By Mirza Shakir, Associate Portfolio Manager, BMO ETFs

(Sponsor Content)

What are Sector ETFs?

Sector ETFs allow targeted exposure to sectors or industries like financials, materials, or information technology – domestic, regional, or global. The sectors are usually classified according to the Global Industry Classification Standard (GICS), but other classifications can also be used. While sector ETFs could be active funds, most track an index, offering transparency, liquidity, and low fees.

There are eleven broad GICS sectors that can be invested in with sector ETFs.

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Utilities

- Real Estate

- Communication Services

- Financials

- Health Care

- Consumer Staples

- Information Technology

There are two common approaches in constructing a sector portfolio: market capitalization weighted and equal weighted. As the names suggest, the former approach weights securities in the portfolio by market capitalization while the latter weights them equally.

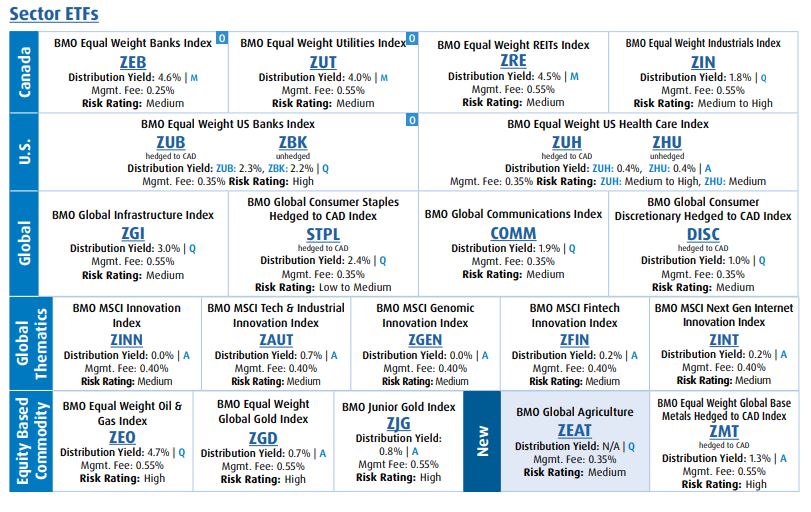

At BMO ETFs, our suite of sector ETFs covers equal-weighted and market-weighted strategies across all sectors, locally and globally. We opt for equal-weighted strategies for sectors that have the potential to get concentrated in a few large names with the market-capitalization approach, ensuring effective diversification and mitigating individual company risk.

Source: BMO GAM, BMO ETF Roadmap February 2023 (Visit ETF Centre – CA EN INVESTORS (bmogam.com)

Annualized Distribution Yield: The most recent regular distribution, or expected distribution, (excluding additional year end distributions) annualized for frequency, divided by current NAV.

Risk is defined as the uncertainty of return and the potential for capital loss in your investments.

Why Invest in Sector ETFs?

Sector ETFs can offer differentiated return and risk profiles for investors, not only from broad market portfolios but also from other sectors. Additionally, investing in a sector ETF allows access to a broad range of companies that have businesses that operate in similar or related industries, which can be more diversified than investing in a single stock. The investor does not have to place individual bets on single companies, which helps limit company-specific risks.

