By Steve Lipper, Senior Investment Strategist, Managing Director, Royce Investment Partners

By Steve Lipper, Senior Investment Strategist, Managing Director, Royce Investment Partners

(Sponsor Content)

Companies with small market capitalization make up one of the more overlooked parts of the global equity markets. This could be attributed to a lack of coverage of their stocks by analysts, but whatever the reasoning, being overlooked creates opportunities for those investors who know where to look among small-cap equities.

Royce Investment Partners has more than 45 years of experience in the small-cap space. Such longevity brings with it a high level of expertise, allowing the firm to build assets under management (AUM) of US$17.6 billion.1

This has been achieved through a combination of specialization in small-cap investments and a commitment to ownership among the firm’s portfolio managers. With an average tenure of 22 years, Royce’s seasoned group of PMs have substantial ownership in the strategies they manage; in fact, 89% of the firm’s assets are in funds where the portfolio manager has invested at least US$1 million themselves.2 In this respect, Royce stands apart from its competitors: 37 asset managers in the U.S. have more than US$5 billion in small-cap assets, but only Royce has more than 95% of its total AUM invested in the space.3

While developing expertise in small-cap investing is complex, the reasoning for specializing in this area is quite simple: quality small-cap companies have been proven to deliver for investors.

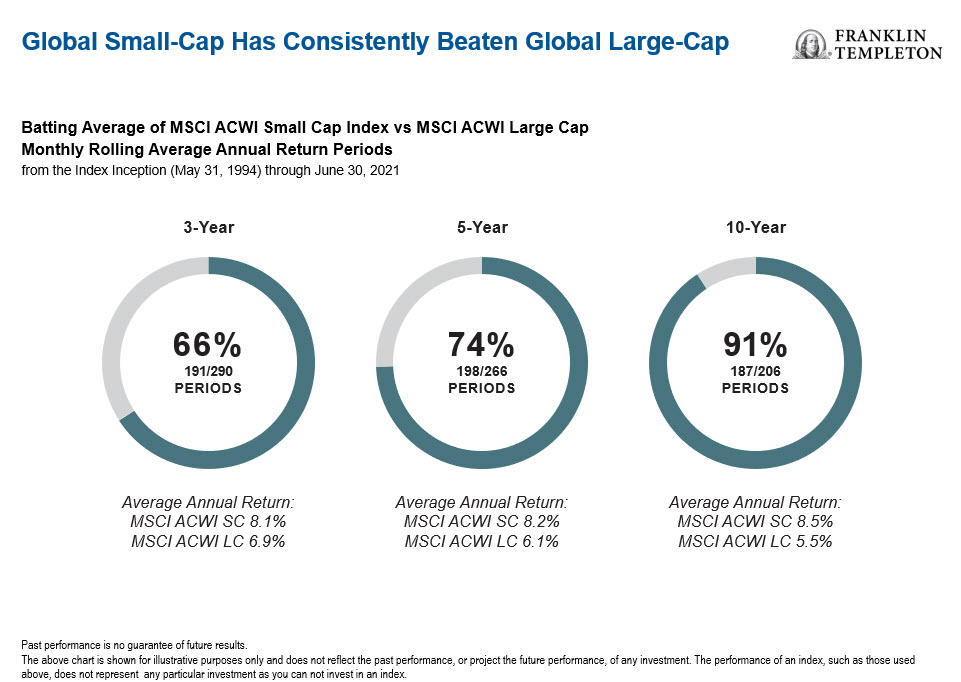

In fact, small-cap stocks have consistently provided meaningful outperformance compared to their large-cap counterparts over the long term. Using the MSCI ACWI Small Cap and MSCI ACWI Large Cap indices as proxies, it shows that small caps have delivered higher annual returns over most multi-year time periods (see chart below). In addition, small caps not only provide a much larger set of companies to invest in (approximately four times the amount in large caps), but with valuations that often understate their true worth. This is an important point to consider, especially given some of the pretty elevated valuations in equity markets right now.

The opportunities that small-cap stocks present for investors were a key factor in introducing our new strategy for the Canadian retail market, Franklin Royce Global Small Cap Premier Fund.4 Continue Reading…