In the quest for Financial Independence, digital products stand out as a versatile and scalable source of income.

We’ve gathered insights from nine business leaders, including entrepreneurs, creators, and coaches, to share their success stories.

From pivoting to evergreen design templates to automating market gap solutions with your platform, discover how these professionals have created and monetized digital products.

- Pivot to Evergreen Design Templates

- Monetize Niche Books via KDP

- Break Down Consulting to Manageable Engagements

- Sell Bulk Online Training Programs

- Create a Recurring Revenue Product

- Offer Personalized Digital Journals with Subscriptions

- Gamify a Toolkit Subscription

- Develop Financial Tools for Entrepreneurs

- Automate a Market Gap Solution with Your Platform

Pivot to Evergreen Design Templates

After burning out as a done-for-you service provider, I pivoted my web design expertise into strategic website templates that I created once and sold over and over again! Then, as I learned more about marketing and selling digital products, I went on to teach others how to package up their knowledge, processes, and shortcuts into paid digital products too. These days, I sell digital products directly from my website using a mix of evergreen and live-launch strategies, which make up more than my old service provider income! — Michelle Pontvert, Digital Product Coach & Creator, Michelle Pontvert

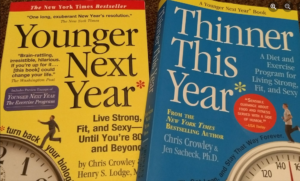

Monetize Niche Books via KDP

I’ve built a sustainable revenue stream by creating books through Amazon’s Kindle Direct Publishing (KDP) platform. Each book was tailored to the niche topics of my blogs, offering specific, useful insights to my audience.

As my blogs grew to over 50,000 monthly sessions, I strategically promoted these books within relevant articles, reaching readers already interested in the subject matter. This alignment between my content and products not only increased book sales but also played a key role in supporting my financial independence. — Alexander Weber, Founder, Axlek

Break Down Consulting to Manageable Engagements

We monetized our consulting services by quickly breaking them down into bite-sized, manageable engagements. This strategy helped us generate over $1M in services on platforms like Fiverr Pro. These platforms allow you to build a network and trust in a marketplace while continually testing new offerings.

The key is to take what you know, package it, and start selling. Start small and gradually add layers. The freemium model works well if you can convert digital downloads into meaningful actions that lead to a relationship, sale, or partnership. Always keep the end goal in mind: growing sales and building long-term value. — Mike Zima, Chief Marketing Officer, Zima Media

Sell Bulk Online Training Programs

As part of my training and coaching business, I created an online training program for managers called Manager Boot Camp. It’s a 23-lesson course delivered over 8 weeks to managers of all levels. The key to this program and how it adds substantially to my financial independence is that it is sold in bulk to companies. Bulk sales bring a higher revenue per transaction. Manager Boot Camp is currently 55% of my annual revenue.

Additionally, most online courses have very little overhead and administration required to run them, which boosts their profitability. Manager Boot Camp and other mini-courses have set me up to head into retirement with a ‘passive’ income stream that doesn’t require my time in person to train or coach clients. — Cecilia Gorman, Management Training Consultant, Manager Boot Camp

Create a Recurring Revenue Product

As the founder of Rocket Alumni Solutions, I’ve created digital products to build revenue and support my financial independence. Within our first year, we launched an interactive touchscreen wall of fame that provides schools and athletic organizations a modern way to recognize student achievement. The software generates over $2M in annual recurring revenue through 500+ subscribers.

To gain our initial set of clients, I spent 6 months cold-calling schools to understand their challenges in alumni engagement and student recognition. This research led to building a touchscreen solution to digitize their awards display. We started by offering free on-site consultations where I would showcase a custom demo and propose three package options at $3,000, $10,000, or $25,000 per year based on the school’s needs. Nearly every consultation resulted in a multi-year contract.

Once we had 50 schools signed up, I hired developers to build a scalable SaaS product. We now charge $5,000 to $50,000 per year, depending on the number of touchscreens and features. This shift to a subscription model has created a recurring revenue stream and high profit margins. The key was identifying a need, developing a solution, proving its value, then scaling through a tech-enabled product. My next venture will follow a similar strategy of leveraging digital tools to solve challenges and build passive income. — Chase McKee, Founder & CEO, Rocket Alumni Solutions

Offer Personalized Digital Journals with Subscriptions

When I was transitioning to financial independence, I turned my passion for storytelling into a profitable venture. I started by creating a series of themed digital journals designed to help people track their personal goals and creative ideas. Instead of going the usual route, I integrated interactive features that allowed users to customize their journaling experience based on their interests, from travel to fitness.

To monetize these journals, I adopted a subscription model where users paid a small monthly fee for access to new templates and features. I also offered premium packages that included personalized coaching and exclusive content. Continue Reading…