While the vast majority (87%) of Canadians are worried about rising costs from Inflation, Questrade Leger’s 2023 RRSP Omni report finds that 73% of RRSP owners plan to contribute again this year, and 79% of TFSA holders plan to recontribute. That’s despite the fact 69% fret that inflation will impact their RRSP’s value and 64% worry about the impact on their TFSA’s value.

“The number of Canadians who are saving for retirement remains consistent with previous years,” the report says. “Among those who are saving for retirement, about three-in-five (58%) say they are very worried compared to Canadians who are not saving for retirement. Women are also more likely to be very worried about the costs associated with rising inflation.”

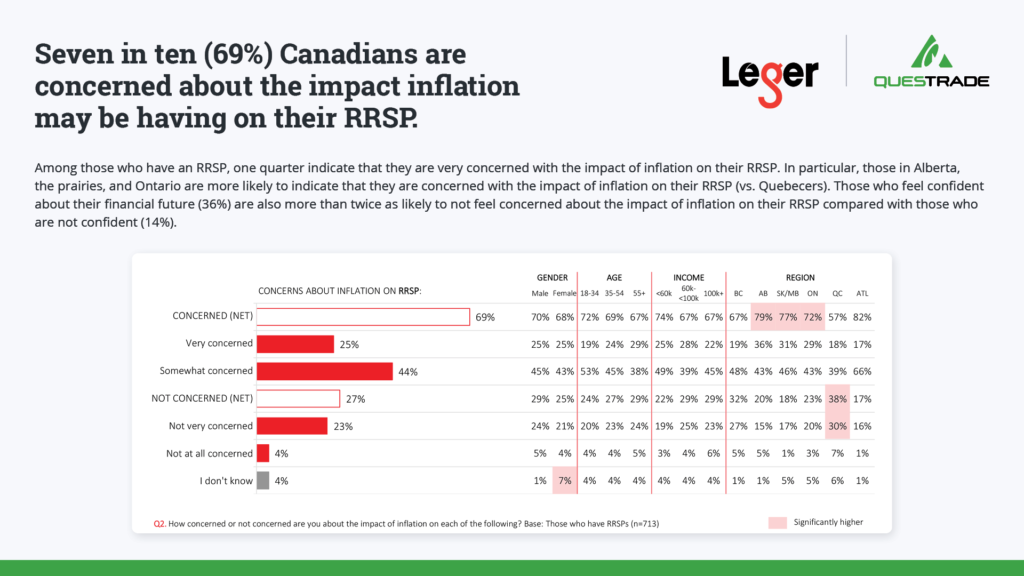

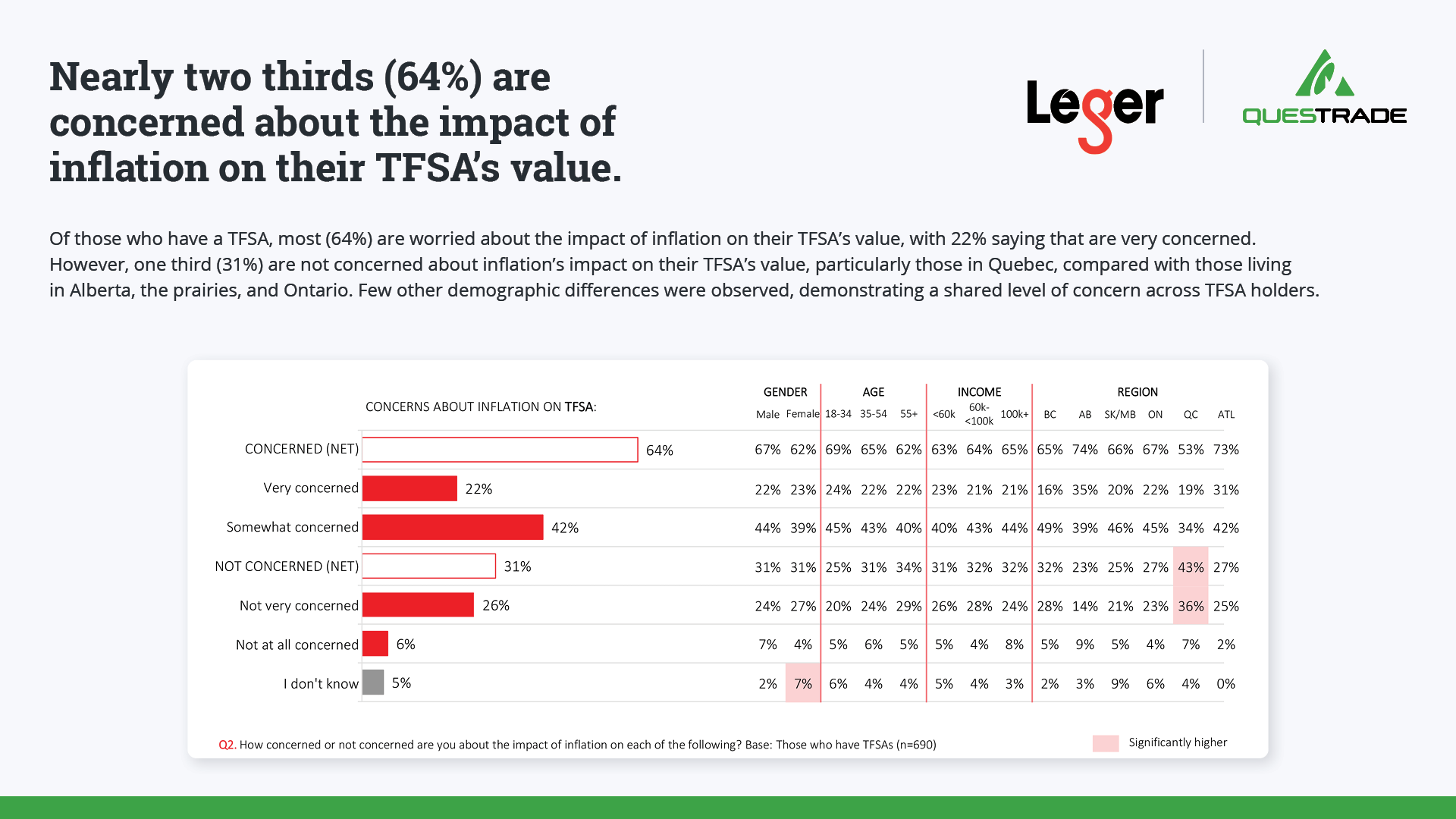

Seven in ten respondents who have RRSPs told the panel they are concerned about the rising costs associated with inflation and a possible recession: 25% indicate that they are very concerned. “A similar trend is observed among those who hold TFSAs for retirement purposes, with almost two-thirds (64%) indicating that they are concerned.”

Worries about inflation and recession “raise questions about the ability of Canadians to control their financial future, especially when it comes to retirement,” the report says. These concerns are most acute for those with an annual income of less than $100,000: “These Canadians are also more likely to agree that they will have to draw upon their savings or investments to cover their expenses in the coming year.”

Less than half are confident about their financial future

Less than half feel they are confident when it comes to their financial future: “Only those making over $60K have confidence in their own financial future despite the current state of the economy.”

The survey seems to imply that Canadians value TFSAs a bit more than RRSPs, based on willingness to max out contribution room of each vehicle. Of course, annual TFSA room only this year moved up to $6500 per person per year, less than a quarter of the maximum RRSP room of $30,780 in 2023, for those with maximum earned income.

