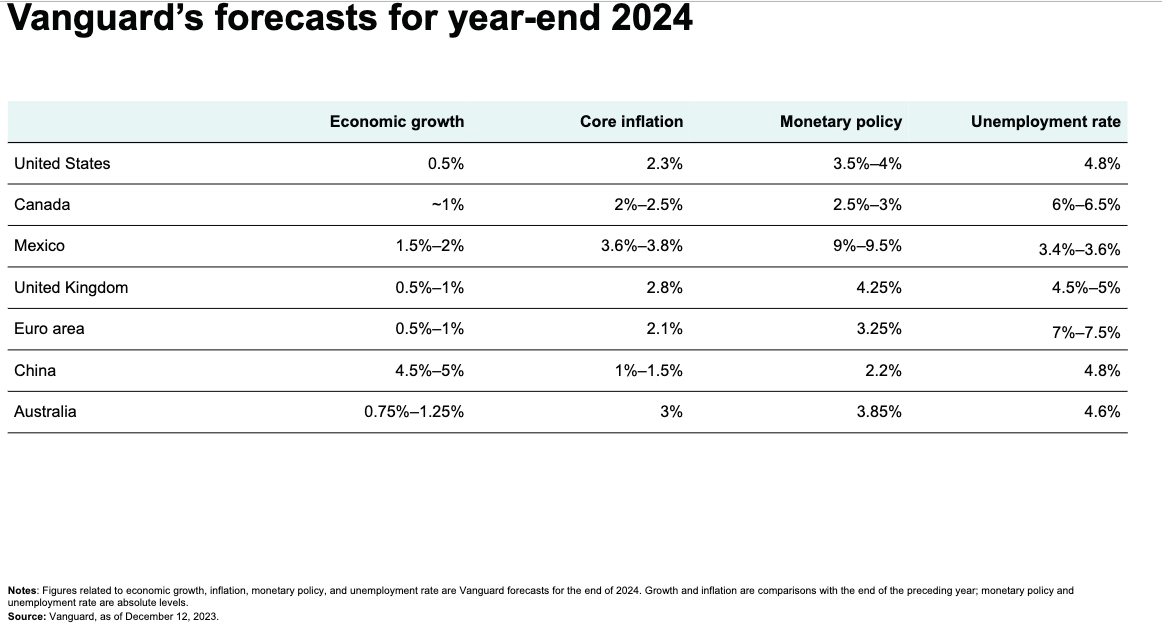

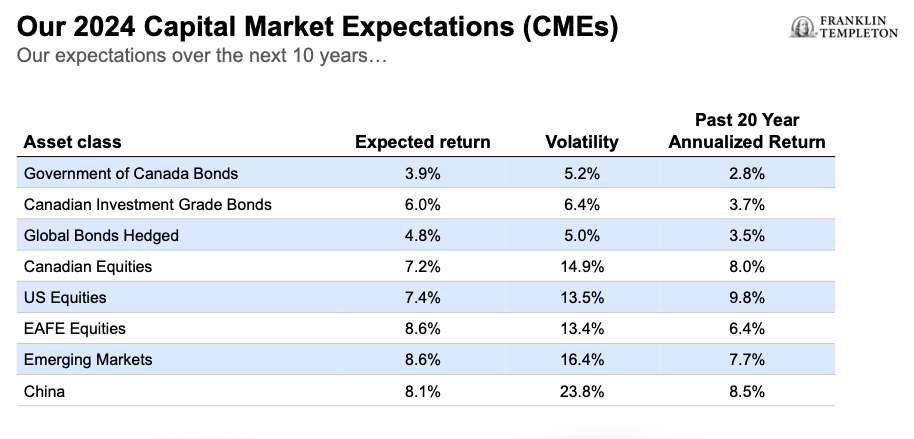

Higher interest rates are here to stay, according to the Vanguard Economic and Market Outlook for 2024, delivered online on Tuesday, Dec. 12. The following is an advance document viewed under embargo and it has been edited down from a Global Summary prepared by Vanguard Global Chief Economist Joseph Davis and the Vanguard global economics team. Anything below in quotes is directly lifted from that document. Otherwise, I have used ellipses and/or paraphrased to make this fit the Hub’s normal blog format. Subheadings are also by Vanguard. At the end of this blog, we have also added a chart about Canada in particular, and projected investment returns in Canada and the rest of the world, supplied by Vanguard Canada.

