Special to the Financial Independence Hub

The mortgage market in Canada is heavily regulated. Both the federal government and the Canada Mortgage and Housing Corporation (CMHC) control almost every aspect of residential mortgage lending.

The government decides what criteria people must meet when getting a mortgage in Canada. Rules apply to almost every aspect of the mortgage, ranging from the maximum amortization to the minimum down payment required when buying a home.

In the last few years, the government has taken action in response to rapidly rising house prices in an effort to keep people from taking on mortgages they can’t afford. A number of changes have been made to mortgage rules since 2012. Dry descriptions of the changes make it difficult to understand their true effect.

Instead, let’s take a look at some examples of how some recent mortgage rule changes affect their ability to borrow.

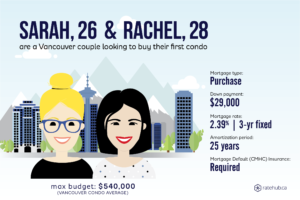

Sarah and Rachel

Even though Sarah and Rachel are choosing a three-year fixed mortgage with a rate of 2.39% for their condo purchase, new “stress testing” rules introduced in October 2016 mean they have to qualify at a substantially higher mortgage rate than they’ll actually get. The qualifying rate is set by the Bank of Canada (BoC), and is currently 4.84%. When checking a mortgage payment calculator, they find that even though their monthly payment will be $2,352 at their chosen rate, they’ll need to prove they can afford payments of $3,043.

Even though Sarah and Rachel are choosing a three-year fixed mortgage with a rate of 2.39% for their condo purchase, new “stress testing” rules introduced in October 2016 mean they have to qualify at a substantially higher mortgage rate than they’ll actually get. The qualifying rate is set by the Bank of Canada (BoC), and is currently 4.84%. When checking a mortgage payment calculator, they find that even though their monthly payment will be $2,352 at their chosen rate, they’ll need to prove they can afford payments of $3,043.

A new rule pertaining to minimum down payments that came into effect in February 2016 will apply to Sarah and Rachel as well. The minimum down payment on a home sold for over $500,000 was raised to 5% of the first $500,000, and 10% of any amount thereafter. For their $540,000 purchase, Sarah and Rachel have to save a little longer: the minimum down payment went up to $29,000 from $27,000. They’ll also need to pay for CMHC insurance since their down payment is less than 20%. Continue Reading…