Market volatility and shifting economic signals are forcing retirement savers to rethink their portfolios in real time. This article gathers practical strategies from five seasoned financial leaders who manage billions in retirement assets and are actively adjusting allocations right now. Their approaches range from bucketing time horizons to integrating global hedges, offering concrete tactics that advisors and individuals can apply immediately.

These experts were gathered by Featured.com, which has been supplying Findependence Hub with quality content for several years. It has changed its procedure so editors like myself can request input on particular topics we think will interest our readership. The sources are all on LinkedIn, as you can see by clicking on their profiles below.

- Secure Core Needs via Indexed Annuities

- Segment Time Buckets to Tame Sequence Risk

- Shift Toward Global Breadth and Tangible Hedges

- Favor Quality Income Plus Balanced Discipline

- Blend Abroad Exposure for Safety Anchors

Secure Core Needs via Indexed Annuities

Given the trade and tariff noise, I start by securing essential lifestyle costs with Fixed Indexed Annuities that provide floors with index-linked upside to blunt sequence-of-returns risk.

Given the trade and tariff noise, I start by securing essential lifestyle costs with Fixed Indexed Annuities that provide floors with index-linked upside to blunt sequence-of-returns risk.

I also require clients to keep separate emergency reserves and a growth sleeve because FIAs have surrender periods. We coordinate annuity design, laddering, and rider choices with Roth conversions and RMD planning to create a predictable income base before taking market risk.

Will Lane, Retirement & Estate Planning Advisor, Top Rank Advisors

Shift toward Global Breadth and Tangible Hedges

Looking ahead to the rest of 2026, portfolio concerns for individuals aged 65 and over, and those close to retirement (within 10 years), include risk management, purchasing power protection, and geopolitical and currency diversifications.

Looking ahead to the rest of 2026, portfolio concerns for individuals aged 65 and over, and those close to retirement (within 10 years), include risk management, purchasing power protection, and geopolitical and currency diversifications.

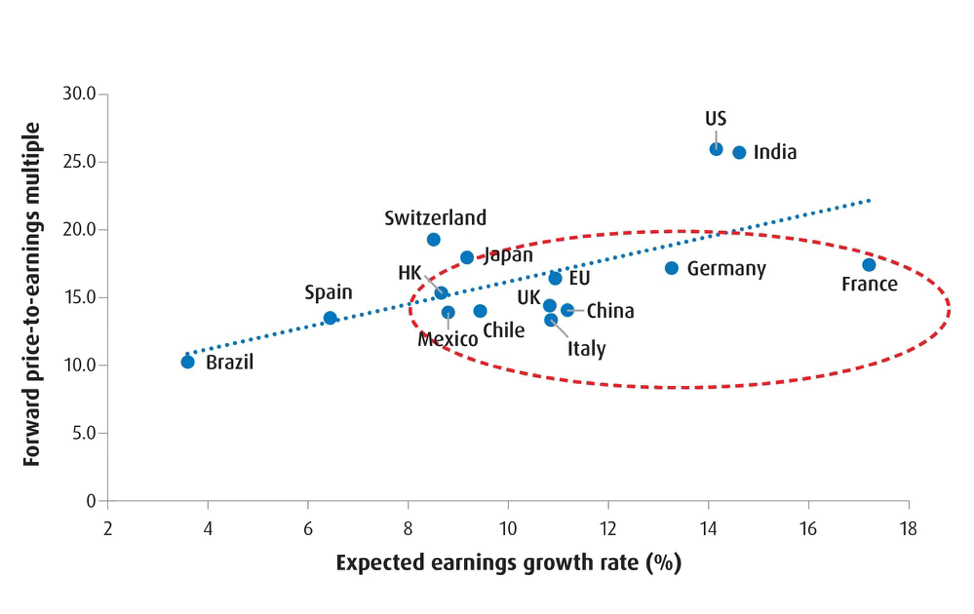

We are seeing a move away from traditional 60/40 or 70/30 portfolios and toward a more dynamic framework for asset allocation. U.S. stocks and high-grade Fixed Income are still foundational, but we are trying to avoid over-allocation to a particular market or macro scenario.

Some key themes for the future are greater geographic diversification, selective access into non-U.S. assets, and cautious hedging versus U.S. dollar declines. We are not making stark currency predictions, but geographical diversification outside of USD-focused assets is becoming sensible for increasing numbers of investors.

At the same time, there’s also been a reinforcement of allocations to hard assets like precious commodities and metals. The inclusion of crypto exposures is small and is based on suitability.

As such, it’s emphasized that there’s a focus on “resilience and adaptability, and positioning to withstand trade tensions, volatility in inflation, and policy uncertainties in a way that is independent of specific narratives.”

Peter Reagan, Financial Market Strategist, Birch Gold Group

Favor Quality Income plus Balanced Discipline

For investors in or approaching retirement, the balance of 2026 should be geared towards capital preservation, income stability, and inflation resilience as the primary objectives: while still maintaining enough growth exposure to support long retirement horizons.

For investors in or approaching retirement, the balance of 2026 should be geared towards capital preservation, income stability, and inflation resilience as the primary objectives: while still maintaining enough growth exposure to support long retirement horizons.

