John Tavares of the Toronto Maple Leafs is in a dispute with the Canada Revenue Agency that could impact pro athletes and high-income earners in general.

John Tavares of the Toronto Maple Leafs is in a dispute with the Canada Revenue Agency that could impact pro athletes and high-income earners in general.

Financial advisor Darren Coleman, a cross-border expert, discussed the Tavares case in a recent episode of the podcast: Two Way Traffic. His guests were tax lawyer Shlomi Levy and tax accountant Kevyn Nightingale of Levy Salis LLP. The firm, which has NHL players as clients, is dedicated to U.S. and Canadian tax and estate planning for individuals, corporations, and those with cross-border interests.

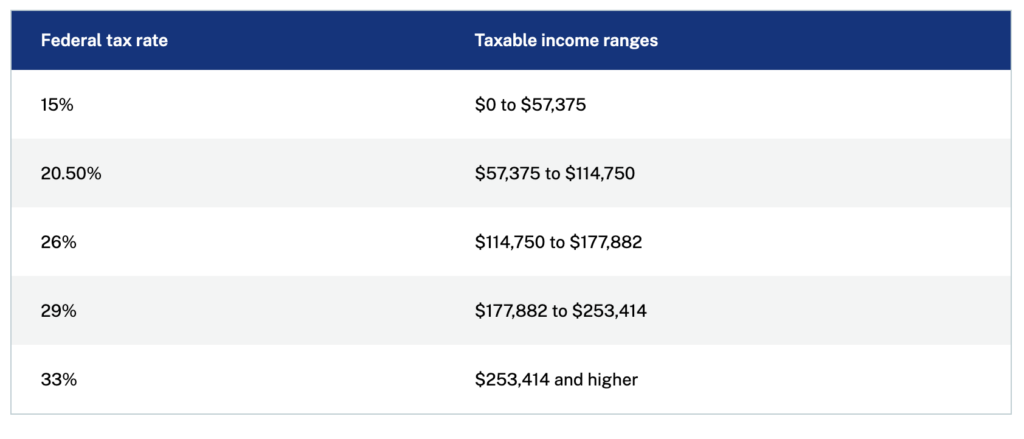

In 2018 Tavares, then a US resident, left the New York Islanders to sign a seven-year, $77-million (US) contract with the Maple Leafs. For the first year of that contract his base salary was $650,000 (taxed in Canada at 53%) with $15.3 million a signing bonus (taxed in Canada at 15%). But now the CRA says that was all salary and wants back taxes. With penalties that comes to about $8 million US.

“The CRA says it was all employment income,” said Nightingale and his colleague Levy explained what a CRA win might mean. “It would make it harder for Canadian NHL teams to compete with American teams in lower-tax jurisdictions. But it goes beyond that.”

Link to podcast …

https://twowaytraffic.transistor.fm/episodes/game-night-john-tavares-vs-cra

Darren Coleman

Today I’m joined by my good friends, Kevin Nightingale and Shlomi Levy of Levy Salis LLP. Kevin is one of the top cross-border tax accountants and Shlomi one of the top cross-border tax attorneys in North America.

We’re going to talk about the John Tavares case and his tax issues with CRA. It’s getting a lot of press and attention. Tavares of the Toronto Maple Leafs is a hometown boy and it was a big deal in July 2018 when he went into free agency and signed with the Maple Leafs a seven-year contract that would have paid him $77 million [US] and $15 million of that was an upfront signing bonus.

Six years later, CRA wants millions of dollars of unpaid taxes because of the way the deal was structured. This can have an impact on how NHL teams recruit and could apply to every sports team, but also in the corporate world when trying to bring talent to Canada. I know you guys have players as clients but do not represent Mr. Tavares.

Kevyn Nightingale

The main issue is it’s expensive to get athletes to come to Canada. The tax difference between Canada and the U.S. is wide and has been widening over years, especially since 2015 when the then new Liberal government decided to raise tax rates, particularly on high earners, and they were thinking of your home-grown high earners. But in a world where talent is mobile, particularly in things like sport, if you raise tax rates you lower their effective income and what they care about is the after-tax income.

