By Ian Duncan MacDonald

By Ian Duncan MacDonald

Special to the Findependence Hub

Why spend days building a stock portfolio when you can almost instantly invest the same amount of money in the units of a popular mutual fund or Exchange Traded Fund [ETF]?

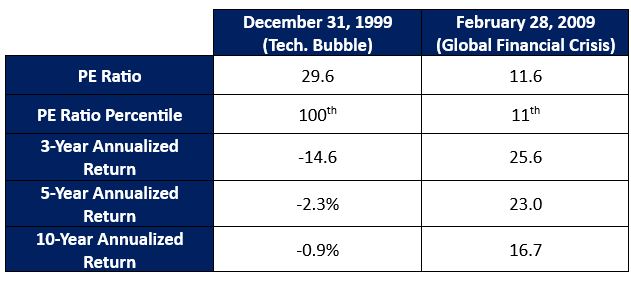

One of the most popular are the Standard and Poor’s 500 Index Exchange Traded Funds and Mutual Funds that are sold by probably hundreds of banks and investment dealers. The rise and fall of the S&P index has become a standard by which the success of all portfolios are often measured against.

The Standard and Poor’s 500 Index is a compilation of stocks selected by a committee called the S&P Dow Jones Indices. It is managed by S&P Global Inc., which sells financial information and analytics. This company is an evolution of the century old McGraw-Hill publishing company.

The S&P 500 tracks the 500 largest American companies selected by their stock market capitalization, which is the value of all the shares held by investors in a company. Fund management companies selling units in their S&P 500 mutual funds and ETFs are quick to brag that just nine of the 500 companies account for 31% of the market capitalization of all 500 companies. These nine are Apple, Microsoft, Amazon, Nvidia, Alphabet, Meta, Tesla, Berkshire Hathaway, and JP Morgan Chase. The sales pitch for buying fund units is, how you can lose with such well known, successful companies in your S&P 500 fund.

These very high-profile companies are the bait to distract you from considering the hundreds of mediocre, but large low-profile stocks in the S&P 500.

I have described the “Magnificent Seven,” which are included in the above nine, as being overvalued when you compare such things as their very high share prices to their much lower book values. For example, Apple’s book value was $4.00 compared to its share price at the time, which was $185. Book values are calculated by professional auditors subtracting what is owed by a company from their assets. The net figure is then divided by the number of outstanding shares to arrive at the stock’s book value. A book value’s logical calculation is far removed from the chaos of optimistic and pessimistic speculators bidding daily for millions of Apple shares in a stock market influenced by media hype, greed, and fear.

Many Investors seek safe stocks that will provide them with a reliable income to support them in their retirement. They look for companies that have demonstrated for years that they share the company profits with the company owners, who are the shareholders. This sharing is done through significant regular dividends.

Only 2 Mag 7 stocks pay dividends

Only two of the Magnificent Seven pay dividends. Their dividends are so small you wonder why they bother. Nvidia is paying a token dividend yield of 0.03% and Microsoft is paying 0.71%.

There are about 25 million companies in the United States. Surely “owning” shares in the 500 largest stocks must be a good investment? However, that very much depends on what your definition of a “good investment” is? My definition of a good, strong, safe stock investment has nothing to do with high market capitalization, which is the primary qualification for being classified as an S&P 500 company.

To me a good stock investment primarily includes:

- A share price that has steadily increased over the last 20 years.

- A high operating margin percent that is calculated from the percentage of the amount remaining after you have subtracted the expenses to generate the revenues from the revenues.

- A company that shares its profits with its shareholders by paying ever-increasing annual dividends yields of at least 5% over the last 20 years. These would include even the market crash years of 2000, 2008 and 2020.

- The profitability of a company as reflected in a price-to-earnings ratio that would be below 20.

- A book value for the company that would be close to or even higher than the share price.

Perfect stocks meeting all these criteria rarely, if ever exist. You thus are required to make compromises based on how close you can come to your ideal stock.

