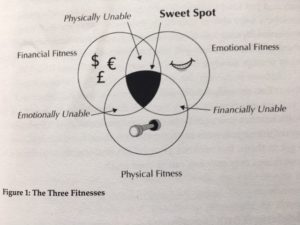

The retirement industry is starting to wake up to the fact that just because a client has achieved a certain level of retirement savings doesn’t mean that they will automatically enjoy a happy retirement.

Life just doesn’t work that way and the truth is that financial planning fails without lifestyle planning: you need to have a good handle on what you are actually saving for and why.

Our level of happiness is not determined by how much money we have; rather, it is how we choose to live our lives. In our new transition guide we have compiled a list of key attributes that if focused on will help you live longer, healthier and happier lives. By focusing on these attributes you will be well on your way to a happy and fulfilling life.

Today I would like to share some thoughts I have on one of these attributes, which is our relationship with time.

Time: Your most precious resource

“Don’t say you don’t have enough time. You have exactly the same number of hours per day that were given to Helen Keller, Pasteur, Michelangelo, Mother Teresa, Leonardo de Vinci, Thomas Jefferson, and Albert Einstein.” – H. Jackson Brown

Visiting my mother at the nursing home always reminds me that I’m getting old and every day is bringing me closer to the end. It is not a negative thought; rather, it’s an important reminder to focus and use my remaining time on this planet wisely on the things that really matter. Rushing around stressed out because I’m wasting my time is a major happiness killer for me. Watching my mother I often wonder if I am living my “why,” the best I can? Can I do better? Am I doing the best for my family? For my friends? Am I making the world a little better?

Best Before Date

Today I’m working hard at getting into shape. My time investment is a priority of mine as it will increase the odds of me living longer, and also help push back my “best before date” increasing the amount of quality time I have at my disposal.

I view “quality time” as the period of my life when I am healthy enough to do the things I love: golfing, fishing, traveling etc. Once you pass the “best before date” and have lost your health it really doesn’t matter how much money or time you have left because you will not be healthy enough to spend it. That’s just the way it is.

Black Swan Events