By Noah Solomon

Special to Financial Independence Hub

Barbarians at the Gate

The dramatic increase in the popularity of ETFs [Exchange Traded Funds] represents one of the biggest changes in financial markets over the past three decades. The tremendous growth of ETFs has come largely at the expense of actively managed mutual funds. Investors are increasingly shunning the latter in favour of the former. I will attempt to shed some light on whether this shift is justified from a performance perspective.

The Trillion Dollar Question

The vast majority of ETF assets are passive vehicles. The underlying portfolios of these securities are constructed to mimic a given index, such as the S&P 500 or the TSX Composite. In contrast, most mutual funds are actively managed, whereby portfolio managers and securities analysts conduct extensive research to overweight stocks they believe will outperform while underweighting those they believe will be laggards to outperform their benchmarks. Relatedly, the costs of running actively managed funds are higher than those associated with passive ETFs. As such, the former tend to charge higher management fees.

Logically speaking, active managers’ higher fees should not necessarily be an issue. To the extent that they are capable of more than offsetting the negative impact of their higher fees with higher returns, their investors are better off on a net basis. As such, the trillion-dollar question is whether active managers’ skill is sufficient to justify their higher fees. If this is indeed the case, it follows that the shift away from active management into passive ETFs is ill-founded. Similarly, if active managers have failed to outperform, then the massive growth of ETF assets can be simply explained as investors following the money.

Active Management: The Author of its own Fate

By and large, active management has failed to live up to its promise. Specifically, most active managers have underperformed their benchmarks over both the medium and long-term.

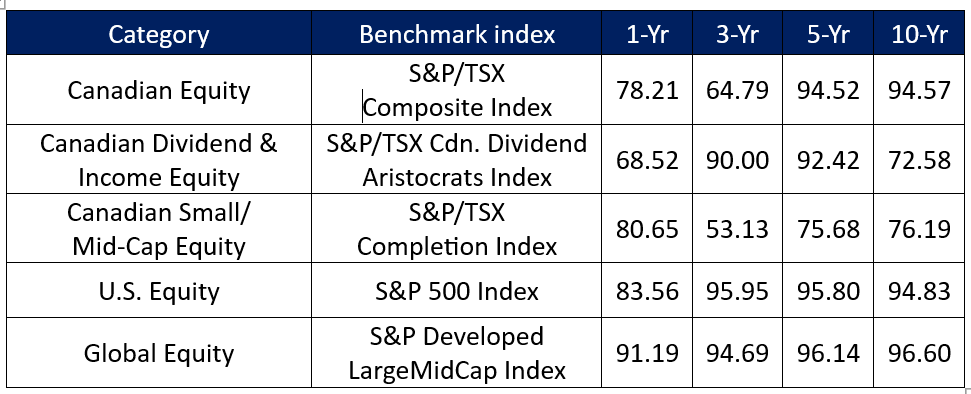

S&P Global’s most recent SPIVA (S&P Index vs. Active) Canada Scorecard, which covers the period ending June 30, 2022, clearly illustrates that the vast majority of active managers have struggled to add value.

Percentage of Funds Underperforming their Benchmarks

As the above table illustrates, the inability of active management to add value over the past 10 years has been nothing short of pervasive. There is not one category in which the majority of active managers did not underperform their respective benchmarks. Importantly, this observation holds true over one-, three-, five-, and ten-year periods.

Outrunning a Bear

To be fair, active management is not alone in its underperformance. While the majority of managers have underperformed, any index-tracking ETF is 100% guaranteed to do so for the simple reason that their returns should be equal to those of their benchmarks less management fees, administrative costs, and trading commissions. Continue Reading…