Compare coming to play for the Toronto Maple Leafs, where tax rates are 53.5% on the vast majority of their income, and going to Florida where the tax rate is 37%. That makes a big difference. Now there are other states where there are significant taxes. California is getting close and New York City is getting close, but there are ways of dealing with that in the US that still make the tax rate effectively lower for many players.

Darren Coleman

So the structuring of the Tavares contract was trying to give him some tax benefit by structuring a signing bonus vs. a salary. Shlomi, can you dig into why that mattered?

Shlomi Levy

Tax paid in the state of New York isn’t credited against the Canadian side, but is based on the Canada-US tax treaty and the potential tax savings were probably $1.3 million. But now, if CRA gets its way between penalties and interest six years down the road, it would be probably three or four times that amount in payment.

So you have to question the strategy. One of the things I like to discuss with clients and athletes is what’s the risk and what is the reward vs. the risk? You want to make sure people take those calculated risks. God knows how long this may take to settle and it might just not be worth it. I represent north of 50 NHL players come training camp and these guys can’t be bothered with legal discussions or tax discussions. They’re focused on playing hockey. This is going to be a huge distraction for John and his family if it doesn’t get settled quickly.

Kevyn Nightingale

He only had to pay Canadian tax of 15% on the signing bonus portion that he received prior to coming to Canada.

Darren Coleman

So I think his assumption was he was not a resident of Canada. I think that’s what CRA is challenging.

Kevyn Nightingale

He was by all accounts a non-resident of Canada because he was living in New York and playing for the Islanders, and had not yet come to Canada when he got this portion of the signing bonus. Now he ultimately did move to Canada, but that was after the fact. So we’re only talking about the part that he received prior to coming to Canada. The deal is if you have a signing bonus and it’s properly authorized as a signing bonus, and you’re a non-resident of Canada and it’s paid by a Canadian team, your Canadian tax goes down from 53.5% to 15% so that is a sizeable savings. As a resident of the US he has to pay US tax on his worldwide income. And he’s paying US tax, and he’s paying New York state tax because he lives in New York state. Now he will get a credit for the Canadian 15% but he’s still paying effectively US and New York rates that may go as high as 45% or even more. So Shlomi is right. The savings are about a million dollars.

Darren Coleman

The difference between the tax rate and what the Canadian tax rate would have been?

Kevyn Nightingale

Yes, he would have been ahead of the game, but not by a huge amount. It’s not like someone who’s living in Texas or Florida, which many athletes do. But CRA says we don’t care what the US aspect is. We lost the difference between 53.5 and 15. That’s what we care about.

Darren Coleman

You mentioned earlier it’s the characterization of a signing bonus. Is that also part of what CRA is saying? That it wasn’t a signing bonus? You received it as income?

Kevyn Nightingale

CRA is arguing that it’s really employment income but you call it a signing bonus. We’re still going to call it employment income. One of the factors that goes into it is whether the employee, in this case, the athlete, has to repay any of it if he doesn’t actually show up to work. So, injured, retired, not feeling like working that kind of stuff. Well, apparently that is not at issue here because if Tavares did not show, he would not get the signing bonus. So that argument is a loser for CRA because they just don’t have the facts on their side.

Shlomi Levy

The nature of the NHL contract is you signed a contract that’s guaranteed and you’re owed the money.

Darren Coleman

Where do you think CRA has ground to stand on this one?

Kevyn Nightingale

CRA is saying it’s just so big compared to everything else. The signing bonus in total is $70 million, almost $71 million and that cannot not be employment income. 71 million of the 77 million has to be employment income and that’s it.

Darren Coleman

How does this affect how you negotiate or how you talk to players about this?

Shlomi Levy

Until there’s a judgment on this, it definitely puts people on their back feet. I want to say only the first 15 million of the signing bonus is being contested here because the following bonuses were paid to him as a Canadian citizen and tax resident. So it’s not really contested. The bulk of the work I’ve done is mostly with Canadian athletes who are resident here. So we haven’t had any of these issues. We do deal with a lot of Canadian athletes who married American girls, so the complexity is still there, but I would say that a lot of free agents, especially when it comes to baseball, and even the CFL in Toronto, are going to be looking at this carefully.

