Hub Blogs

The Revival of the Balanced Portfolio

By Alfred Lee, Director, BMO ETFs

(Sponsor Blog)

The 60/40 portfolio has been long considered the prototypical balanced portfolio. This strategy consists of the portfolio investing 60% of its capital to equities and the remaining allocation of 40% in fixed income.

The two segments in the portfolio each have its unique purpose: equities have provided growth and fixed income has historically provided stability and income. When combined, it allowed a portfolio to have stable growth, while generating steady income.

In the last decade, however, the 60/40 portfolio has been challenged on two fronts. The first has been due to the lack of yield available in the bond market, as interest rates have grinded to all-time lows. As a result, many looked to the equity market to generate higher dividends in order to make up for the yield shortfall left by fixed income.

The second shortcoming of the 60/40 portfolio has been the higher correlation between bonds and equities experienced in recent years, which has limited the ability for balanced portfolios to minimize volatility.

However, the resurgence of bond yields in the recent central bank tightening cycle has breathed new life into the 60/40 portfolio. Suddenly, bonds are generating yields not seen since the pre-Great Financial Crisis era. A higher sustained interest rate environment also means a slower growth environment; that means equity risk premiums (the expected excess returns, needed to compensate investors to take on additional risk above risk-free assets) will be lower. This means fixed income may look more attractive than equities on a risk-adjusted basis, which may mean more investors may allocate to bonds in the coming years. Fixed income as a result, will play a crucial role in building portfolios going forward and its resurgence has revived the balanced portfolio.

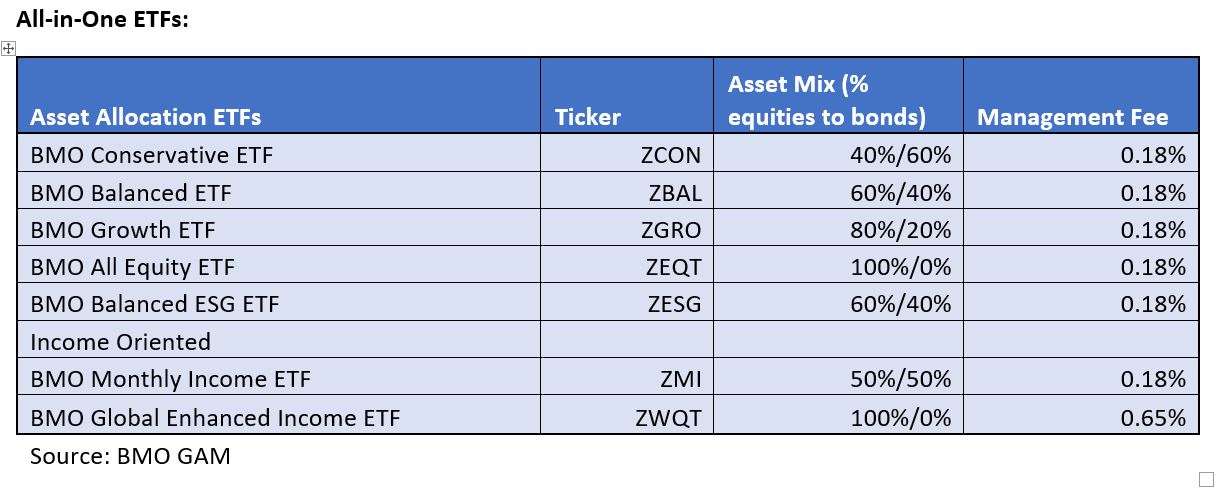

Investors can efficiently access balanced portfolios through one-ticket asset allocation ETFs. These solutions are based on various risk profiles. In addition to the asset allocation ETFs, we also have various all-in-one ETFs that are built to generate additional distribution yield for income/dividend-oriented investors. Investors in these portfolios only pay the overall management fee and not the fees to the underlying ETFs.

How to use All-in-One ETFs

- Standalone investment: All-in-one ETFs are designed by investment professionals and regularly rebalanced. Given these ETFs hold various underlying equity and fixed income ETFs, they are well diversified, and investors can regularly contribute to them over time. Continue Reading…

Retired Money: Some upsides of inflation for retirees

My latest MoneySense Retired Money column looks at one unexpected upside of inflation; the government’s indexing to inflation of tax brackets, retirement savings limits and OAS thresholds. You can find the full column by clicking on the link here: Inflation a scourge for retirees? Ottawa’s silver lining(s)

TFSA room rises to $7,000

Fans of the popular Tax-free Savings Account (TFSA) will experience this as early as Jan. 1, 2024, when the annual maximum contribution room rises to $7,000, up from $6,500 in 2023. As of January 2024, someone who has never before contributed to a TFSA now has cumulative contribution room of $95,000.

In November Kyle Prevost’s weekly Making Sense of the Markets column included an item titled Make inflation work for you. “We shouldn’t ignore or discount the more advantageous aspects of inflation, such as increased government benefits and more contribution room in our RRSPs and TFSAs.”

