By Matthew J. Ardrey, CFP, R.F.P. FMA, CIM®

Special to Financial Independence Hub

As I sit here at the beginning of 2026, I would like to take a moment to reflect on 2025. We had increased U.S. protectionism through tariffs, labour market concerns with the advancement of AI, changing interest rates and another strong year of stock market returns.

With all of these macro themes out of our control, I thought of some of the personal conversations I had with clients during the year about things in their control.

1.) Keep a Positive Cashflow

One of the simplest rules in personal finance is to spend less than you earn. One of the most consistent matters I see when drafting financial plans is people know what they earn and know what they save, but do not have a complete grasp on what they are spending.

A simple way to know what you are spending is to subtract savings from after-tax earnings. Whatever remains you are spending. To take control of that spending though, you need to know where the funds are being spent. Armed with that knowledge, you can decide to continue spending on something, reduce it or cut it out altogether.

Once you are in control of your budget, use it to your advantage to save. Savings are key to wealth creation.

2.) Stay Invested

We have now had several strong years of market performance since COVID in 2020. There is no way we can predict what will happen in 2026. We may have another great year or maybe we won’t. Either way, studies show over and over again that staying invested is one of the most important factors in financial success.

There is a famous phrase in investing, “time in the market beats trying to time the market.“ Aside from how impossibly difficult it is to time them market, this also shows the power of compounding returns over time.

3.) Getting Wealthy vs. Staying Wealthy

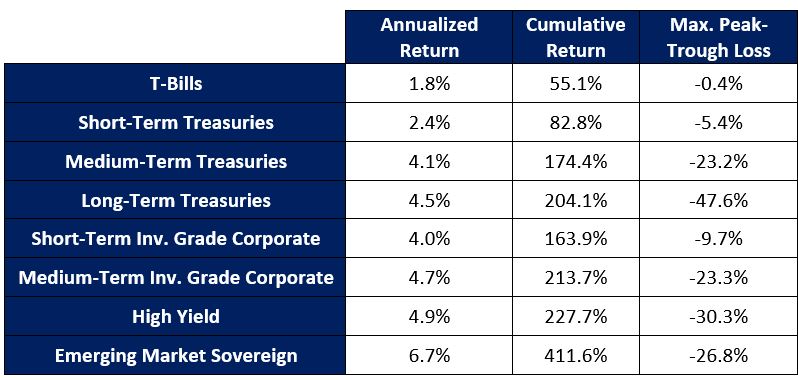

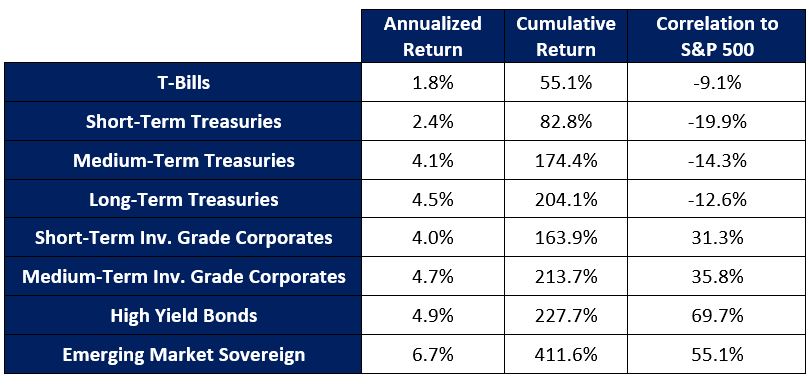

Many financial plans I did for new clients this year were for people planning to retire in the next five years and almost every one of them had a portfolio that was at least 80-90% in stocks.

A large allocation to stocks is a great way to get wealthy but may not be the best way to preserve your wealth, especially when decumulating that wealth as part of your retirement plan.

Though we have not seen much of it in recent years, stocks can be a very volatile asset class. In the 2008 Global Financial Crisis, the S&P500 fell more than 50% and took close to six years to fully recover. A similar situation would be devastating to a retirement plan, as not only would the portfolio value fall, but there would also be crystallization of losses, as stocks are sold at losses to fund the retirement.

A well diversified portfolio among asset classes and geographic regions can help mitigate the impact of market declines. Once you have made your wealth, you don’t need homeruns to win the game. You can get around the bases on singles and doubles.

4.) Risk Mitigation: Part 1

In every plan I prepare, I want to create safety margin for my client. It could be using a Monte Carlo volatility analysis in retirement projections or an emergency fund against loss of income or large, unexpected expenses.

The benefits of these safety margins include the ability to survive a negative event, stress reduction and with that the ability to think more clearly to make better decisions. Stress clouds decision making and in a time of crisis, it is clear thinking that is most needed.

Life is never a straight line from A to B. Preparing for inevitable risks that life will bring you is sound financial planning.

5.) Keeping up with the Joneses

There is an immense amount of social pressure to fit in. To make sure you are of a similar status of those around you. But have you ever thought, how do others achieve or maintain that status? Your neighbour with the fancy house, pool and great car make look wonderful on the outside but may be swimming in debt up to their neck to “afford” all of their luxuries.

This is where the real value of a comprehensive, personal financial plan is visible. It will quantify if you can afford the reality you want. It also removes all of the rules of thumb and what works for the average person and focuses on what you need to do to achieve your personal financial goals.

6.) Risk Mitigation: Part 2

Much of financial planning is focused on the happy ending. Sailing off into the retirement sunset and enjoying the life you have worked so hard to earn. Unfortunately, life throws us curveballs and ensuring the risk management side of financial planning is covered is just as important. Continue Reading…