Higher interest rates are here to stay, according to the Vanguard Economic and Market Outlook for 2024, delivered online on Tuesday, Dec. 12. The following is an advance document viewed under embargo and it has been edited down from a Global Summary prepared by Vanguard Global Chief Economist Joseph Davis and the Vanguard global economics team. Anything below in quotes is directly lifted from that document. Otherwise, I have used ellipses and/or paraphrased to make this fit the Hub’s normal blog format. Subheadings are also by Vanguard. At the end of this blog, we have also added a chart about Canada in particular, and projected investment returns in Canada and the rest of the world, supplied by Vanguard Canada.

The main paper begins:

“Higher interest rates are here to stay. Even after policy rates recede from their cyclical peaks, in the decade ahead rates will settle at a higher level than we’ve grown accustomed to since the 2008 global financial crisis (GFC). This development ushers in a return to sound money, and the implications for the global economy and financial markets will be profound. Borrowing and savings behavior will reset, capital will be allocated more judiciously, and asset class return expectations will be recalibrated. Vanguard believes that a higher interest rate environment will serve investors well in achieving their long-term financial goals, but the transition may be bumpy.”

Monetary policy will bare its teeth in 2024

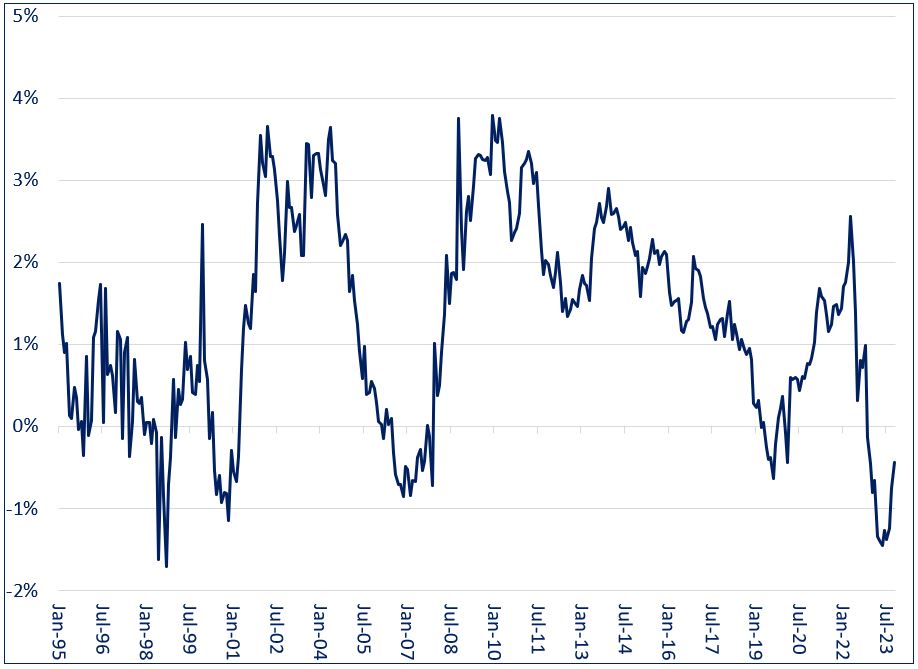

“The global economy has proven more resilient than we expected in 2023. This is partly because monetary policy has not been as restrictive as initially thought. Fundamental changes to the global economy have pushed up the neutral rate of interest — the rate at which policy is neither expansionary nor contractionary. Various other factors have blunted the normal channels of monetary policy transmission, including the U.S. fiscal impulse from debt-financed pandemic support and industrial policies, improved household and corporate balance sheets, and tight labor markets that have resulted in real wage growth.