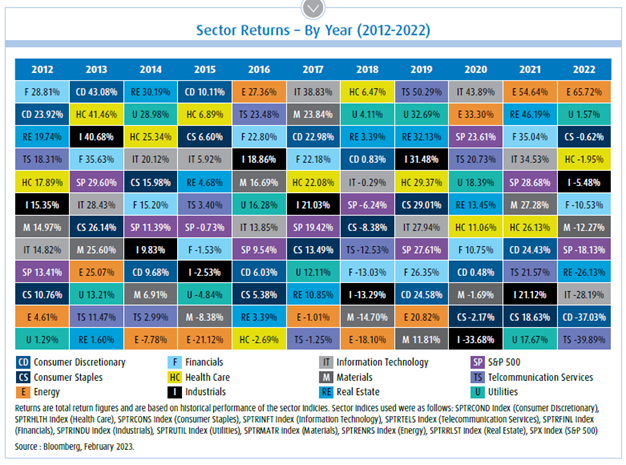

The table shown at the top of this blog, and shown to the right in miniature, shows the performance of all sectors in the U.S. from 2011 to 2022. Notably, the best and worst performing sectors change every year, leaving an opportunity for market timing to generate high returns. However, timing the markets can be extremely difficult. A more effective strategy can be sector rotation, which involves overweighting or underweighting sectors relative to the stage of the business cycle.

The table shown at the top of this blog, and shown to the right in miniature, shows the performance of all sectors in the U.S. from 2011 to 2022. Notably, the best and worst performing sectors change every year, leaving an opportunity for market timing to generate high returns. However, timing the markets can be extremely difficult. A more effective strategy can be sector rotation, which involves overweighting or underweighting sectors relative to the stage of the business cycle.

Playing Defense – Sector Rotation Strategies

The business or economic cycle refers to a cycle of expansion and contraction that economies undergo, accompanied by similar upswings and downswings in economic output and employment.

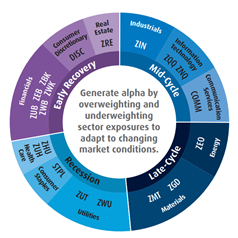

The business cycle can then be categorized in four broad stages – early recovery, mid-cycle, late-cycle, and recession. While the economy can experience shocks like the COVID pandemic that disrupt activity, the economy can generally be put into one of the four phases at any given time. Each stage produces different sector winners and losers.

Source: BMO Global Asset Management. For illustrative purposes only.

Alpha: A measure of performance often considered the active return on an investment. It gauges the performance of an investment against a market index or benchmark which is considered to represent the market’s movement as a whole. The excess return of an investment relative to the return of a benchmark index is the investment’s alpha.

The visuals above sketch out a framework for sector rotation strategies. With economic growth slowing down and a potential recession on the horizon, defensive strategies may be better positioned to outperform. Investors can thus overweight sectors like utilities, consumer staples and health care sectors to play defense.

While tough macroeconomic conditions can weigh down most companies, firms in defensive sectors benefit from resilient earnings. Poor or negative growth impacts the earnings of pro-cyclical companies more so as consumers clamp down on spending. However, spending on utilities, consumer staples and health care – so called necessities – remains relatively stable. As a result, the divergence in earnings can create an opportunity to overweight and underweight sectors tactically.

Tactically trading sectors can lead to higher volatility, especially compared to diversified, broad market portfolios. There can also be underlying factors in a sector that can offset tailwinds from macroeconomic conditions. For instance, new government regulation can disrupt earnings in the financial sector despite the economy entering the early recovery stage.

Mirza Shakir is an Associate on the BMO ETF team, covering all index equity ETF mandates as well as further enhancing and automating processes using programming. Prior to joining BMO GAM in 2021, Mirza spent 3 years in ETF market-making and index research at a large Canadian investment bank. Mirza holds a Bachelor of Arts degree in Joint Honours Economics and Finance from McGill University in addition to a Data Science certificate from the University of Toronto.

Mirza Shakir is an Associate on the BMO ETF team, covering all index equity ETF mandates as well as further enhancing and automating processes using programming. Prior to joining BMO GAM in 2021, Mirza spent 3 years in ETF market-making and index research at a large Canadian investment bank. Mirza holds a Bachelor of Arts degree in Joint Honours Economics and Finance from McGill University in addition to a Data Science certificate from the University of Toronto.

Disclaimer: This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. Risk tolerance measures the degree of uncertainty that an investor can handle regarding fluctuations in the value of their portfolio. The amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult their financial advisor before making a decision as to whether this Fund is a suitable investment for them. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. ®/™Registered trademarks/trademark of Bank of Montreal, used under licence