From setting specific financial goals for success to having someone hold you accountable, here are 18 answers to the question, “What are your best tips for how to stay motivated and disciplined in the pursuit of financial independence?”

- Stay Disciplined and Goal-Oriented

- Tie Your Goals to a Tangible Item

- Stay Educated

- Equate Money to Your Time

- Celebrate Small Wins Along the Way

- Develop an Action Plan

- Create a Budget

- Invest in Yourself

- Develop a Strong “Why”

- Have Fun With It

- Set Specific Financial Goals for Success

- Balance Spending Now and Saving for the Future

- Start Tracking Your Progress

- Focus On the Big Picture

- Be Present

- Build a Support System

- Set Yourself Micro-Goals Along the Way

- Find a Financial Accountability Buddy

Stay Disciplined and Goal-Oriented

Staying motivated and disciplined while pursuing financial independence requires commitment. One approach to remaining committed is to practice goal-setting, breaking down big goals into smaller goals that are based on achievable objectives. For example, if you want to save $1,000 in 3 months, break your bigger goal of saving money into a series of monthly phases, setting benchmarks each month as you inch closer to achieving your end goal. This helps with momentum and development while moving towards your desired result. — Michael Alexis, CEO, swag.org

Tie Your Goals to a Tangible Item

One often overlooked way to accomplish this is to tie your goals to a tangible item, such as a savings jar or bank account. Visualize yourself with it when planning out what you need to do today and watch as your small contributions add up.

Having this visual representation can be just the thing you need on days when you feel unmotivated and looking for an excuse not to save money. Taking ownership of your financial goals is the first step towards realizing those dreams – that’s what staying disciplined will help you achieve! — Tasia Duske, CEO, Museum Hack

Stay Educated

Continually educating yourself about personal finance is crucial in staying motivated and disciplined as you pursue financial independence. Of course, this starts with knowing how to budget and set boundaries for yourself.

As you strive toward financial independence, it’s important that you know where your money is going and identify areas where you can cut back on spending. There are a variety of ways that you can budget your money, so explore those options and find a way that works for you.

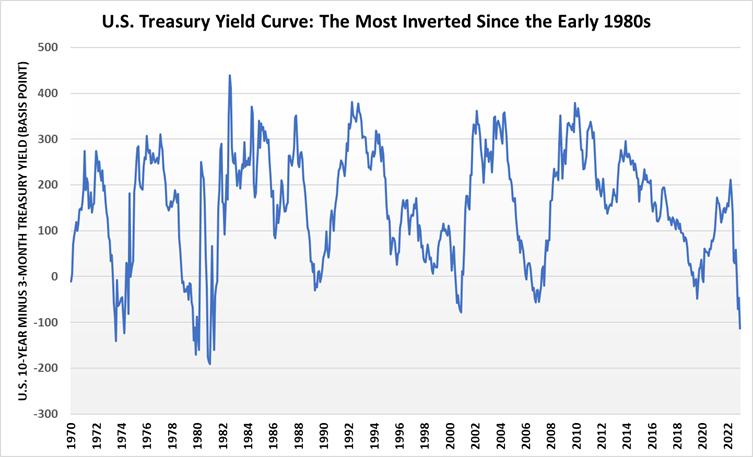

If you are one who likes to invest, stay up to date on current market trends so you don’t take any enormous risks that could cost you a lot of money. As you continue to stay informed and educated about personal finance, you will make informed decisions and avoid costly mistakes, which will ultimately help you achieve your goals. — Bill Lyons, CEO, Griffin Funding

Equate Money to your Time

Whether you make minimum wage or $100 an hour, we all trade time for money. Spending less money is one way to achieve greater financial independence. But when you’re struggling to cut expenses, one way to stay motivated is to understand how much time your money costs you.

For example, if you’re toying with the idea of a $50 purchase, think of how much of your time it would take to make back that $50. How far would that put you behind? Would you be willing to spend that time getting that item?

Thinking about money in terms of minutes/hours of your life can help you exercise some restraint on impulse buys or unnecessary purchases. If you feel like it would be a waste of time, it’s probably a waste of money, too. — Alli Hill, Founder and Director, Fleurish Freelance

Celebrate Small Wins along the way

Achieving financial independence can be a long and difficult journey, and it’s easy to become discouraged if you only look at the result. You can keep your motivation and momentum going by celebrating minor victories along the way.

Set attainable short-term goals, such as paying off a credit card or increasing your monthly savings by a certain amount. When you achieve these objectives, take the time to recognize your accomplishments and reward yourself.

As a reward for sticking with it, give yourself a small treat or indulge in a favorite activity. This will help you in maintaining your motivation and discipline, as well as making the journey to financial independence more enjoyable. –– Johannes Larsson, Founder and CEO, JohannesLarsson.com

Develop an Action Plan

It is important to develop a plan with realistic goals. Start by setting short-term goals that are achievable, such as saving a certain percentage of each paycheck or paying off the debt within a certain timeframe.

Then, set longer-term goals for retirement savings or other goals related to financial independence. Having a plan will help keep you motivated and on track to achieving your financial goals. — Martin Seeley, CEO, Mattress Next Day Continue Reading…