Prevost linked to a spreadsheet posted on X (formerly Twitter) by financial advisor Aaron Hector, posted late in October, after the CPI announcement that Ottawa’s official inflation indexing rate for 2024 would be a sizeable 4.7%. While below 2023’s 6.3% indexation rate, it’s well above 2022’s 2.4% and 2021’s 1%.

Also quoted in the MoneySense column is Matthew Ardrey, wealth advisor with Toronto-based TriDelta Financial. “One of the main benefits is paying less taxes.” Income tax brackets increase with inflation each year. For example, in 2021 the lowest tax bracket in Ontario ended at $45,142 of income. “Starting in 2024, this lowest tax bracket now ends at $51,446. This is a 14% increase over just a few years.” Continue Reading…

Becoming an Entrepreneur in Retirement: Is it for You?

By Devin Partida

Special to Financial Independence Hub

With people living longer than ever, retirement now makes up a significant portion of our lives. Could it be the perfect time to start a business? Here are the pros and cons of becoming an entrepreneur in your golden years.

Important Considerations

Entrepreneurship can enrich your life in immeasurable ways. However, before launching your own business, you should consider the following challenges.

Financial Risk

According to a 2018 study by Harvard Business Review, older entrepreneurs tend to run more successful companies. The businesses that financially thrive in their first five years are, on average, started by 45-year-old entrepreneurs, probably due to this cohort’s experience and willingness to take risks.

Although the odds may be in your favor, it’s still important to consider whether you have the capital to run a business — and to pick up the pieces if it doesn’t work out. Over 80% of small businesses fail because of cash flow problems. Decide how much money you’re willing to invest and potentially lose in your new venture.

Time Commitment

How do you envision retirement? If you’re considering entrepreneurship, you’re probably not the type of person who wants to lounge around sipping drinks on a beach.

If you do want a more relaxed retirement, however, you might find the time commitment required to run a business overwhelming. Entrepreneurs often put in long days to get their businesses up and running. Even after your company gets off the ground, you may find yourself having to work longer hours than you were expecting.

Of course, as a business owner, you also have a lot of sway over how big you want to let your venture get. If things start getting out of hand, you can always scale back.

Social Security Deductions

If you’re younger than full retirement age in the U.S. — which can range from 66-67, depending on when you were born — becoming an entrepreneur during retirement can affect your Social Security benefits.

Before you reach full retirement age, the IRS will deduct one dollar from your benefit payments for every two dollars you earn above $21,240. The year you reach full retirement age, the IRS will subtract one dollar from your Social Security benefits for every three dollars you earn above $56,520.

Consider whether these fees will impact your ability to retire comfortably. You might find you’re earning more money from your business than you would from Social Security anyway, so the deductions may be of little consequence.

Benefits of Entrepreneurship

Although it may be challenging, starting your own business will likely enrich your life. Here are some ways it could positively affect your retirement: Continue Reading…

Interac predicts busiest shopping day of the year next Friday, as holiday gifting stress looms

By Nader Henin, Interac Corp.

Special to Financial Independence Hub

As Canadians shop for last-minute gifts and search for deals, our Interac transaction data predicts that the busiest shopping day of the year will fall this year on December 22nd.

According to the transaction data, nearly 27.8 million purchase transactions are expected to take place next Friday (Dec. 22), representing roughly 2.7 million more transactions than the same date last year.

While Canadians are still planning to partake in gift giving, hosting, and more this holiday season, they’re feeling the constraints of today’s economic climate. Recent Interac survey* findings reveal that nearly four in ten Canadian shoppers (38 per cent) say they are feeling the pressure to spend during the holiday season even though their finances are tight.

Our survey revealed this phenomenon is felt as well among newcomers to Canada. Nearly seven in ten newcomers (69 per cent) say they feel more pressure to spend money around the holidays now that they live in Canada. What’s more, 71 per cent say their financial stress during the holidays has grown since moving to this country.

Amid rising prices, the holidays can be a stressful time of year. More than two thirds of Canadians (68 per cent) say they’re stressed about at least one aspect of spending during the holiday season and some sources of stress beat out others. Among those who are stressed, our survey shows us that buying gifts (77 per cent), spending money hosting and entertaining family and friends (41 per cent) and giving money to family members (34 per cent) are the top sources of stress.

For newcomers who are experiencing at least some holiday spending stress (82 per cent), spending money travelling to visit family and friends (48 per cent) is a prominent stressor.

As stressful as holiday spending can be, there are ways to make things a little easier:

Plan ahead

Try creating a gifting budget well in advance of any spending plans to help stay on track. Where possible, you can also look for a sale, consider a refurbished item or tap into purchases that make you and those around you feel good. You can also lean on Interac Debit to track your payments easily and take charge of your own money

Share the love, split the cost

When purchasing gifts for loved ones, organizing festive outings or hosting your family and friends, split the cost using Interac e-Transfer. Sharing the cost is one of the best ways to make sure you’re maximizing fun while staying in control of spending.

Embrace experiences

The holidays are a time to get together with friends and family and enjoy one another’s company. Consider sharing in an experience, rather than giving a physical gift. Interac research shows us that feel-good experiences are more likely to deliver happiness than material goods.