The following is an edited transcript of an interview conducted by financial advisor Darren Coleman’s of the Two Way Traffic podcast with tax expert Kim Moody, of Moody Private Client. It appeared on August 8th: click here for full link.

Moody recently wrote an article in the Financial Post about the government flirting with the idea of a home equity tax, even on principal residences. Such a tax could result in an annual levy of about $10,000 for a home worth $1 million. He described that, along with the increase in the capital gains inclusion rate that has already passed into law, “really bad tax planning” based on ideology, not economics.

In the podcast Moody and Coleman also discussed …

- The disparity between U.S. and Canadian tax rates, beginning with how the state of Florida compares with Ontario, a difference of 17%.

- The tax model established in Estonia lets you reinvest in your company without paying corporate tax while personal income is taxed at a flat rate of 20%. They say such a system would work in Canada, and celebrate success and entrepreneurship.

- What organizations like the Fraser Institute and mainstream economists think about Canada’s economic performance.

Below we publish an edited transcript of the start of the interview, focusing on the capital gains inclusion rate and trial balloon about taxing home equity.

Darren Coleman: I’m Darren Coleman, Senior Portfolio Manager with Raymond James in Toronto. I’m delighted to be joined by Kim Moody of Moody’s tax and Moody’s private client. You’re also a law firm based in Calgary, Alberta, and probably one of Canada’s best known tax and estate planning advisors. You may have heard our last conversation with Trevor Perry about some of the issues we might be seeing in terms of taxation of the principal residence in Canada.

I think because governments have spent so much money that we’re going to see tremendous innovation in taxation. Do you want to set the table for the article you wrote in the Financial Post, where you talked about where this is coming from, and why Canadians might be on alert for what might be coming to tax the equity in their homes.

Kim Moody: The point of the piece was mainly just to put Canadians on notice that you had the Prime Minister and the finance minister sitting down with what I call a pretty radical

think tank. I consider them an ideological bastion of radical thought but that issue aside,

they call them call themselves a think tank, and this particular one, led by Paul Kershaw of

Generation Squeeze, has stuff on their website that pretty much attacks older Canadians:

basically saying they’ve gotten rich by going to sleep and watching TV. Unbelievable. Whoever approved that, it’s just so offensive. But that issue aside, the whole connotation of the messaging is that, hey, these people are rich. We’ve got these poor young Canadians who are not rich and they can’t afford houses because you’re rich and …

Darren Coleman Someone should do something about it, right? That’s the trick.

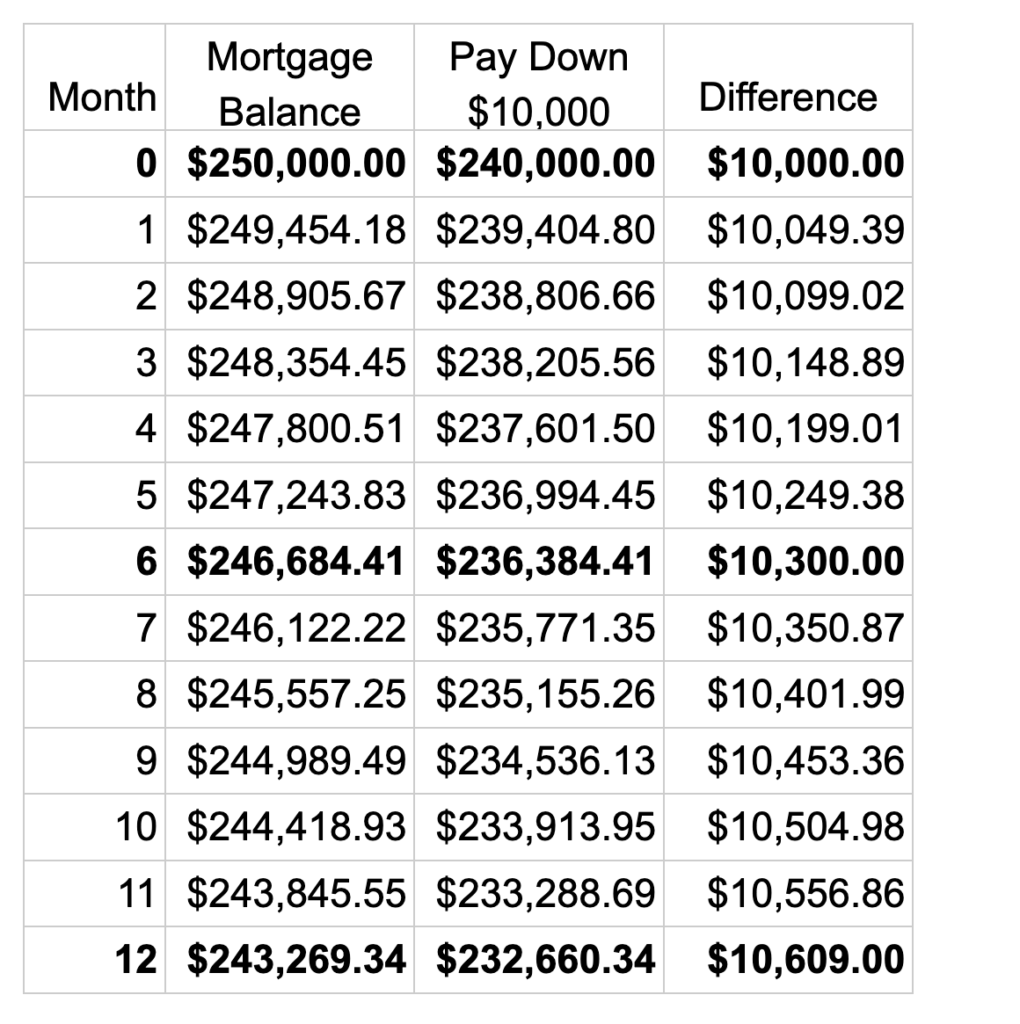

Kim Moody: Someone should do something about it. And their solution is to introduce a so-called Home Equity tax on any equity of a million dollars or more. And they call it a modest surtax of 1% per year. So it’s like another, effectively property tax … It’s just so nonsensical and so offensive on a whole bunch of different levels. Like you think about grandma and grandpa, yeah, they’ve got equity in their homes, but they don’t have a lot of cash. They’ve been working hard their entire lives to pay off their houses. And yes, they want to transfer down to their kids at some point, but right now, they’re living again, and they’re making ends meet by living off their pensions that they worked hard, and you’re expecting them to shell out more money for that, and I find that offensive.

…. Back to the original premise of why I wrote the article: to let Canadians know that our leaders are entertaining stuff like this. It doesn’t mean they’re going to implement it, but they’re actually entertaining radical organizations like this and secondly, just to put Canadians on

notice that this is just the beginning. If this regime continues with out-of-control spending and no

adherence to basic economics, then we could expect a whole bevy of new taxes.

Darren Coleman

Indeed, they’ve already done some of this, right? So you know that this idea about we’re going to tax home equity, either through some kind of annual surtax on equity over a certain amount, or we’re going to put a capital gain on principal residences. And I would argue that for years now, Canadians have had to report the sale of the principal residence on their tax returns, which is a non-taxable event, yet you now have to tell them, and if you don’t, there’s a penalty. Continue Reading…