full-service brokerage or investment advisor, ideally with at least one face-to-face meeting. One thing Birenbaum says retirees often miss is specifying tax withholding, since there is no minimum withholding tax period required on the minimum withdrawal. I imagine we will ask to have 30% tax taken out at the time of each withdrawal: which is what we do with existing pension income. It’s on the high side to make up for the fact we also have taxable investment income (mostly dividends) that is NOT taxed at source.

“I find the majority of retirees like having that withholding tax held at source so they don’t have to deal with installments and owing the CRA.” You can of course have more than 30% withheld.

With a LIRA, you need to get the account liquid before the money is sent to the insurance company to annuitize. This means keeping tabs on the maturity dates of GICs or other fixed income.

The paperwork is minimal: we provided a recent LIRA statement, then had an online meeting with one of Birenbaum’s insurance-licensed advisors to go through the application, then sign a transfer form to move the cash to the insurance company for a deferred annuity. The transfer takes a few weeks, with the actual annuity rate determined when the insurance company actually receives the money: registered transfers are recalculated at the point of purchase. There is a form T2033, which is an RRSP-to-RRIF transfer form that moves the money from the bank to the insurance company.

Having a mix of RRIF and annuities

Semi-retired actuary and author Fred Vettese says he has endorsed retirees buying a life annuity ever since the first edition of his book “Retirement Income for Life” back in 2018. “If you buy one, it should be a joint-and-survivor type, meaning it pays out a benefit to the survivor for life.” Continue Reading…

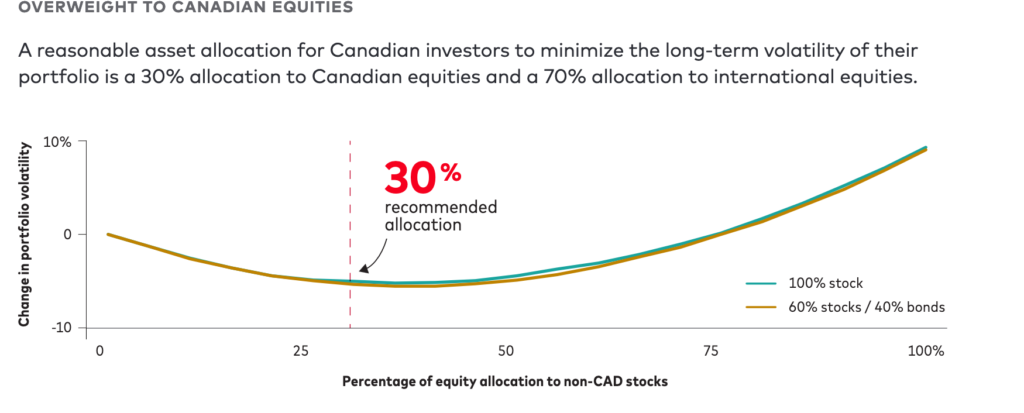

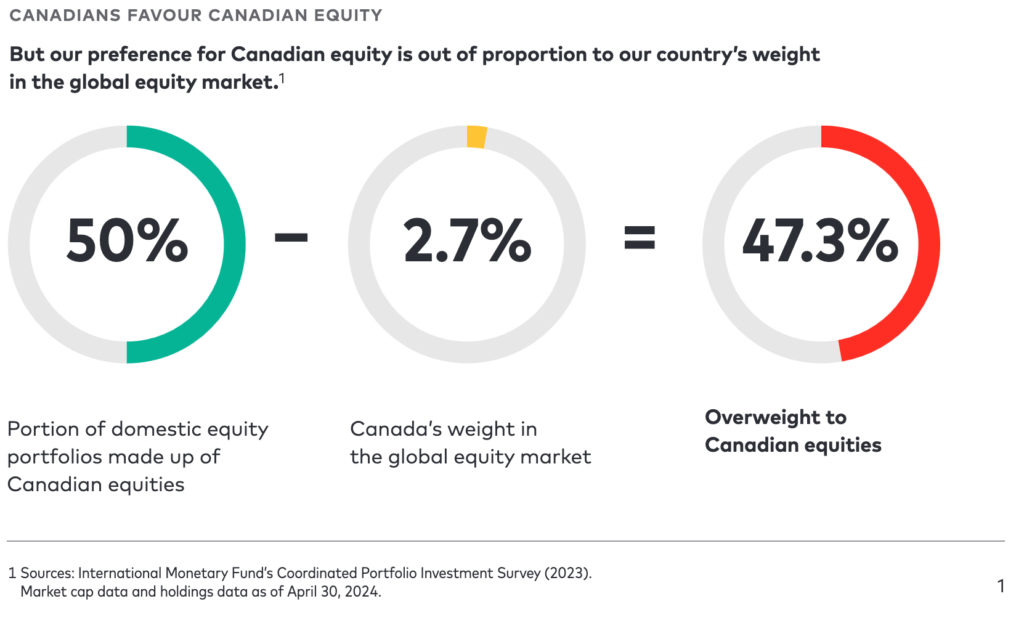

As the chart below shows, Vanguard recommends just 30% in Canadian stocks but notes that the domestic overweight is slowly decreasing as investors move to global and U.S. equities.

As the chart below shows, Vanguard recommends just 30% in Canadian stocks but notes that the domestic overweight is slowly decreasing as investors move to global and U.S. equities.