From opening two different savings accounts to giving your money a job, here are 12 answers to the question, “Give your best tip for how to balance the need to save and invest for the future with the desire to enjoy my life and spend money on things that are important to you?”

- Open Two Different Savings Accounts

- Consider Your Housing Costs

- Focus on The Three Aspects of Great Personal Finances

- Use Financial Aggregators to Monitor Spending

- Spend Money On Your Passions; Avoid Pointless Purchases

- Invest in Things That Will Last

- Understand Your Cash Flow

- Consider the 50-50 Rule

- Create and Follow a Budget

- Use Fixed Percentages for Saving /Investing

- Schedule a ‘Spending Period’ in Your Life

- Give Your Money a Job So It Has a Purpose

Open two different Savings Accounts

Most people have a checking account and a savings account. If you want to save for the future, open up a second savings account and put your long-term savings in that pot. Find the best interest opportunities you can find for that account and leave that money alone to the best of your ability.

Most people have a checking account and a savings account. If you want to save for the future, open up a second savings account and put your long-term savings in that pot. Find the best interest opportunities you can find for that account and leave that money alone to the best of your ability.

For the money that you want to use in the shorter term (shopping, traveling, buying gifts), manage that money in a separate savings account. Your checking account should cover all of your expenses while your primary savings account should be your “fun-spending” money.

The third account should be your long-term savings and that should be the money that you take to your financial advisor for the best long-term investment opportunities. Let that build up for a while and then try to make smart investments with it. — Brittany Dolin, Co-founder, Pocketbook Agency

Consider your Housing Costs

If you’re struggling to save and invest for the future while also enjoying life, consider your housing costs. Housing is one of the biggest monthly expenses, so if you’re living in a home that’s too big for you, or you’re paying more than you can afford for it, you may want to consider downsizing.

Consider your needs and wants when choosing a home. Do you really need a five-bedroom home if you’re a family of two? Can you live somewhere with fewer amenities if it means you can save money on your monthly housing costs? Homeownership is an investment in yourself and your future, so it’s important to find a balance between spending on your housing and investing in the future. — Matthew Ramirez, CEO, Rephrasely

Focus on the three Aspects of Great Personal Finances

I’ve learned from my mentors that great personal finances can be broken down into three areas: Budgeting Expenses, Creating Income, and Developing Cashflow-Producing Assets.

I’ve learned from my mentors that great personal finances can be broken down into three areas: Budgeting Expenses, Creating Income, and Developing Cashflow-Producing Assets.

With any money-related goal, identifying which area(s) to focus on is key. For example, getting out of debt requires stricter budgeting and increasing income. Meanwhile, retirement has to do with areas 1 and 3. This also makes it simple: budget a percentage of your income to save and invest based on your long-term goals.

Then determine your priorities. Perhaps you need to be strict with some other living expenses to be able to spend money on what’s important to you and set savings and investment goals for larger purchases while you also work to increase your income. — Eric Chow, Chief Consultant, Mashman Ventures

Use Financial Aggregators to Monitor Spending

The balance between saving and investing for the future, while also enjoying life and spending money on what matters to you, is a difficult one to achieve.

One uncommon way to reach this balance is by using financial aggregators. Financial aggregators are tools that allow you to connect all your accounts, such as investments and bank accounts, into one place in order to get a better look at where your hard-earned money is going. This makes it easier for you to budget wisely and allocate money towards satisfying both savings goals, as well as needs or wants for immediate enjoyment.

With this knowledge in hand, you’ll be more aware of how much flexibility you can have with your monthly expenses since both needs are being fulfilled simultaneously. — Carly Hill, Operations Manager, VirtualHolidayParty.com

Spend Money on your Passions; Avoid Pointless Purchases

The best way to save money and enjoy life is to spend money on your passions and cut back on everything else. For example, you might grab a Starbucks drink before work every day. But does this really add value to your life? You can make the exact same coffee at home for a fraction of the price. This is just one example, but most people are spending thousands of dollars a year on unimportant things.

Once you’ve cut expenses out of your life that don’t provide value, spend this extra money on your passions. Let’s say you’re a big fan of motorbiking. You can use this money to buy a sport bike and go to your local racetrack every weekend. Or, if you love hiking, buy quality hiking gear and hike with friends and family. This strategy allows you to cut back on unimportant expenses, save money, and spend more on things that bring happiness. — Scott Lieberman, Owner, Touchdown Money

Invest in Things that will Last

A great way to balance the need to save and invest for your future while still enjoying life is mindful spending. This means considering each purchase you make, big or small, and evaluating if it will add long-term value and benefit you; an uncommon example of this would be investing in a massage package.

A great way to balance the need to save and invest for your future while still enjoying life is mindful spending. This means considering each purchase you make, big or small, and evaluating if it will add long-term value and benefit you; an uncommon example of this would be investing in a massage package.

Instead of splurging on something that won’t provide sustainable value, such as multiple nights out with friends, consider treating yourself to regular professional massages — which have medical benefits from managing pain to reducing stress — that promote mental health and well-being. Practicing mindful spending ensures money is not wasted frivolously but also allows for some indulgences now that can later prove beneficial. — Grace He, People and Culture Director, teambuilding.com

Understand your Cash Flow

Understanding your household cash flow is among the most important aspects of securing your financial future. In order to have more money to spend or save now, you must be acutely aware of your spending habits. Continue Reading…

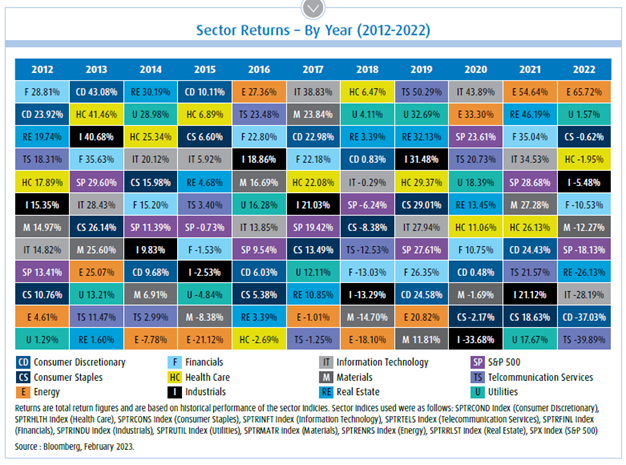

The table shown at the top of this blog, and shown to the right in miniature, shows the performance of all sectors in the U.S. from 2011 to 2022. Notably, the best and worst performing sectors change every year, leaving an opportunity for market timing to generate high returns. However, timing the markets can be extremely difficult. A more effective strategy can be sector rotation, which involves overweighting or underweighting sectors relative to the stage of the business cycle.

The table shown at the top of this blog, and shown to the right in miniature, shows the performance of all sectors in the U.S. from 2011 to 2022. Notably, the best and worst performing sectors change every year, leaving an opportunity for market timing to generate high returns. However, timing the markets can be extremely difficult. A more effective strategy can be sector rotation, which involves overweighting or underweighting sectors relative to the stage of the business cycle.