By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

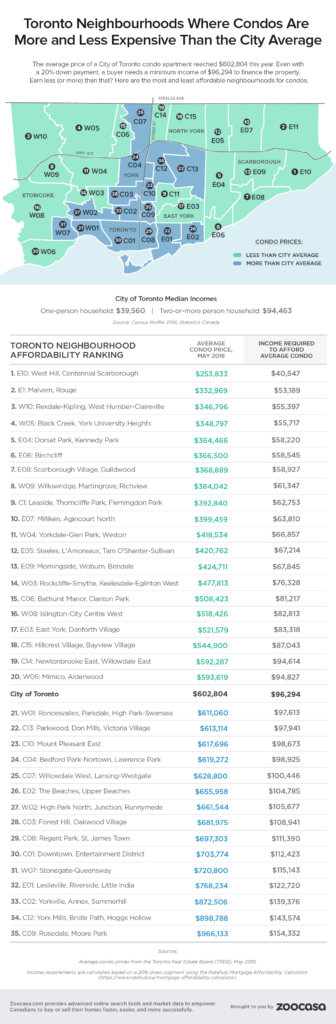

There’s no denying Toronto real estate prices have tumbled since the Fair Housing Plan was introduced by the Ontario government last April, to address the searing 33-per-cent year-over-year price growth that alarmed buyers and policymakers alike. Detached house prices – the hardest hit segment following the Plan – have since declined 14.8 per cent, representing a dollar loss of $180,878, while the average aggregate home price is down 11.8 per cent, a loss of $108,696.

However, affordability continues to be a keenly-felt issue in the city, especially among what is supposed to be the affordable entry point for new home buyers: condos.

While the priciest home segments posted deep declines in the volatile months following the Plan, condos consistently posted year-over-year gains in value; now, just over a 15 months later, they’re sitting at an average of $561,097, an increase of 8.1 per cent.

FHP did little for first-time buyers

That means that, while those in the move-up markets have enjoyed improved buyer conditions, the most vulnerable and cash-strapped have faced only worsening affordability following the new policies. Rather than find an affordable entry-hold in the 416, first-timers are increasingly drawn to further-flung communities, such as homes for sale in London, Ontario, or even Ottawa real estate, where detached living can be had at the fraction of the cost for a city condo.

However, these are aggregate data, reflecting home prices collected from the entire region monitored by the Toronto Real Estate Board. As real estate is extremely local, and can differ from neighbourhood to neighbourhood, savvy condo buyers seeking a deal may still have options within the City of Toronto proper.

Toronto’s most affordable Condo communities

To identify where this is possible, Zoocasa crunched the affordability numbers per neighbourhood, factoring in the average price in each as well as the median income earned in Toronto households.

The findings revealed that, for households earning two or more incomes at the median of $96,294, 18 of the 35 examined markets remained within the realm of affordability. They are: