Repeat after me: The Canada Pension Plan will be there for me when I retire.

Repeat after me: The Canada Pension Plan will be there for me when I retire.

In fact, CPP is sustainable over the next 75 years according to the most recent report issued by Canada’s Chief Actuary. This projection assumes a modest 3.9 per cent annual real rate of return over that time.

The plan is operated at arms length from governments by the CPP Investment Board (CPPIB), whose sole mandate is to maximize long-term investment returns in the best interests of CPP contributors and beneficiaries.

Despite this assurance, I still see numerous comments on blogs and social media dismissing CPP as something doomed to fail.

“The feds are robbing the CPP fund to pay for infrastructure and massive debt loads.”

“I’m fairly certain there won’t be a CPP fund in 25 years when I’m ready to retire.”

“My retirement projections don’t include CPP, just in case . . . “

The media exacerbates the problem by reporting on the CPPIB’s quarterly earnings, which, most recently, slumped to 0.7 per cent thanks to a strong loonie dragging down its foreign investments. But to the CPPIB and its long-term investing mandate, a quarter isn’t measured in three months: it’s more like 25 years.

Don’t ignore CPP in your retirement projections

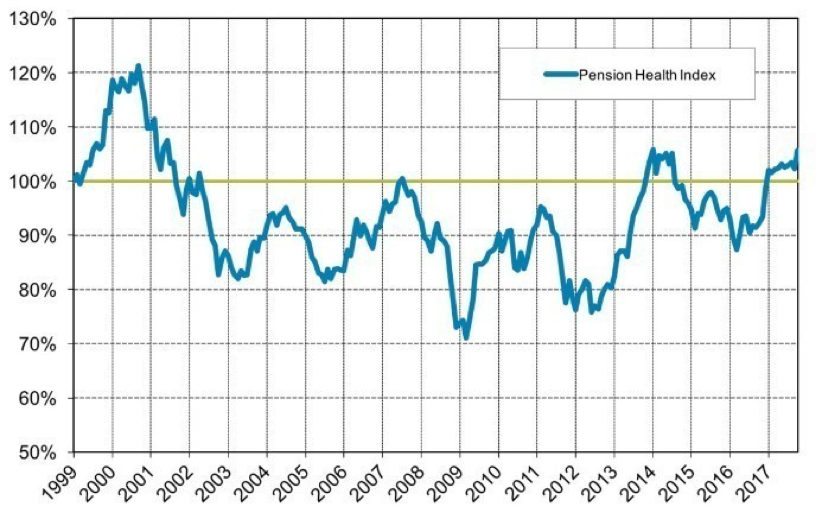

Source: Mercer Pension Health Index published October 2, 2017

Source: Mercer Pension Health Index published October 2, 2017