“Retirement: World’s longest coffee break.”

“Retirement: World’s longest coffee break.”

—Author Unknown

Families are becoming increasingly concerned about achieving and maintaining their long term retirement goals. Some retirements will be in doubt. Others will fall short of the objectives. Having sufficient, reliable sources of funds is at the top of the worry list. Deploying a secure retirement plan spanning 20 to 30 years, often longer, is a demanding journey for many.

Planning for retirement remains a balancing exercise between providing for today and salting away a big enough portion for the later years. Sadly, not everyone gets it right. Hopefully, you will never have to face that dreaded realization. That is, you don’t have enough money to retire, or continue retirement, as planned.

“Most retirement concerns or mishaps typically surface after age 60.”

Someone who is broadly qualified should be in charge of stickhandling this exercise. Perhaps, someone who can take on duties of a “wealth pilot.” Extensive experience is desirable in navigating the nest egg through the myriad of temptations for making sudden moves. Logical decisions that place the family’s best interests first are a must. It also manages overreactions to daily headlines.

Canadian families rely on a combination of financial sources to fund retirement: personal savings such as cash, RRSP, RRIF and TFSA accounts. A variety of real estate properties contribute. Employer pension plan benefits are important to many. Government benefits typically include Old Age Security payments net of clawbacks and the Canada Pension Plan. The last two offer some flexibility as to when they commence. American families have their own assortment of registered accounts, such as 401(k) and IRAs, along with entitlements to Social Security.

Most retirement concerns or mishaps typically surface after age 60. This situation may pose a variety of difficulties to recover from. Some investing landscapes have been getting a little tattered of late. Continued low-return environments contribute to the dilemma.

What causes shortfalls

All retirements need to deal with several moving parts at once that develop along the roadway. I summarize some of the more critical reasons that affect retirement funding shortfalls:

- Not saving enough to fully fund the family retirement.

- Being in denial that the nest egg is not sufficient.

- Spending more than can be safely drawn from the nest egg on hand.

- Incurring large investment losses or borrowing more than safe limits.

- Sustaining a breakup of the marriage or relationship.

- Employer developments forced you to early retire sooner than planned.

- Enduring a business failure or financial setback.

- Involuntary payment reductions from an employer pension.

- Incurring significant health costs or financial emergency.

- Investment game plan is too conservative or concentrated.

- Underestimating costs incurred, such as a retirement home facility.

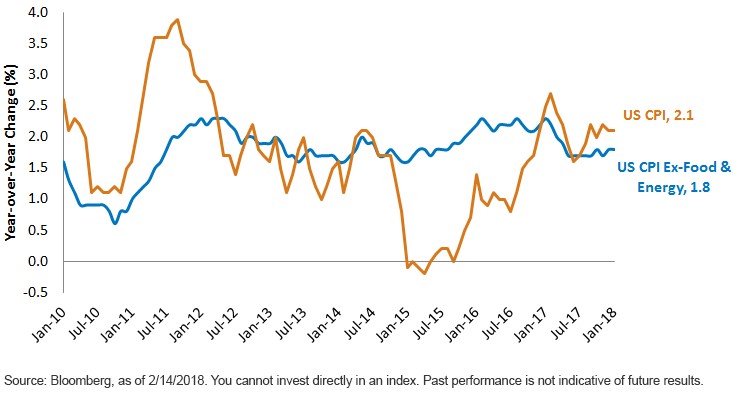

- Ignoring the adverse impact of inflation over the long run.

Investors are wise to delve into the pressures of delivering long-term portfolio results. Most nest eggs receive little or no saving capacity after retirement begins. Think of this as having to rely only on investment returns, say for 30 years. That is both hard to imagine and accomplish.

In addition, emotional attachments to investments owned typically prevent portfolios from taking corrective actions in a timely manner. For example, investors hold onto loss positions far longer than necessary.

Any one reason, or combination, can abruptly slam the brakes on family retirement goals. You typically need to act quickly to rectify the setback in the making.

I suggest starting with a deep breath. Then proceed to methodically analyze and estimate the size of your retirement shortfall. Sketching a few “what if” scenarios should help your family identify and select the best ways to move forward.

Assess your options