Just as I thought it was going alright

I found out I’m wrong when I thought I was right

It’s always the same, it’s just a shame, that’s all

I could say day and you’d say night

Tell me it’s black when I know that it’s white

Always the same, it’s just a shame, and that’s all

— That’s All, by Genesis

By Noah Solomon

Special to Financial Independence Hub

As we enter 2025, the general consensus is that stocks are set to deliver another year of decent returns. Most strategists contend that we will be in a goldilocks environment characterized by positive readings on economic growth, profits, inflation, and rates.

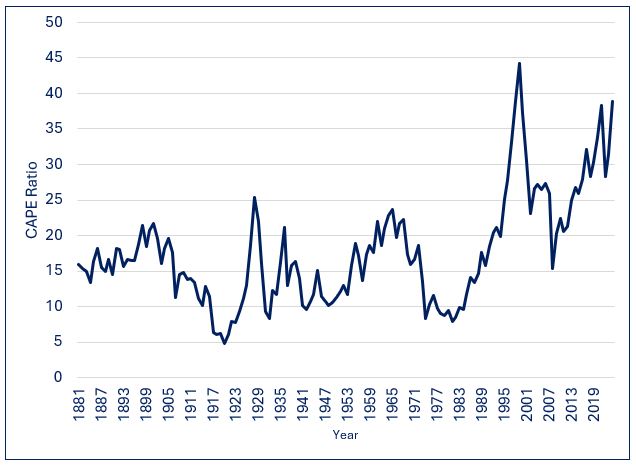

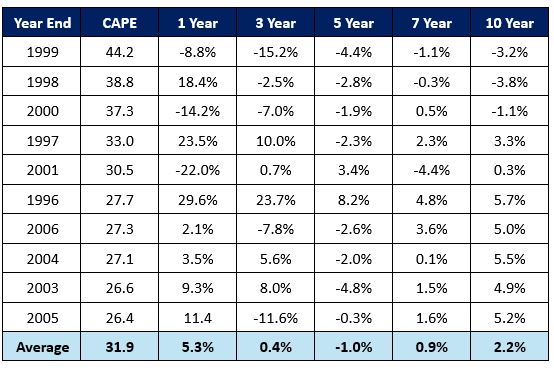

This sentiment is particularly evident in the current valuation level of the S&P 500 Index. Regardless of which metric one uses, the index is extremely elevated relative to its historical range. Interestingly, U.S. stocks are an outlier when compared to other major markets (including Canada), which are trading at valuations that are in line with historical averages.

The Best of Times and the Worst of Times

Unfortunately, the history books are quite clear about what can happen to markets that attain peak valuations. The four largest debacles in the history of modern markets were all preceded by peak valuations.

- In 1929, the U.S stock market traded at the highest PE multiple in its history up to that time. This lofty multiple presaged the worst 10 years in the history of the U.S. stock market.

- In 1989, the Japanese stock market was trading at 65 times earnings. The aggregate value of Japanese stocks exceeded that of U.S. stocks despite the fact that the U.S. economy was three times the size of its Japanese counterpart. Soon after, things went from sensational to miserable, with Japanese stocks suffering a particularly prolonged and steep decline.

- In early 2000, the S&P 500 Index, aided and abetted by a tremendous bubble in technology, media, and telecom stocks, reached the highest multiple in its history. Not long thereafter, the index suffered a peak trough decline of roughly 50% over the next few years.

- In early 2008, the S&P 500 stood at its highest valuation in history, with the exception of the multiples that preceded the Great Depression and the tech wreck. The ensuing debacle brought the global economy to the brink of collapse and required an unprecedented amount of monetary stimulus and government bailouts.

The bottom line is that markets have historically been a very poor predictor of the future. At times when asset prices were most convinced of heaven, they could not have been more wrong. The loftiest valuations have not merely been followed by tough times, but by the worst of times. Time and gain, peak multiples have foreshadowed the worst results, which brings to mind one of my favorite quotes from John Kenneth Galbraith:

“There can be few fields of human endeavor in which history counts for so little as in the world of finance. Past experience, to the extent that it is part of memory at all, is dismissed as the primitive refuge of those who do not have the insight to appreciate the incredible wonders of the present.”

The Common Feature

There is one common feature to these sorrowful tales of peak multiples which ended in tears. In each case, peak valuations followed a prolonged period of near-perfect environments characterized by strong economic and profit growth unmarred by any obvious clouds on the horizon.

- The years preceding the Great Depression entailed an economy that had not merely been growing but booming.

- Prior to 1989, the Japanese economy enjoyed decades of torrid growth, prompting some economists and strategists to predict that it would eventually eclipse the U.S. economy.

- In early 2008, the U.S. economy was being propelled by a real estate bubble underpinned by an “it can only go up” mindset and a related explosion in lax credit and lending standards.

The S&P 500 Index currently stands at its highest multiple in the postwar era, save for the late 1990s tech bubble. Optimists justify this development by pointing to what they believe to be a rosy future with respect to the U.S. economy, earnings, inflation, and interest rates. Sound familiar?

I’m not saying that highly elevated multiples necessarily foreshadow imminent doom. However, when juxtaposing the current valuation of the S&P 500 with historical experience, one should consider becoming more defensive. As famous philosopher George Santayana stated, “Those who cannot remember the past are condemned to repeat it.”

Driving without Airbags or Seatbelts

The underlying cause of the aforementioned market crashes is not merely economies and profits that were contracting, but that asset prices were priced for exactly the opposite. This left markets woefully exposed when the proverbial music stopped.

Think of market risk like you think about driving a car. If you are driving a car with airbags and you are wearing a seatbelt, then chances are you will emerge with minimal or no injuries if you get into an accident. However, if your car has no airbags and you are not wearing a seatbelt, then the chances that you will sustain serious injuries (or worse) are materially higher. Similarly, when multiples are at or below average levels and profits hit a rough patch, the resulting carnage in asset prices tends to be muted. Conversely, if any financial bumps in the road occur when valuations lie significantly higher than historical averages, then the ensuing losses will be much more severe. Also, even if you manage to complete your journey without any mishaps, it’s not clear that having no airbags and not wearing a seatbelt made your ride much more enjoyable or comfortable than if this had not been the case. Continue Reading…