By Ian Moyer

(Sponsor Content)

Pamela is a 63-year-old widow residing in Ontario, Canada with two adult children who live on their own. Pamela worked for more than 30 years as a Payroll Manager and was able to pay off her mortgage with the life insurance inheritance she received from her husband’s passing and put her savings towards retirement.

She is preparing to retire in two years and has increasing concerns about the amount she has saved for retirement.

Pamela earns $76,000 a year. Now age 63, she has saved:

- $306,000 in a Registered Retirement Savings Plan (RRSP), contributing $5000 annually until retirement

- $36,000 in A Tax-Free Savings Account (TFSA), contributing $1000 annually, which doubles as an emergency fund.

- At age 65 Pamela plans on selling her cottage and adding $400,000 to her retirement funds.

Using Cascades Financial Solutions retirement income planning software, we help Pamela determine if she can retire at the age of 65 and sustain her lifestyle and accommodate traveling.

Pamela will decide to retire at the age of 65 if the after-tax income will meet her needs. With retirement fast approaching, she has three main questions:

- Do I have enough to retire? Pamala assumes she will need approximately 50% of her income to travel for five years.

- What are other income sources I can rely on? Pamela is concerned about the sustainability of her RRSP, TFSA and sale of the cottage alone.

- How do I deal with taxes? Pamela is unsure about the amount of taxes she will need to set aside.

Answering Pamela’s first question: “Do I have enough to retire?” The answer is YES! Based on her needs.

Using Cascades Financial Solutions, we’ve run a retirement income withdrawal plan resulting in three different ways to produce an after-tax annual retirement income of $45,703 for Pamela:

We’ve selected an asset allocation as moderate in the software: Moderate: 60% Fixed Income, 40% Equity, 5% rate of return and 2% inflation. All income and savings are reported in “today’s dollars” by Cascades.

Strategy Descriptions

Registered Funds First: This strategy involves creating retirement income from registered funds first, reducing the risk of leaving highly taxable investment accounts to an estate. The second priority is given to taxable non-registered accounts, leaving Tax Free Savings Accounts (TFSAs) last.

Non-Registered Funds First: This strategy involves creating retirement income from non-registered funds first, deferring the income taxes payable on registered investments. The second priority is given to registered investments, leaving Tax Free Savings Accounts (TFSAs) last.

Tax Free Funds First: This strategy involves creating retirement income from non-registered funds first and postpones the use of registered funds as long as possible. The second priority is given to Tax Free Savings Accounts (TFSAs), leaving registered funds last.

Determining a Winning Strategy: With all other factors being equal, the winning strategy provides a client longevity and the highest estate value, net of taxes and fees, at life expectancy. The differences in the net estate value represents the income tax savings of the winning strategy.

Answering Pamela’s second question: “What are other income sources I can rely on?” There are two main programs that provide retirement income for most Canadians: the CPP or Quebec Pension Plan (QPP), and OAS. The maximum CPP / QPP Pension you could receive starting at age 65 is $1,203.75 monthly ($14,445 annually) for 2021.[1]

Pamela was aware of Canada Pension Plan (CPP) and Old Age Security (OAS); however, she didn’t realize she would receive so much in government benefits.

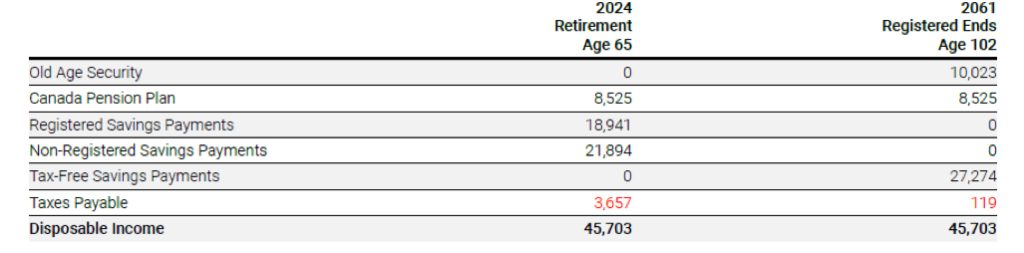

The chart below depicts the breakdown of income Pamela will receive annually during the time of retirement:

Pleased with the amounts Pamela has seen; we answer her third question: “How do I deal with taxes?”

Using Cascades Financial Solutions retirement income plan details. Pamela will know exactly how much to put aside for her tax payments based on the desired or maximum income. The detailed ledger will provide her with the withdrawal amounts and taxes applicable. One of the Key Considerations in Cascades is to consider charitable donations. Charitable donations in Canada are eligible for both federal and provincial donation tax credits, with combined incentives of up to 53% in some provinces. You can claim charitable gifts up to an annual limit of 75% of your net income a number that rises to 100% for gifts made in the year of death and the year before.

Using Cascades Financial Solutions retirement income plan details. Pamela will know exactly how much to put aside for her tax payments based on the desired or maximum income. The detailed ledger will provide her with the withdrawal amounts and taxes applicable. One of the Key Considerations in Cascades is to consider charitable donations. Charitable donations in Canada are eligible for both federal and provincial donation tax credits, with combined incentives of up to 53% in some provinces. You can claim charitable gifts up to an annual limit of 75% of your net income a number that rises to 100% for gifts made in the year of death and the year before.

After going though the Cascades retirement income plan Pamela feels confident she will be comfortable when she retires.

“The question isn’t at what age I want to retire, it’s at what income.” – George Foreman, two-time world heavyweight boxing champion and an Olympic gold medalist

1 in 5 (21%) of respondents in a CIBC poll did not know how much annual income they might have in retirement.[i]Cascades solves for a level after tax retirement income answering this question for many Canadians across the country. The Cascades calculator clearly summarizes your annual retirement income and taxes based on the level after-tax income it solves for. Cascades’ goal is to help you implement the best retirement income strategy possible.

To find out how Cascades can help you visit our website here.

[1] https://www.canada.ca/en/employment-social-development/programs/pensions/pension.html

[i] Information about the January 2019 CIBC Retirement Poll can be found online at cibc.mediaroom.com/2019-01-30-Retire-or-re-hire-1-in-4-retiredCanadians-regret-retiring-and-want-to-go-back-to-work-CIBC-Poll.

Ian Moyer is a 40 year veteran of the financial services industry. He is a long term member of the MDRT, as well as Court and Top of the Table. In 2013 he started developing Cascadesfs.com with his business partner Jonathan Kestle. Cascades’ focus is to illustrate the value of advice, by revealing the tax difference of comparing withdrawal strategies.

Ian Moyer is a 40 year veteran of the financial services industry. He is a long term member of the MDRT, as well as Court and Top of the Table. In 2013 he started developing Cascadesfs.com with his business partner Jonathan Kestle. Cascades’ focus is to illustrate the value of advice, by revealing the tax difference of comparing withdrawal strategies.

is using a 2% rate of inflation valid anymore? Also, I think people should know what their estate tax is based on when they use their registered (non TFSA) funds. If they die early, it can often be 50% so CRA gets a huge chunk.

Does the Cascade software allow testing different scenarios with higher inflation and lower investment returns for different years?

Currently we use 2% as the default for inflation however a user can increase or decrease depending on their thoughts. The illustration shows a year over year graph with an Estate Expense projection that includes taxes, probate and fees. Scrolling with a mouse will change and highlight the amounts from year to year.

A user can run different scenarios with higher inflation and lower investment returns by running each scenario and comparing reports.