By Mirza Shakir, Associate Portfolio Manager, BMO ETFs

(Sponsor Content)

What are Sector ETFs?

Sector ETFs allow targeted exposure to sectors or industries like financials, materials, or information technology – domestic, regional, or global. The sectors are usually classified according to the Global Industry Classification Standard (GICS), but other classifications can also be used. While sector ETFs could be active funds, most track an index, offering transparency, liquidity, and low fees.

There are eleven broad GICS sectors that can be invested in with sector ETFs.

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Utilities

- Real Estate

- Communication Services

- Financials

- Health Care

- Consumer Staples

- Information Technology

There are two common approaches in constructing a sector portfolio: market capitalization weighted and equal weighted. As the names suggest, the former approach weights securities in the portfolio by market capitalization while the latter weights them equally.

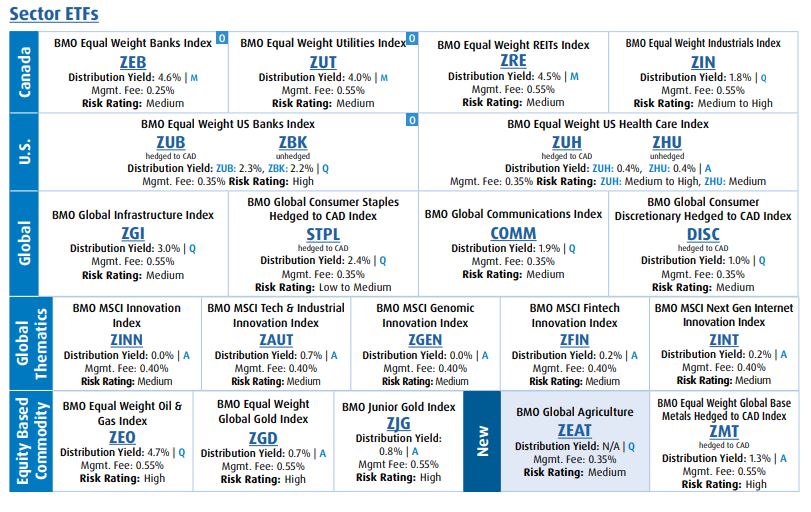

At BMO ETFs, our suite of sector ETFs covers equal-weighted and market-weighted strategies across all sectors, locally and globally. We opt for equal-weighted strategies for sectors that have the potential to get concentrated in a few large names with the market-capitalization approach, ensuring effective diversification and mitigating individual company risk.

Source: BMO GAM, BMO ETF Roadmap February 2023 (Visit ETF Centre – CA EN INVESTORS (bmogam.com)

Annualized Distribution Yield: The most recent regular distribution, or expected distribution, (excluding additional year end distributions) annualized for frequency, divided by current NAV.

Risk is defined as the uncertainty of return and the potential for capital loss in your investments.

Why Invest in Sector ETFs?

Sector ETFs can offer differentiated return and risk profiles for investors, not only from broad market portfolios but also from other sectors. Additionally, investing in a sector ETF allows access to a broad range of companies that have businesses that operate in similar or related industries, which can be more diversified than investing in a single stock. The investor does not have to place individual bets on single companies, which helps limit company-specific risks.

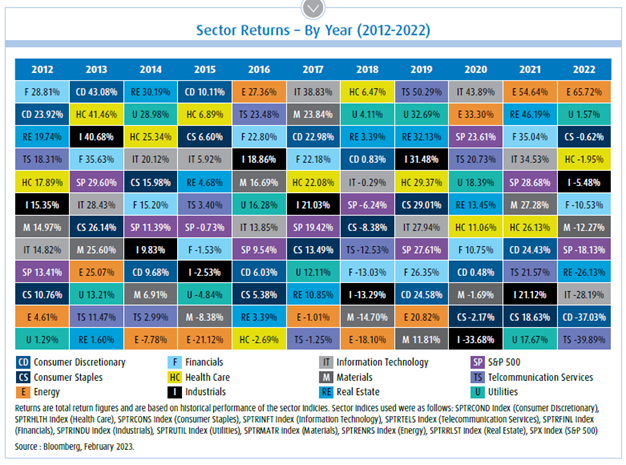

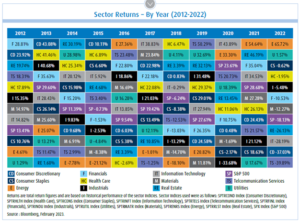

The table shown at the top of this blog, and shown to the right in miniature, shows the performance of all sectors in the U.S. from 2011 to 2022. Notably, the best and worst performing sectors change every year, leaving an opportunity for market timing to generate high returns. However, timing the markets can be extremely difficult. A more effective strategy can be sector rotation, which involves overweighting or underweighting sectors relative to the stage of the business cycle.

The table shown at the top of this blog, and shown to the right in miniature, shows the performance of all sectors in the U.S. from 2011 to 2022. Notably, the best and worst performing sectors change every year, leaving an opportunity for market timing to generate high returns. However, timing the markets can be extremely difficult. A more effective strategy can be sector rotation, which involves overweighting or underweighting sectors relative to the stage of the business cycle.

Playing Defense – Sector Rotation Strategies

The business or economic cycle refers to a cycle of expansion and contraction that economies undergo, accompanied by similar upswings and downswings in economic output and employment. Continue Reading…