The term “investment synergy” entered common investor use during the takeover craze of the 1960s — but we see a new synergy that’s a big plus for investors.

The term “synergy” entered common investor use during the takeover craze of the 1960s, when businesses started to expand by taking over companies in unrelated fields. This was supposed to make the combined companies grow faster than if they had stuck to their own fields.

The acquirers borrowed a term from biology to explain their rationale: this mix-rather-than-match growth strategy brought synergistic benefits. Synergy refers to an interaction between two or more drugs. The total effect of the drugs is greater than the sum of the individual effects of each drug if taken separately. For instance, today’s treatments for cancer, prostate and other health issues often call for prescribing two or more drugs. The combined impact may be more powerful and beneficial than you’d expect from adding up what they could do separately.

However, the synergy effect can also be negative. For example, combining alcohol with tranquilizers or opiates can lead to negative outcomes, even death.

The impact of 1960s investment synergy-seeking growth was uneven. Sometimes it worked, but it was better at producing temporary gains in stock prices than lasting gains in corporate earnings. In later decades, however, it turned out that unwinding synergy-seeking takeovers could lead to even larger profits.

This unwinding broke companies up into a “parent” and one or more “spinoffs.” The parent would then hand out shares in the spinoff to its own shareholders, as a special dividend.

A number of academic researchers have studied the outcome of spinoffs. Most found that spinoffs produce some of the most dependable profits you can find in the stock market, at least for patient investors. The academic findings were so impressive that we called spinoffs “the closest thing to a sure thing that you can find in investing.” (In fact, we were so impressed that it spurred us to launch our Spinoffs & Takeovers newsletter.)

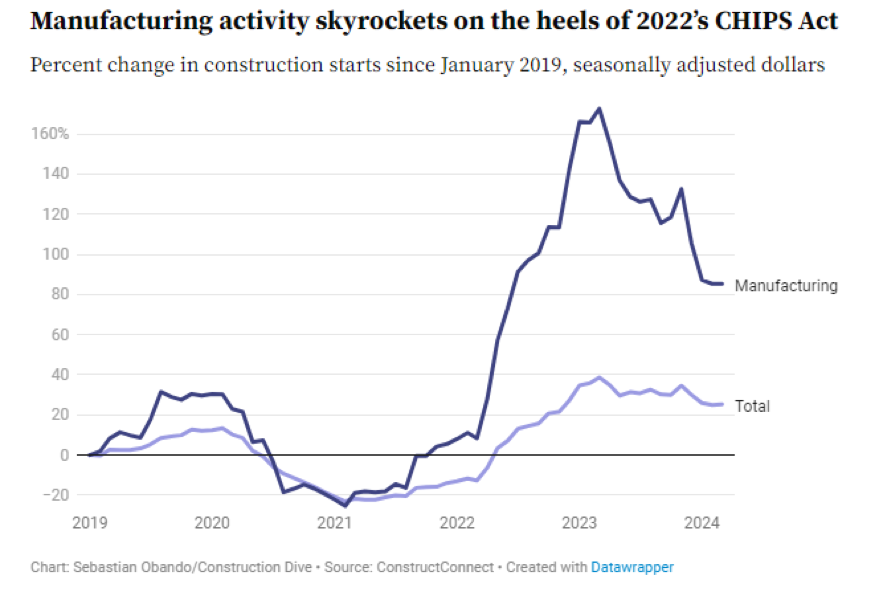

You can find a number of processes in finance and investing that seem vaguely biological or scientific. For instance, consider Moore’s Law. It refers to the 1965 observation made by Gordon Moore (co-founder of Intel Corp.) that the number of transistors in a dense integrated circuit (now called a microprocessor) doubles about every two years. As a result, costs drop by half, and computing speed doubles. (Manufacturing progress later cut that time down to 18 months.)

This high growth rate was due to improvements in the basic design of early transistors. The continuing improvements spurred fast growth in the profits of Intel and other microprocessor stocks, and sharp gains in their stock prices in the 1980s and 1990s. Around 2005, however, the rise in computer processing speed began to slow. Now some bearish analysts predict that Moore’s Law is dead. They say the effect is bound to peter out because microprocessors can only get so small before they quit working. Meanwhile, cramming too many processors on a chip can lead to over-heating. Continue Reading…