The following is the second excerpt from Create the Retirement You Really Want: And Retire Smarter, Richer and Happier

The following is the second excerpt from Create the Retirement You Really Want: And Retire Smarter, Richer and Happier

By Clay Gillespie

Special the Financial Independence Hub

It was a beautiful May morning when I next saw Rachel and Mike. Rachel was carrying a large gift-wrapped box.

“This is for you,” she said, smiling and handing the box to me.

“Thank you,” I said, pleasantly surprised. “Most of my clients wait until they see how their portfolio performs before expressing their appreciation.”

“Shall we take it back then?”

“No, no! I’ll keep it,” I said, smiling, as I began to slide off the ribbon and remove the wrapping.

I opened the lid, looked inside and grinned with pleasure. “Much appreciated,” I said, looking proudly at a genuine leather soccer ball with my daughter’s name custom-printed on the top panel. “Sarah’s going to love it!”

“We wanted to give you a memento of our first meeting,” Rachel said.

“How very appropriate. Well, I don’t have a soccer ball for you,” I said, putting the ball down. “But hopefully I have an equally useful gift.”

“One that will last a lifetime?” Rachel asked.

“Yes. You might say it’s a gift that keeps on giving,” I said, grinning and handing them each a file folder.

“Our retirement numbers?” Mike asked.

“Yes. These are your illustrations.”

“Will we need to eat cat food?” Mike asked with a smile.

“No.” I laughed. “My goal is to help you maximize your retirement income, not minimize it.”

“And we won’t outlive our money?” Mike asked, more serious now.

“You should have plenty left for your children, unless you live to be Methuselah’s age.”

“Methuselah lived to be 969 years old,” Rachel said. “So I think the odds of that happening to us are slim,” she said pointedly.

“Right. My mistake,” I admitted. “I’ve taken the liberty of including a life expectancy table in your retirement illustration, so you’ll know the odds.”

“The odds of us dying at a certain age? I’m not sure I’m ready to see that!” Mike said uneasily.

“Don’t be such a worrywart, Mike,” Rachel said, chiding him gently. “It’s not as if you’re going to see the exact date and time of your death.” Suddenly, she frowned and looked at me. “Are we?”

“No,” I said smiling. “The actuaries aren’t that good, at least not yet. The life expectancies I’ve included are estimates based on a number of factors including your current age, your diet, exercise frequency, stress, body fat, genetics and the quality of health care.We’ll get to those in a moment. What you’re about to see is a financial illustration. It’s designed to give you an initial picture of your retirement situation for planning purposes. But first, we need to review your finances together so we’re all on the same page. Agreed?”

“Agreed,” they said together.

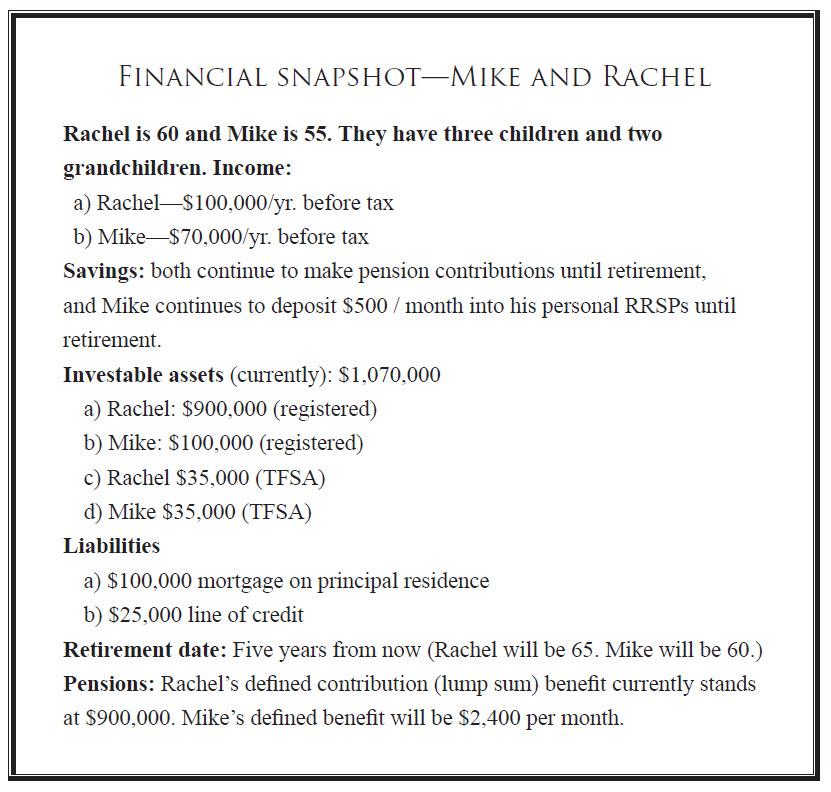

“Good. Here’s a quick snapshot of your current finances. As we go through it, I want you to let me know if anything is amiss.”

This is what they saw:

“As you can see, your gross income is $170,000 per year, while your combined income after tax is approximately $125,000.” “We work hard for our income,” Rachel said defensively.