Only 29% of RRSP holders plan to maximize their RRSP contribution room in 2023, compared to almost half (46%) who plan to max out their TFSAs. The most enthusiastic TFSA contributors are males and those aged 55 or older.

Given economy, most worry about rising cost of food and everyday items

Day-to-day living expenses continue to be a concern in the face of rising inflation: 79% worry about rising food prices and 77% rising everyday items. The third major concern (for 45%) is inflation’s impact on savings/investments and fourth (at 30%) is rising mortgage costs. Depending on annual incomes, worry over inflation can centre either on investments or on debt: those in the middle to upper income brackets ($60K or more) “are much more likely to find the impact on savings / investments and increasing mortgage concerns more worrisome than compared to those who make less than $60K.”

Ability to save impacted by inflation

Three in four (74%) agree that inflation has impacted their ability to save, at least somewhat. And half (47%) have had to draw upon their savings or investments to cover expenses due to rising costs, especially those under 55 and those who are not currently saving for retirement. Many Canadians also agree they will have to draw upon their savings/investments to cover expenses in the coming year (43%).

Half (49%) believe they will have their saving/investment strategy disrupted due to the threat of recession.

Three quarters of Canadians are saving for Retirement

It’s a positive that 75% of Canadians surveyed are saving for Retirement in some form or another. In 2021, the single biggest vehicle was the RRSP, cited by 42% of respondents; followed by TFSAs by 40%. Given that RRSPs have been around since the 1950s and TFSAs were only introduced in 2009, I’d say it’s significant that TFSAs have almost pulled even. However, only 26% reported contributing to a workplace pension.