Darren Coleman

Because as a group they have more Americans moving to Canada than hockey players, right?

Shlomi Levy

Correct. Look at Toronto. You’ve got Austin Matthews, who’s an American citizen and he’ll probably straddle that line. He’s never considered a Canadian tax resident. You’ve got some Europeans with Nylander in Toronto as well. Big contract, big signing bonuses. So a lot of people are going to be watching this, and the strategy for Canadian teams might change significantly depending on what this judgment produces.

Darren Coleman

I think fans are watching this because the tax thing can really affect the fortunes of how teams are going to be able to produce. Because if they can’t, if they’ve got such a huge tax hurdle, how are we ever going to recruit top talent if this is an issue?

Kevyn Nightingale

It is an impediment to hiring people, to doing business anywhere if you don’t know what the answer is going to be.

Shlomi Levy

In the US your individual tax rates at the federal level are low, and if you’re lucky enough to play in a state like Florida or Texas where there is no state tax, your maximum tax exposure is 37%. Now assume these guys are all making over a million bucks, so 37% versus 53.5%. There was an issue a few years ago in a Canadian team where a player was negotiating as an unrestricted free agent and ended up signing the same numerical deal, but one season less, with Dallas vs. the Canadian team, and everybody went up in uproars.

The argument is very simple. He was going to make net the same amount of money playing one year less. Agents and players are a lot more sophisticated. There’s a lot more that goes into negotiations, and not just the numerical value. 100 million in Montreal or Toronto is easily 85 million in the US, and add to that life, weather, taxes and probably paying less for the same amount of net money. At the end of the day, these athletes are phenomenal individuals. They’re well-tuned machines, but they also have an expiration date on their career, and they’re trying to optimize it.

Kevyn Nightingale

This is something many governments have trouble coming to terms with, and that is there are limits to tax. And this is the thin edge of the wedge, where you see at the top end, the talent is mobile. And you can’t just say, well, we’re going to raise their tax rates from 45% to 55% and we’re going to get 10 extra points. No. People respond. People respond to incentives.

And if you tell them you’re going to pay that much more here, they’ll say, I’ll go somewhere else where I can do better on a net basis. And that is not just the NHL and NBA and football and basketball and baseball. It is every sport, but it’s also more importantly in business. Business is more and more global, and employment is more and more global at the top end. Major Canadian corporations are hiring a CEO. They’re not just looking at Canada. They’re looking to the US as well. If you’re a new potential CEO coming up from the States you say, Well, I understand your taxes are that much higher. Pay me that much more if you want me. That makes the Canadian company much less competitive.

Darren Coleman

You run into a problem. One, it’s hard to recruit people in the lower-tax jurisdiction to come to our higher-tax jurisdiction. And then we have the way Canadians are taxed. I want to get into this because a lot of people don’t know this nuance. It’s easier for Canadians to leave our tax system. So we not only have trouble recruiting brainpower, but we also can lose talent and brainpower. It’s surprising to me how many people are surprised by this and it’s the difference between how Americans are taxed, which is on citizenship, and Canadians are taxed on residency.

Shlomi Levy

I want to go back to a statement made a bit earlier that one of the other big concerns we should have as Canadians is the attitude of our current government just grabbing as much as they can get. You look at the way the treaty works, and very often there’s a bit of IOU, you know, Canada to the US and US to Canada. It all works on an IOU system and it worked just fine until this current government came and started piling up all kinds of new catches and new grabs to make it much more difficult.

And the recent legislation they pushed forward about businesses and foreign affiliates doing business and foreign tax credits going up and down and the imposition it wishes to impose on dividends from a foreign affiliate and an extra 22% in Canada, and then one day issue a credit on extractions of dividends from that company. These are cash grabs that are telling a guy sitting in his office thinking about expansion to the US and thinking that he’s going to use corporate money and get that taxed like an individual. Next thing you know he says I’m not going to do it. And it takes away from our ability to expand our business and ideas into the US. Our Canadian government just wants to tax the jitters out of us. Continue Reading…