By Bob Lai, Tawcan

Special to Financial Independence Hub

Long-time readers will know that we hold both individual dividend stocks and index ETFs in our dividend portfolio. We are doing a hybrid investing strategy to capture the best of both worlds: holding individual stocks allows us to dictate which companies we want to hold (usually because we like the long term outlook) and holding index ETFs allows us to geographical and sector diversification. At the end of the day, we care about ‘total return.”

- How to start investing in dividend paying stocks

- How to start dividend investing with a s little as $1,000

It’s always good to understand the financial numbers of a company that you plan to invest in. One can read through all the annual and quarterly reports, compare the different financial metrics, and even do technical analysis to determine whether it makes sense to invest your money or not.

However, if you start getting into the very nitty and gritty details, it’s easy to get stuck in the ‘analysis-paralysis’ loop.

Therefore, I believe it’s always important to step back and look at the big picture. Some questions I like to ask include the following:

- Is the company producing products that you or other consumers rely on daily? And will it continue to do so in the future?

- Is it difficult to replace these products with cheaper equivalents?

- Does the company have fundamental advantages over its competitors?

- Do I believe the company can continue to excuse its core strategy for the next 10 years or more?

- Am I comfortable with holding this stock for at least a decade or more?

For example, imagine in March 2021 you wanted to initiate a position in National Bank because you missed the opportunity during the COVID-19 pandemic downturn. Due to the historical price during the downturn, you arbitrarily set a target price of $80 and an absolute ceiling price of $85.

You then convinced yourself that no matter what, you wouldn’t buy a single National Bank share unless the price was at $80 or below.

During 2021, National Bank’s share price never fell within your price target so you completely missed the boat on a solid Canadian bank.

Let’s say you continued with the desire to initiate a position in National Bank and kept your $80 price target and $85 ceiling price. Again, the share price never fell below $80. It got close a few times during 2022 (~$83), but because you were so set on your target price and refused to pay $3 over your target price, you didn’t initiate a position.

Fast forward to 2024, and you are still waiting on the sidelines because the share price never hit below $80 and the share price has climbed to above $110 since.

A missed opportunity because of this arbitrarily set price target?

Yup, I think so.

Again, this is why I think it’s more important for us DYI investors to step back and look at the big picture. Sometimes you may need to ignore the price target. If a company is solid with a great future outlook, you may need to ignore a few dollars of share price difference during your initial entry. After all, you can always dollar cost average in the future.

With that in mind, I thought it’d be interesting to list my five highest-conviction positions in our dividend portfolio.

My five highest conviction positions

Please note that everything in this post is purely my personal opinion and is not buying and selling recommendations. Please always make buying and selling decisions on your own after doing your own research..

#1.) Apple

I have written a lot about Apple in the past and I continue to like Apple long term. If you look at Apple’s history, it’s easy to point out that the company went through some identity crisis in the ‘90s and early 2000s. But things have changed since the launch of the iPad and the company has completely transformed around the launch of the iPhone.

Apple is one of the most recognizable brands in the world. Years ago Apple used to be seen as a pure hardware company but it has transformed itself into a services company and perhaps can now be considered as a consumer staples company. The beauty of Apple is the strong ecosystem that Apple has built around its different products. Once you’re in the ecosystem, it gets increasingly difficult to get out of it.

For example, many people I know started their Apple journey with an iPhone. AirPods were next on the shopping list to pair with their phones. They then purchased an Apple Watch for ease of accessibility and AirTags to track their devices. It wouldn’t come as a surprise for these users to have multiple iPads and MacBook laptops too. Before they know it, they are tightly integrated within the Apple ecosystem.

Although we own an iMac at home, we are probably the outliers as the typical Apple users because we don’t own any other Apple products. I do see the attraction for owning iPhones and other Apple products for the tightly integrated ecosystems though (for example, I see the attraction for AirTags but they don’t make sense for Android users).

Apple has never been a company that comes out with a first-to-market product. It always takes its time to study the market and launch with a high-quality product that’s been perfected. Although some people argue that Vision Pro is a very niche product that not many consumers will purchase, I think it has some unique usage cases and I can see future Vision Pros gaining popularity, just as what happened to Apple Watch.

