By Fritz Gilbert, TheRetirementManifesto

Special to the Financial Independence Hub

The 4% safe withdrawal rule is a well-known “rule of thumb” for those planning for retirement.

One thing it has going for it is that it’s simple to apply.

If you have $1 Million, the 4% safe withdrawal rule says you can spend $40,000 (4% of $1M) in year one of retirement, increase your spending by the rate of inflation each year, and you’ll never run out of money.

Simple, indeed.

But, I’d argue that simplicity comes at a potentially very serious cost. Like, potentially running out of money in retirement.

Today, I’ll present my argument against the 4% safe withdrawal rule given our current economic situation, and propose 3 modifications I’d recommend as you determine how much you can safely spend in retirement.

Rethinking the 4% Safe Withdrawal Rule

I read a lot of information on retirement planning, and lately, I’ve been seeing more content challenging the 4% safe withdrawal rule. I agree with those concerns and felt a post outlining my position was warranted.

As a brief background, the 4% Safe Withdrawal Rule is based on the “Trinity Study,” which appeared in this original article by William Bergen in the February 1998 issue of the Journal of the American Association of Individual Investors. For further background, here’s an article that Wade Pfau published on the study. I’ll save you the details, you can study them for yourself at the links provided.

The conclusion, based on the study, is summarized below:

“Assuming a minimum requirement of 30 years of

portfolio longevity, a first-year withdrawal of 4 percent,

followed by inflation-adjusted withdrawals in

subsequent years, should be safe.”

My Concerns With The 4% Safe Withdrawal Rule

In short, some key factors about the study are relevant, especially as we “Rethink The 4% Safe Withdrawal Rule”

- It’s based on historical market performance from 1926 – 1992.

My Concern: Relying on past performance to predict future returns can mislead the investor, especially given the unique valuations in today’s markets (more on that below). This point is driven home by this recent Vanguard article that projects future returns based on current market valuations:

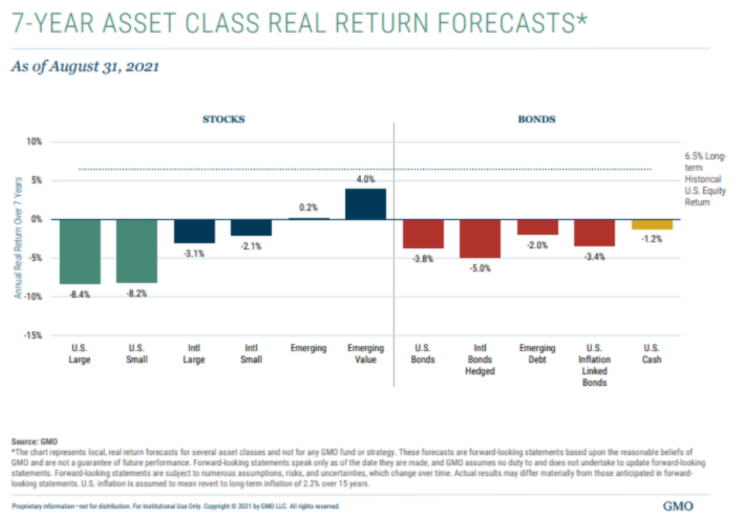

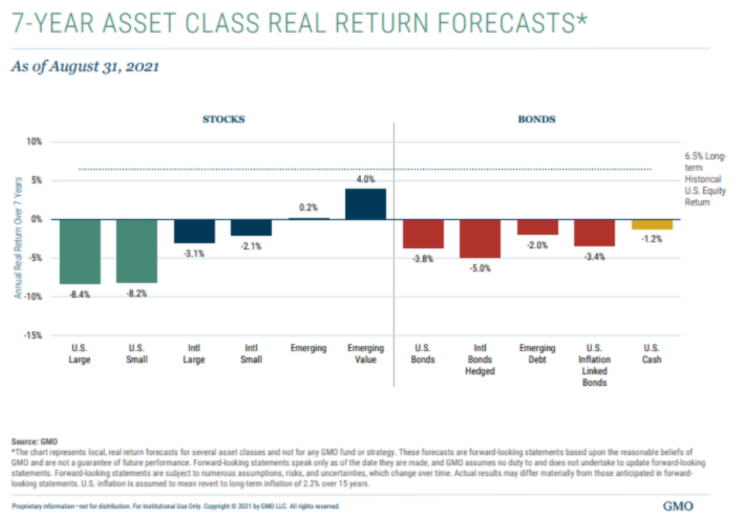

If you think the Vanguard outlook is depressing, check out this forecast from GMO as presented in this Wealth of Common Sense article titled “The Worst Stock and Bond Returns Ever”:

- Note the VG forecast is nominal (before inflation) whereas the GMO is real (after inflation).

