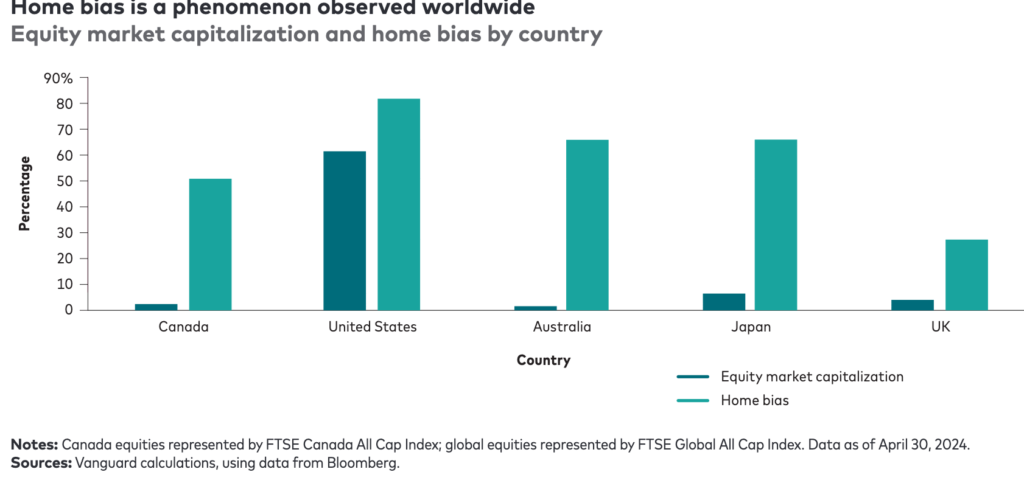

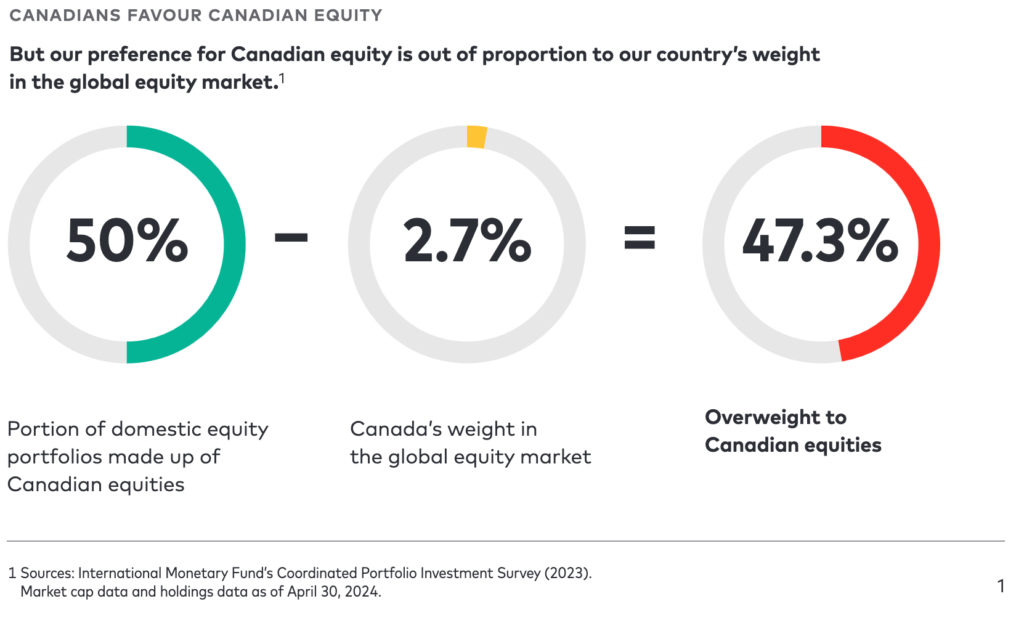

A just-released study from Vanguard Canada on Home Country Bias shows that Canadians have about 50% of their portfolios allocated to Canadian equities: well beyond what is recommended for a country that makes up less than 3% of the global stock market.

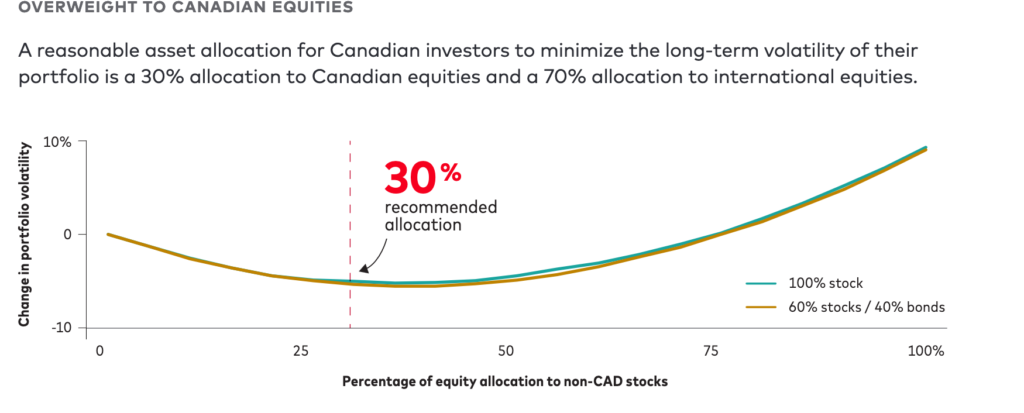

As the chart below shows, Vanguard recommends just 30% in Canadian stocks but notes that the domestic overweight is slowly decreasing as investors move to global and U.S. equities.