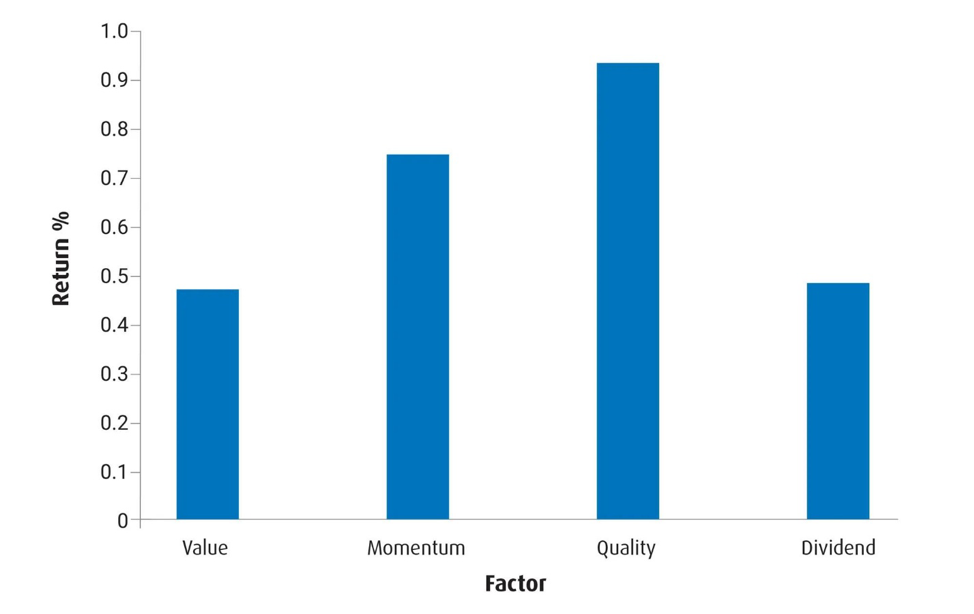

Retirees cannot afford to eliminate equities, especially with longer life expectancies and ongoing inflation risk. But favor high-quality cash-generating companies over speculative, momentum-driven stocks. Bonds should primarily reduce volatility and fund near-term spending. Real assets, alternatives can support diversification while improving returns, and investors could have a small exposure to this segment.

For retirees and near-retirees in 2026, the goal is not to time markets, but to construct a portfolio that:

- Can withstand equity volatility

- Generates dependable income

- Preserves purchasing power over a multi-decade retirement

Asset allocation should be personalized, tied to spending needs, risk tolerance, and other income sources — but the overarching theme is balance, quality, and discipline. Not aggressive risk-taking or excessive conservatism.

Geetu Sharma, Founder and Chief Investment Officer, AlphasFuture LLC

Segment Time Buckets to Tame Sequence Risk

For my pre-retiree clients, one of the biggest risk factors to a successful retirement is Sequence-of-Return risk, or the risk of experiencing poor market conditions at the start of retirement.

For my pre-retiree clients, one of the biggest risk factors to a successful retirement is Sequence-of-Return risk, or the risk of experiencing poor market conditions at the start of retirement.

To help address this risk, I believe in holding a diversified portfolio that consists of several accounts that have different asset allocations and amounts. For example, funds needed in the first year of retirement would be allocated more conservatively than funds needed in the 15th year of retirement. This helps to reduce the impact of geopolitical risk or currency risk on their portfolio and thus their retirement. Additionally, having a portfolio that includes commodities like gold or international equities helps to balance the risk of a particular underperforming asset class throughout retirement as well.

Stu Evans, Wealth Advisor, Blackbridge Financial

Blend Global Exposure for Safety Anchors

For retirees and those within ten years of retirement, the ongoing tariff tensions and global trade uncertainties require a careful reassessment of asset allocation while maintaining a focus on capital preservation and income reliability. Traditional allocations, such as the 60/40 or 70/30 equity-to-bond mixes, still provide a strong foundation, but we are increasingly emphasizing diversification across geographies and asset types to manage both market and currency risks.

For retirees and those within ten years of retirement, the ongoing tariff tensions and global trade uncertainties require a careful reassessment of asset allocation while maintaining a focus on capital preservation and income reliability. Traditional allocations, such as the 60/40 or 70/30 equity-to-bond mixes, still provide a strong foundation, but we are increasingly emphasizing diversification across geographies and asset types to manage both market and currency risks.

For U.S.-based investors approaching retirement, a modest increase in non-U.S. equities makes sense to capture growth opportunities abroad while reducing concentration risk in domestic markets that may be more exposed to trade disruptions.

We are also monitoring the U.S. dollar closely, and while we are not making aggressive currency bets, selective exposure to assets that historically hedge dollar weakness — such as precious metals and certain commodities — can provide a measure of protection and portfolio resilience.

We continue to stress bonds and cash equivalents for retirees, particularly high-quality, short- to intermediate-duration bonds that preserve capital while providing reliable income. However, in light of persistent inflation pressures and potential geopolitical shocks, we are selectively introducing alternatives, such as commodities, real assets, and limited exposure to crypto in small, highly managed positions: not as core holdings but as strategic diversifiers. The goal is not chasing yield or speculative gains, but rather enhancing portfolio resilience and smoothing volatility.

Overall, the guiding principle remains risk-adjusted diversification: maintaining sufficient equity exposure for growth, bonds for income and stability, and alternatives to hedge against systemic risks, while keeping allocations flexible and aligned with liquidity needs. Retirees should avoid over-concentration in any single market or asset type and prioritize investments that protect purchasing power, provide consistent income, and withstand trade or currency shocks over the remainder of 2026.

Andrew Izrailo, Senior Corporate and Fiduciary Manager, Astra Trust

Featured.com creates community-driven content featuring expert insights. Sign up to answer questions and get published