In the U.S., our analysis suggests that these offsets almost entirely counteracted the impact of higher policy interest rates. Outside the U.S., this dynamic is less pronounced. Europe’s predominantly bank-based economy is already flirting with recession, and China’s rebound from the end of COVID-19-related shutdowns has been weaker than expected.

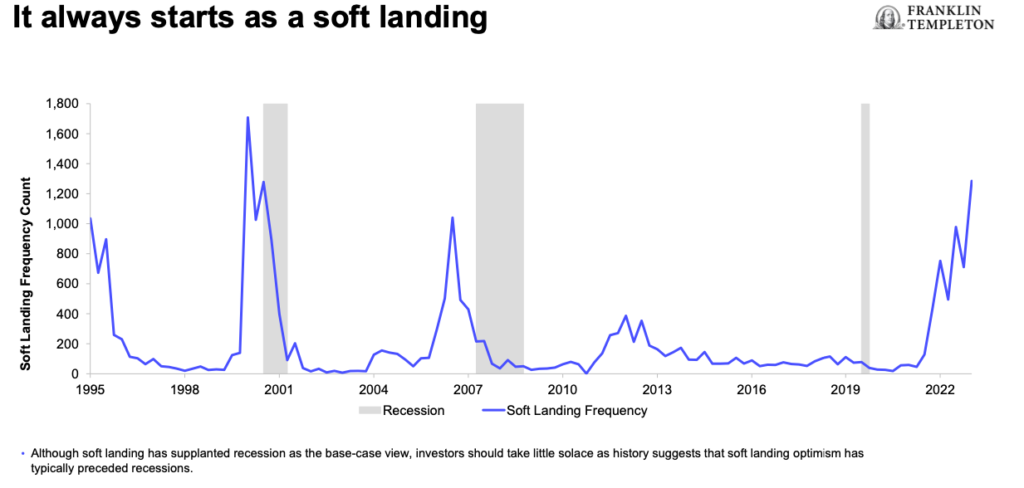

The U.S. exceptionalism is set to fade in 2024. We expect monetary policy to become increasingly restrictive as inflation falls and offsetting forces wane. The economy will experience a mild downturn as a result. This is necessary to finish the job of returning inflation to target. However, there are risks to this view. A “soft landing,” in which inflation returns to target without recession, remains possible, as does a recession that is further delayed.

In Europe, we expect anemic growth as restrictive monetary and fiscal policy lingers, while in China, we expect additional policy stimulus to sustain economic recovery amid increasing external and structural headwinds.”

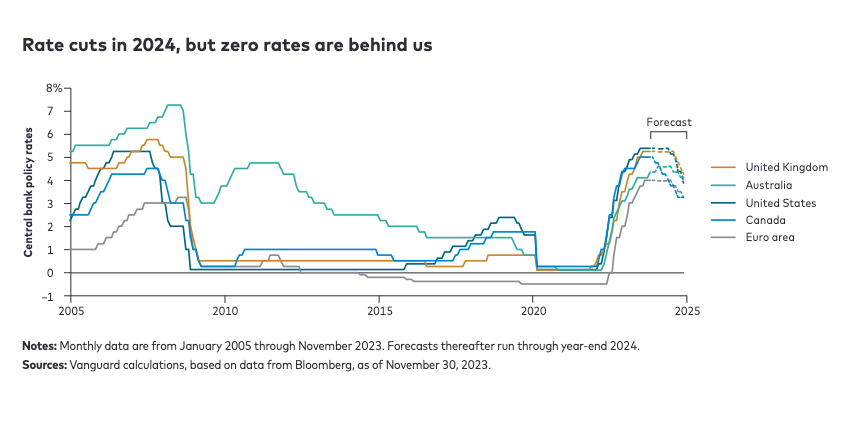

Zero rates are yesterday’s news

“Barring an immediate 1990s-style productivity boom, a recession is likely a necessary condition to bring down the rate of inflation, through weakening demand for labor and slower wage growth. As central banks feel more confident in inflation’s path toward targets, we expect they will start to cut policy rates in the second half of 2024.