As the chart below shows, Vanguard recommends just 30% in Canadian stocks but notes that the domestic overweight is slowly decreasing as investors move to global and U.S. equities.

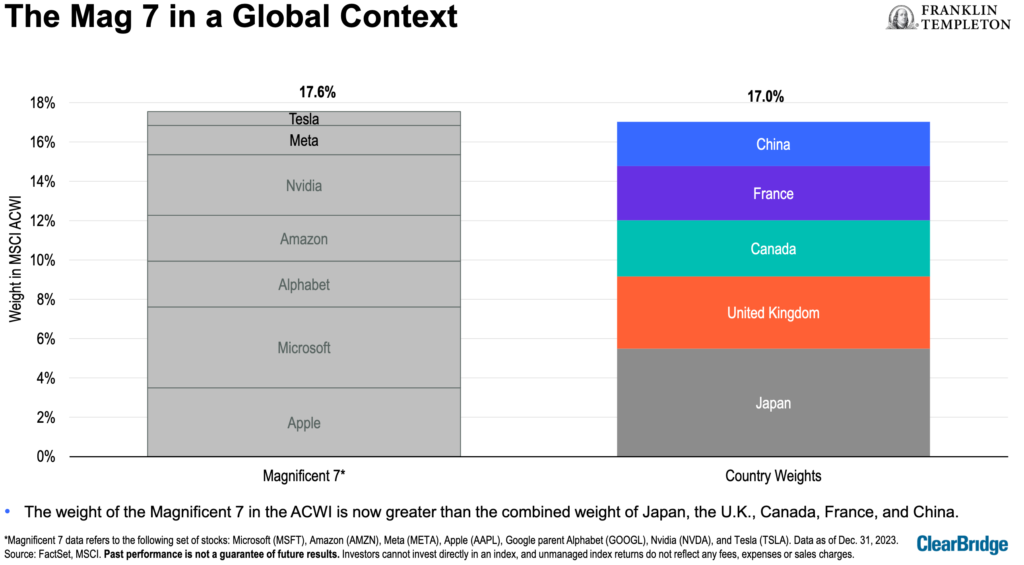

Vanguard says home country bias is not unique to Canada: Americans behave similarly with respect to the U.S. stock market. But as you can see from the chart below, because the U.S. makes up more than half of the global stock market by market capitalization, the gap between its relative overweighting is far less dramatic than in Canada. Canada’s home country bias is almost as pronounced as in Australia (a similar market to Canada in terms of resources and financial stocks), and Japan is not far behind.

However,Vanguard adds, “overall, Canadians and investors in other developed countries are trending towards a greater appetite for diversification through global equities.”

Too much Canada can be volatile

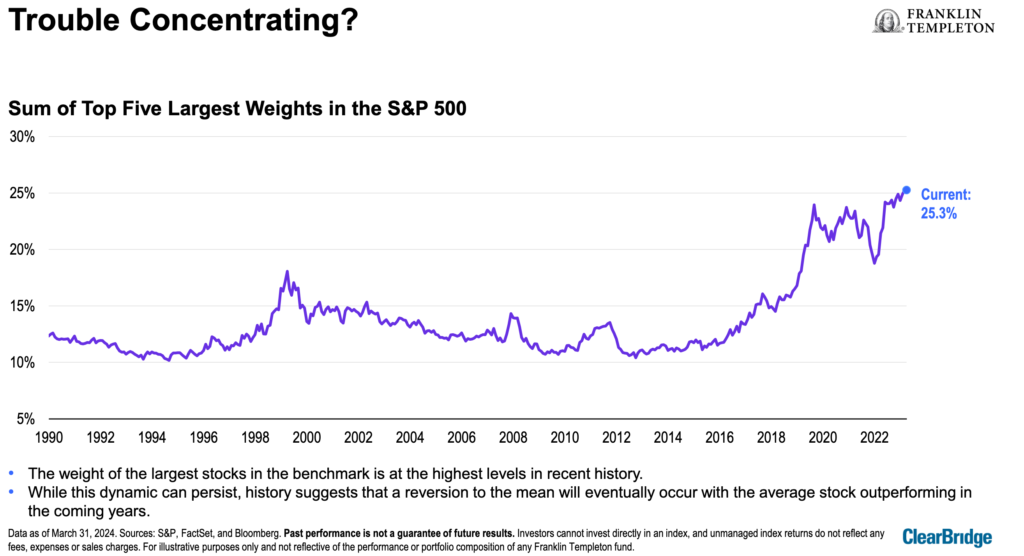

So what’s wrong with having too much Canadian content (both stocks and bonds)? Vanguard says portfolios overweight Canadian equity can be volatile because the domestic market is too concentrated in just a few economic sectors. “Relative to the global market, Canada’s market is concentrated within a few large names. It is also significantly overweight in the energy, financials and materials sectors, and significantly underweight in others.” Continue Reading…