My latest MoneySense Retired Money column is a belated review of Dan Bortolotti’s recently published ETF book, Reboot Your Portfolio. You can read the full review by clicking on the highlighted text: The Canadian Book about ETFs that will have you saying eh-t-fs.

My latest MoneySense Retired Money column is a belated review of Dan Bortolotti’s recently published ETF book, Reboot Your Portfolio. You can read the full review by clicking on the highlighted text: The Canadian Book about ETFs that will have you saying eh-t-fs.

The book has already been well reviewed by prominent financial bloggers: for example, early in December the Hub ran this blog by Michael James on Money’s Michael J. Wiener: Do as I say, not as I do.

As the column notes, MoneySense readers should find the book a nice complement to the MoneySense ETF All-stars feature that I used to write each spring, and which was initially a collaboration between myself and Dan back when we were both full-time MoneySense editorial staff. The 2022 edition ran last week and is now written by Bryan Borzykowski.

Dan’s book is an excellent primer for any aspiring do-it-yourself investor who wants to buy ETFs at a discount brokerage, or someone wanting to create an ETF portfolio with or without the help of a financial advisor like Dan or his employer, PWL Capital.

Since the dawn of Asset Allocation ETFs early in 2018 (starting with Vanguard, soon matched by iShares, BMO and Horizons), it’s now possible to have an entire portfolio consisting of a single ETF. Those who like the traditional pension fund allocation of 60% stocks to 40% bonds could choose VBAL, XBAL or ZBAL, or Horizon’s slightly more equity intensive, HBAL (with a slightly more aggressive 70/30 stocks/bonds mix).

One-decision funds and automatic rebalancing

Bortolotti is quite enthused with these Asset Allocation ETFs, as are most of the other ETF experts in MoneySense’s ETF All-stars feature. One thing he particularly likes about such funds is the automatic rebalancing between asset classes, or at least between the stocks and bonds that most of them hold in varying proportions. As he says in chapter 8 (Keep it in Balance), “There’s a lot of research suggesting that people do better when the rebalancing decision is taken out of their hands.”

The book takes a holistic approach to financial planning and ETF portfolio creation. In fact, he makes a point of not even addressing ETFs until chapter 5, after first covering the need to cease trying to beat the market, set financial goals, determine the right asset allocation and then fine-tuning.

Like most indexing enthusiasts, Bortolotti takes a dim view of such investing sins as market timing and stock picking. In his chapters on Asset Allocation, Bortolotti does not restrict his readers to strictly ETFs: there may be a place for GICs and high-interest savings accounts. He says many could put half their fixed-income allocation in GICs and use bond ETFs for the other half.

But he does believe that even very conservative and very aggressive investors should have at least some exposure to stocks and bonds; conservative retirees should still have at least 20% in stocks and aggressive stock investors should have at least 20% in bonds. For those between, he is comfortable with their holding the traditional 60/40 portfolio, which has returned between 6 and 7% a year since 1990.

Beyond stocks and bonds, however, Bortolotti is less enthused. He doesn’t recommend commodities like gold and other precious metals, collectibles like rare coins, fine wine and artwork, or even REITs, preferred shares or Real Return Bonds: whether held directly or via ETFs.

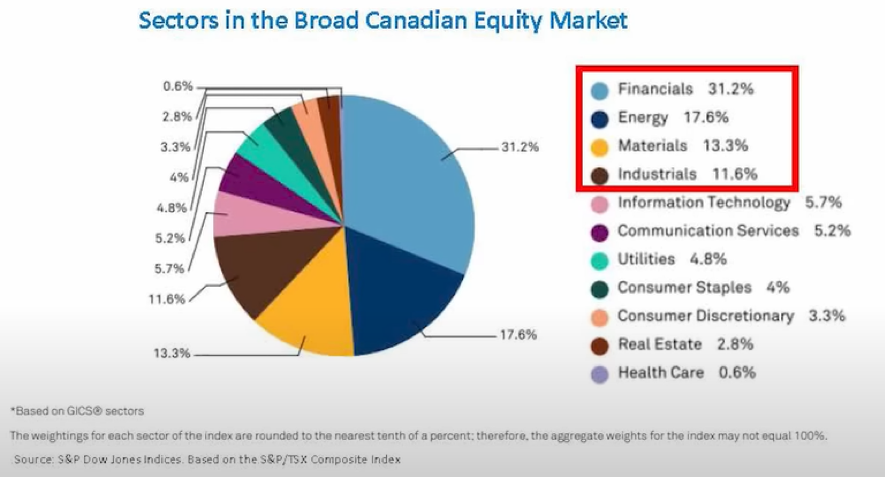

When it comes to ETF portfolios, Bortolotti is primarily focused on broadly diversified low-cost ETFs that use traditional market-cap weighting, although he also sees the case for equal-weighted ETFs. But he does not recommend what he calls “narrowly focused” sector or “theme” ETFs. He covers the pros and cons of “smart beta” ETFs, which usually cost more than plain-vanilla ETFs but will at least be cheaper than actively managed mutual funds.

All in all, any MoneySense reader will probably find the combination of Reboot Your Portfolio and the ETF All-Stars as a nice one-two punch for their portfolio.