By Mark Seed, myownadvisor

Special to Financial Independence Hub

A few months ago I wrote:

“Yes, interesting times may call for interesting portfolio changes! Or not. :)”

Well, here we are.

Regardless about how you feel about the current U.S. Administration, I would think most people would agree that this U.S. President feels very emboldened right now. With no future term to go: this is his last shot at taking shots at pretty much anything and everyone he wants without too many consequences near-term. At least it seems that way …

Since writing this post below from December I thought I would update such a post about any recent portfolio changes and beyond that, how our shopping habits have shifted (if at all) in recent months.

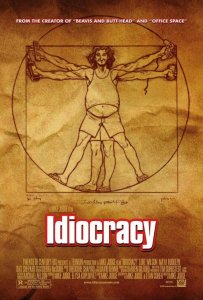

How to invest and shop during Trump idiocracy

I put the term “idiocracy” in the post title since it’s very much how I feel right now.

It’s like watching the Ferris Bueller movie scene: on tariffs.

History repeats.

Now that tariffs are in place and we’re now in a (trade) war between Canadian and U.S. businesses, consumers and workers (sadly), I’m expecting these tariffs will roil stock markets for months or years to come.

I have.

This is how I intend to invest and shop during some prolonged Trump idiocracy.

Approach #1 – What investments can withstand stagflation?

New tariffs are likely, in my opinion, to trigger a sustained period of low economic growth and even higher inflation: which will impact everyone.

At the most basic level, inflation means a rise in the general level of prices of goods and/or services over a period of time. When inflation occurs, each unit of currency buys fewer goods and services. Inflation results in a loss in the value of money and purchasing power. We will all be impacted by this.

Stagflation is essentially a combination of stagnant economic growth, high unemployment, and high inflation. When you think about it …. this combination probably shouldn’t exist: prices shouldn’t go up when people have less or no money to spend. This could be a place where things are trending…

Farmland might perform well during stagflation but we don’t own any.

Instead, I own some “defensive stocks” including some in key economic sectors like consumer staples, healthcare and utilities in my low-cost ETFs that should be able to weather a prolonged disruption. I also consider a few selected stocks we own as defensive plays: waste management companies. At the time of this post, both Waste Management (WM) and Waste Connections (WCN) we own have held up very well and provided stellar returns over the last 5+ years that I’ve owned them.

- WM is up almost 100% in the last 5-years.

- WCN is up over 100% in the last 5-years.

We’ll see what the future brings and my low-cost ETFs are a great diversifier: regardless.

Approach #2 – Staying global while keeping cash

Beyend certain sectors, investors should always consider holding a well-diversified stock portfolio across different sectors and different economic regions to reduce the long-term reliance on industries directly affected by tariffs.

While I have enjoyed a nice tech-kicker return from owning low-cost ETF QQQ for approaching 10 years now, and I will continue to hold some QQQ in my portfolio, I could see technology stocks tanking near-term. To help offset that, I own some XAW ETF for geographical diversification beyond the U.S. stock market. Thankfully.

Times of market stress are however times to buy stocks and equity ETFs.

Near-term and long-term investing creates buying opportunities for disciplined investors. A well-structured, diversified global mix of stocks including those beyond the U.S. could provide some decent defence against a very toxic, unpredictable economic and political agenda.

For new and established readers on this site, you might be aware I’ve mentioned that our investing approach could be considered a “hybrid approach” – a structure that was established about 15 years ago as follows:

- We invest in a mix of Canadian stocks in our taxable account: to deliver income and some growth, and

- Beyond the taxable account, we own a bunch of low-cost ETFs like QQQ and XAW inside our registered accounts: inside our RRSPs, TFSAs and my LIRA for extra diversification.

I like the hybrid approach, the process and the results to date.

At the time of this post, I just don’t see how I should be making any significant changes to our equity portfolio.

Beyond our portfolio of stocks and equity ETFs we keep cash/cash equivalents.

Cash savings remains a good hedge for a very uncertain near-term future. We have a mix of Interest Savings Accounts (ISAs) / High Interest Savings Accounts (HISAs), along with Money Market Funds (MMFs) in particular in our registered accounts. Generally, plain-vanilla savings accounts offer very low interest rates. So, if you want to earn more on your savings deposits (rather than simply using your savings account) then consider an ISA or HISA.

The greatest appeal of ISAs and HISAs for taxable savings IMO is liquidity, while earning interest, and member financial institutions of Canada Deposit Insurance Corporation (CDIC) insure savings of up to $100,000. It’s good business for banks and institutions as well since money deposited generates interest by allowing the bank to access those funds for loans to others. There are usually no fees for these accounts and while interest rates have come down in recent months, ISA and HISA interest rates are consistently north of 2% at the time of this post.

I believe some form of savings account / ISA / HISA remains the cornerstone of everyone’s personal finance portfolio since 1. your money is saved for future expenses or ready for emergencies, 2. it is safe/low risk, 3. it is liquid, and 4. you still earn returns.

Let your equities do as they wish after that.

Approach #3 – Shop local, buy local, and avoid U.S. travel

We are fortunate to live in an area in Ottawa where we can shop local and buy from local farmers. We will continue to do that.

For those that want to shop more in Canada and buy more Canadian goods visit here:

We’ve been fortunate to save up some money in our “sunshine fund” as I call it for some future travel. I/we have no near-term plans to spend our money in the U.S.

I’ve been fortunate to visit many, many U.S. States over the years but given this recent trade war initiated by this current U.S. Administration I hardly have any desire to spend my money in a country whereby that government talks about annexing us.

It’s that simple for us.

I encourage other Canadians who can and do travel, to consider the same – avoiding the U.S. – not because of its citizens but the U.S. Administration decisions. Continue Reading…