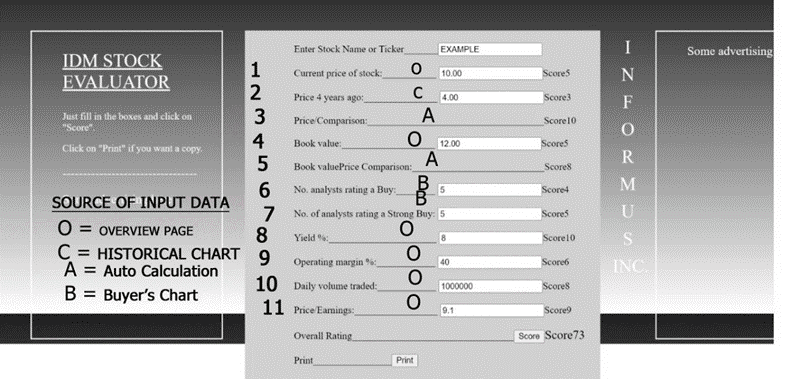

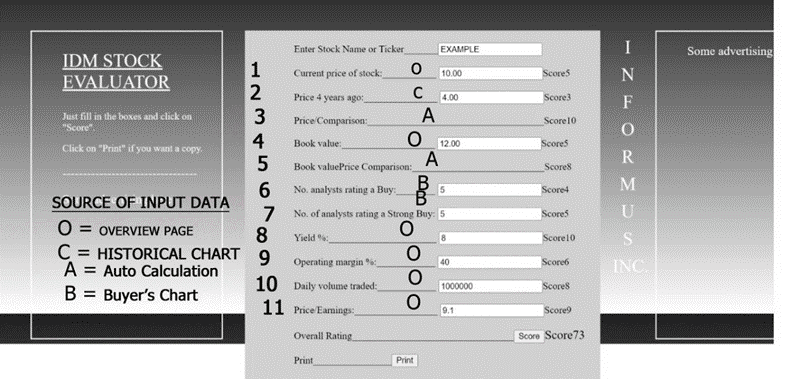

Creating stock-scoring software

To make such compromises easier, I invented for myself stock scoring software that calculates an objective number from zero to 100. This number allows the sorting of stocks from the most to least desirable. The higher the number the more desirable the stock. Having scored thousands of stocks, the lowest I have ever calculated was an 8 and the highest was a 78. I avoid stocks scoring under 50.

For safe diversification and to avoid disastrous surprises you should aim at investing equally in 20 carefully chosen stocks. Your expectation from historical trends of strong companies is that most of your dividend payouts and your share prices will increase steadily. This will keep your dividend income well ahead of inflation.

There are about 16,000 stocks available in North America to choose from. Sorting through these thousands of stocks for your “best” 20 is not difficult once you are shown how to do it. It can be done in hours, not days.

When I reviewed all the stocks that make up the S&P 500, I found only 5 stocks that would qualify for consideration in my portfolio. 113 of the S&P 500 had been immediately eliminated for consideration because they pay no dividend. Even some of the very largest companies in the S&P 500 like Amazon, Alphabet, Tesla, Berkshire Hathaway, Facebook, and Disney pay no dividends. A further 288 of the S&P 500 stocks only paid dividends between 3.5% and 1%.

Why would a 3.5% minimum dividend yield be important? For the last 100 years the average inflation rate is reported to have averaged 3.5%. If you had bought a share that never increased or decreased in value but paid out a steady 3.5% in dividends your stock would theoretically have stayed ahead of inflation if it were invested back into the portfolio.

Strong shares have histories of steadily rising share prices.

As share prices increase many companies steadily increase their dividend payouts out of pride and competitive reasons to at least maintain their traditional high dividend yield percents. Usually, the dividend payout increase percentages rise much faster than share prices. This can be easily observed.

Only 100 S&P500 stocks pay dividends higher than 3.49%

Within the 500 stocks you are left with only 100 that are paying dividends higher than 3.49%. To give you a reasonably generous income, the ideal is to realize an annual dividend income generating at least 6% of your portfolio’s value. On a million-dollar portfolio this would be $60,000.

There are only 12 of the S&P 500 companies paying a dividend greater than 5.97%. Two of the 12, AT&T and Altria Group, had return-on-expense percentages of zero or less which eliminated them from consideration. When the remaining 10 were scored it was found that 7 of them were now paying a dividend of less than 6% which eliminated them. Of the remaining three only one had an operating margin greater than zero. This left just one company, Verizon, out of all 500 that would meet my minimum requirements for inclusion in my portfolio. It had a good score of 62.

Verizon’s score was based on a share price of $40.48, a price 4 years previously of $58.22, a book value of $21.98, Ten analysts recommending it as a buy, a dividend yield percent of 6.57%, an operating margin of 16.57%, a daily trading volume of 12,645,534 shares and a price-to-earnings ratio of 14.7.

Verizon’s score was based on a share price of $40.48, a price 4 years previously of $58.22, a book value of $21.98, Ten analysts recommending it as a buy, a dividend yield percent of 6.57%, an operating margin of 16.57%, a daily trading volume of 12,645,534 shares and a price-to-earnings ratio of 14.7.

We still needed 19 more stocks to create a strong diversified portfolio. Fortunately, there is a wide choice of companies with lower capitalization who are paying dividends of 6% and will have scores higher than 50. Some of these are foreign based companies traded on the New York Stock Exchange who were automatically excluded from being included in the American centric S&P 500. Some had high capitalizations that could have easily included them. Foreign stocks can give a portfolio a geographic diversification which strengthens it.

If you had $200,000 to invest, you could do far better investing the $200,000 in 20 carefully chosen, high-scoring, high-dividend stocks than investing that $200,000 in S&P 500 fund units. While the 20 stocks could generate a dividend income of $12,000, the dividend income generated from the fund units of an S&P 500 fund would be a diluted 1.3% or an annual dividend return of $2,600. The total dividend income received from all 500 stocks becomes diluted when it is split among all those S&P 500 stocks paying little or no dividends. Continue Reading…