Therefore, I’m convinced that Apple will continue to do well in the future and have no concern with adding more Apple shares to our portfolio.

#2.) Visa

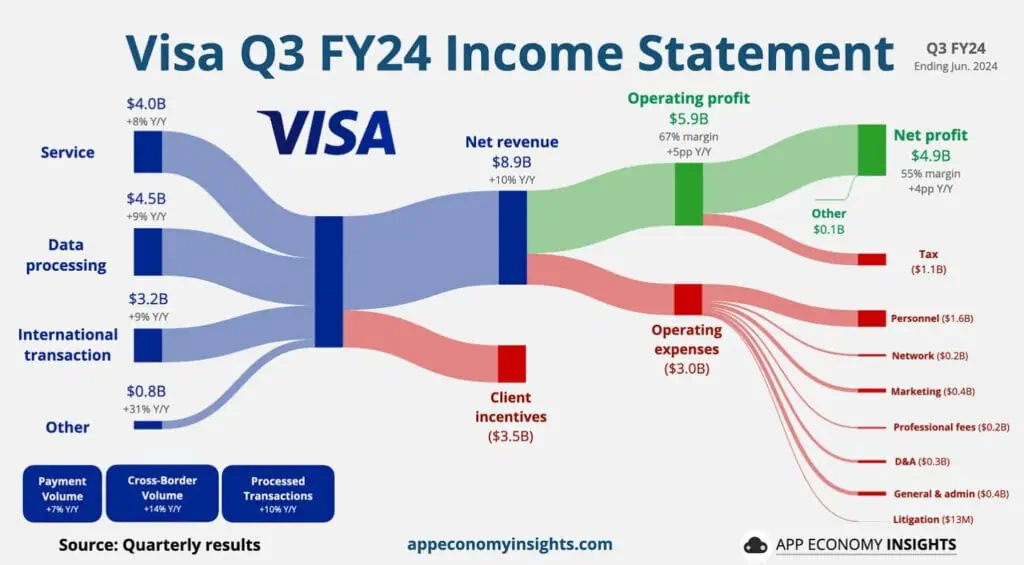

Visa is yet another well-recognized global brand that facilitates electronic fund transfers throughout the world, most commonly through Visa-branded credit cards, debit cards, and prepaid cards.

As one of the largest payment processors in the world, Visa has a nearly impenetrable moat. Yes, Visa does have competitors like MasterCard, AmericanExpress, and even lesser ones like Paypal and new Fintech companies, but Visa is in a well-established position to fend off these competitors.

Because of the wide moat, it is well-positioned for future growth in developing countries. In addition, Visa is a company that doesn’t have to worry about inflation because people will continue to use Visa-branded products regardless of the inflation rate. This is also true whether there’s a recession or a bull market (yes consumers can cut back on their spending but Visa can combat this by increasing transaction fees on merchants).

- When a transaction is completed using a Visa card, the merchant is required to pay an interchange fee

- To access Visa’s electronic payment network, merchants and financial institutions need to pay Visa service fees

- When transactions are processed, Visa charges processing fees.

- When there are international transactions, which is common nowadays, Visa charges international transaction fees

As you can see from the visualized Visa income statement above, we’re talking about billions of dollars from each of these income streams. Visa also enjoys a very high profit margin.

I don’t see Visa going away anytime soon. If anything, I strongly believe the cashless interactions will only increase moving forward and Visa is in a strong position to capture any future growth.

#3.) Royal Bank

I can’t have a high-conviction-position post without mentioning one of the Canadian banks. Royal Bank is the largest bank in Canada by market capitalization serving over 20 million clients with more than 100,000 employees worldwide. Recently Royal Bank completed the acquisition of HSBC Canada to expand its Canadian client base further.

Although many see Royal Bank as a Canadian bank, over the years, the company has been expanding outside of Canada, with operations in over 30 countries.

If we disregard all the financial metrics and analyze Royal Bank from a 30,000 foot view, Royal Bank’s large client base is extremely attractive.

Why? Continue Reading…