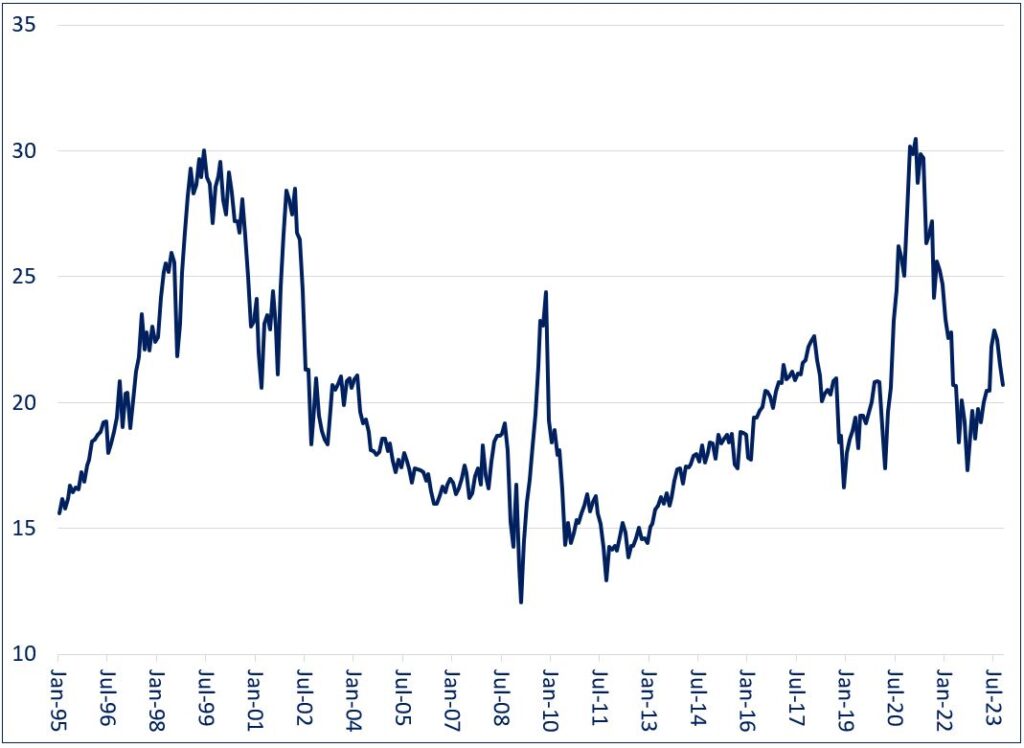

That said, we expect policy rates to settle at a higher level compared with after the GFC and during the COVID-19 pandemic. Vanguard research has found that the equilibrium level of the real interest rate, also known as r-star or r*, has increased, driven primarily by demographics, long-term productivity growth, and higher structural fiscal deficits. This higher interest rate environment will last not months, but years. It is a structural shift that will endure beyond the next business cycle and, in our view, is the single most important financial development since the GFC.”

A return to sound money

“For households and businesses, higher interest rates will limit borrowing, increase the cost of

capital, and encourage saving. For governments, higher rates will force a reassessment of fiscal

outlooks sooner rather than later. The vicious circle of rising deficits and higher interest rates

will accelerate concerns about fiscal sustainability.

Vanguard’s research suggests the window for governments to act on this is closing fast — it is

an issue that must be tackled by this generation, not the next.

For well-diversified investors, the permanence of higher real interest rates is a welcome

development. It provides a solid foundation for long-term risk-adjusted returns. However, as the

transition to higher rates is not yet complete, near-term financial market volatility is likely to

remain elevated.

Bonds are back!

Global bond markets have repriced significantly over the last two years because of the transition

to the new era of higher rates. In our view, bond valuations are now close to fair, with higher

long-term rates more aligned with secularly higher neutral rates. Meanwhile, term premia

have increased as well, driven by elevated inflation and fiscal and monetary outlook

uncertainty.

Despite the potential for near-term volatility, we believe this rise in interest rates is the single

best economic and financial development in 20 years for long-term investors. Our bond

return expectations have increased substantially. Continue Reading…