Why Are Future Returns Expected to Be Below Average?

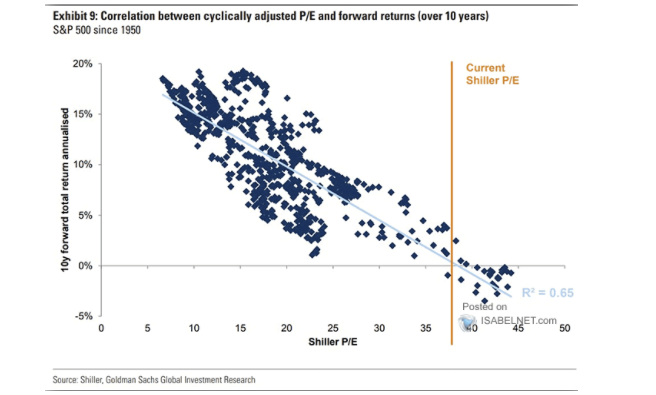

The biggest driver for the projected below-average returns is the high valuation in today’s equity market (particularly in the USA), and the fact that interest rate increases would negatively impact bond yield. In my view the CAPE Ratio is one of the best indicators of market valuations. Below is the current CAPE ratio as I write this post on November 16, 2021:

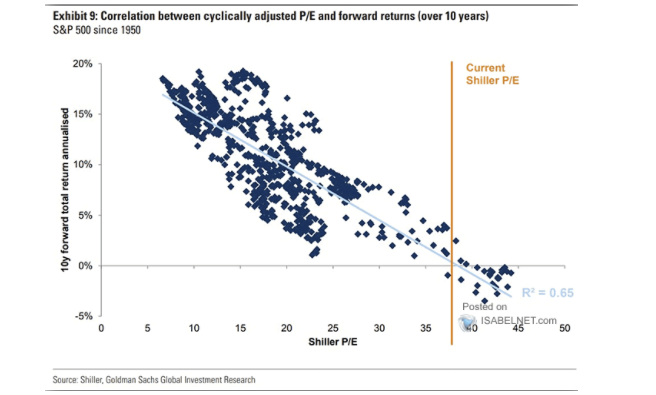

The reason current valuations matter is the fact that they’re highly correlated to future returns, as indicated from this concerning chart that I saw last weekend on cupthecrapinvesting:

Based on today’s CAPE ratio, the historical correlation suggests the forward total returns over the next 10 years could be close to 0%. Scary stuff for someone who’s planning on equity growth to pay for their retirement expenses. Scary stuff for someone who’s committed to the 4% safe withdrawal rule.

In addition to the bearish outlook for US equities, bonds could be negatively impacted if when interest rates increase. To get a sense of how low the US 10-year Treasury yields are now compared to long-term averages, below is the current chart of 10-year yields from CNBC:

Bond prices are inversely related to interest rates, so as rates go up, bond prices go down. So, if you’re holding 60% stocks and 40% bonds, it’s possible that you could see decreases in both asset classes.

As cited in this Marketwatch article, The Fed has begun signaling that interest rates are “on the table” for 2022, especially if the current bout of inflation proves to be less than a transitory event (for the record, I suspect it will be more than transitory, but what do I know?).

This brings us to the next concern …

My Other Big Concern With The 4% Safe Withdrawal Rule:

In addition to my concern above (the risk of an extended period of below-average market returns), I don’t like the part of the rule which states you should “increase your spending the following year based on the rate of inflation.” As most of you know, inflation has been on a bit of a tear lately, as demonstrated in this chart from usinflationcalculator.com:

Based on the 4% Safe Withdrawal Rule, you would be increasing spending next year based on the higher inflation rate, which could well be the same time you’re seeing lower than expected returns.

I don’t know about you, but that doesn’t sit well with me.

Suggested Modifications to the 4% Safe Withdrawal Rule

It wouldn’t be fair to cite my concerns with the 4% Safe Withdrawal Rule without suggesting an alternative. Following are the 3 modifications I’d suggest for your consideration. I’m applying all 3 of these modifications in our personal retirement strategy. Continue Reading…

By Billy Kaderli, RetireEarlyLifestyle.com

By Billy Kaderli, RetireEarlyLifestyle.com