Sadly, 9% reported they were not saving but planned to do so eventually, and another 9% said that not only were they not saving but they had no plans to ever begin. On top of that, 6% said they didn’t know.

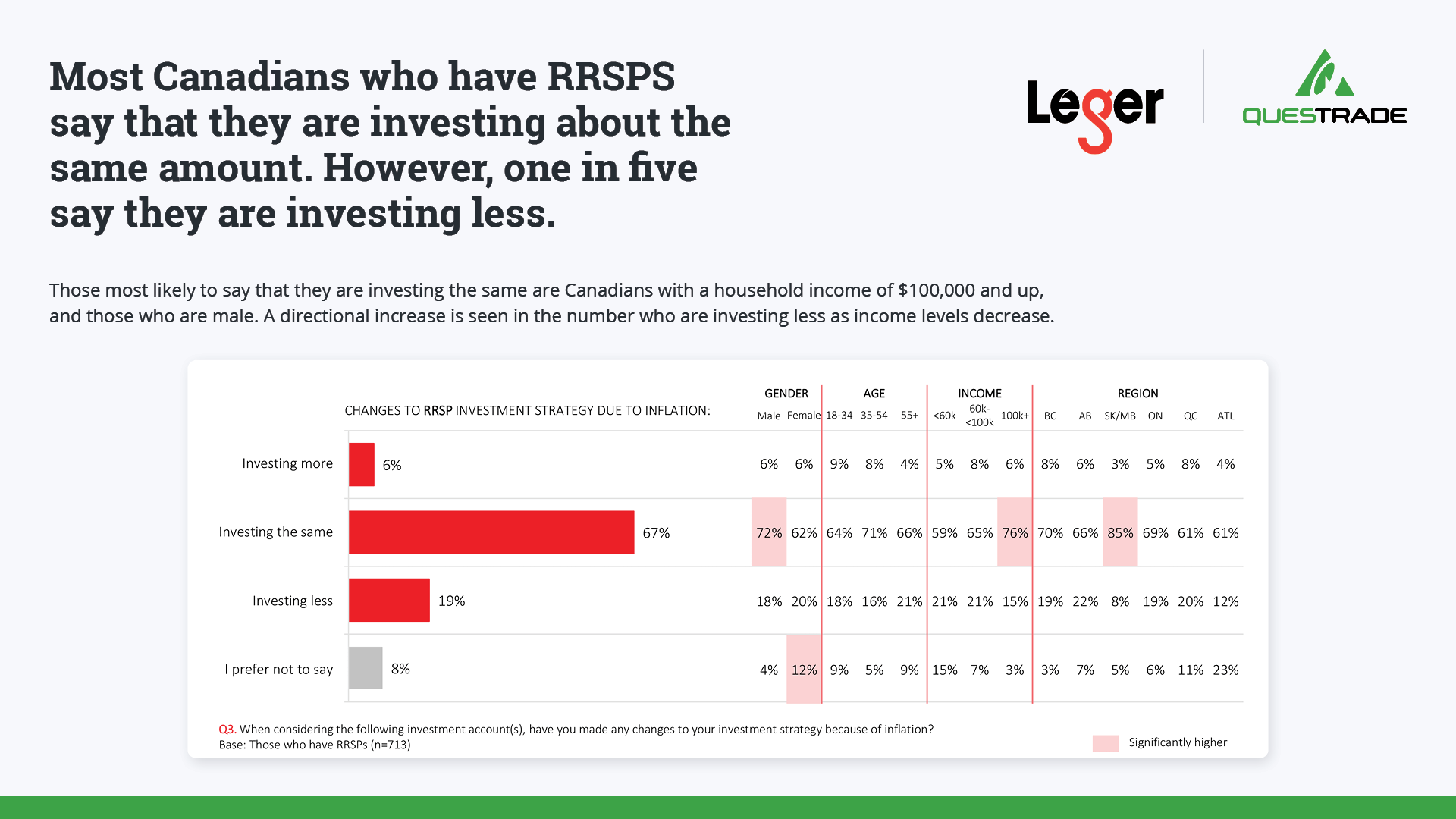

Among those with RRSPs, two thirds (67%) say they plan to invest about the same as last year, while 6% planned to invest more this time around. However, a disappointing one in five (19%) said they plan to invest less this year while another 8% preferred not to say. 29% plan to max out their RRSP contribution this year, versus 59% who do not and 12% more who don’t know.

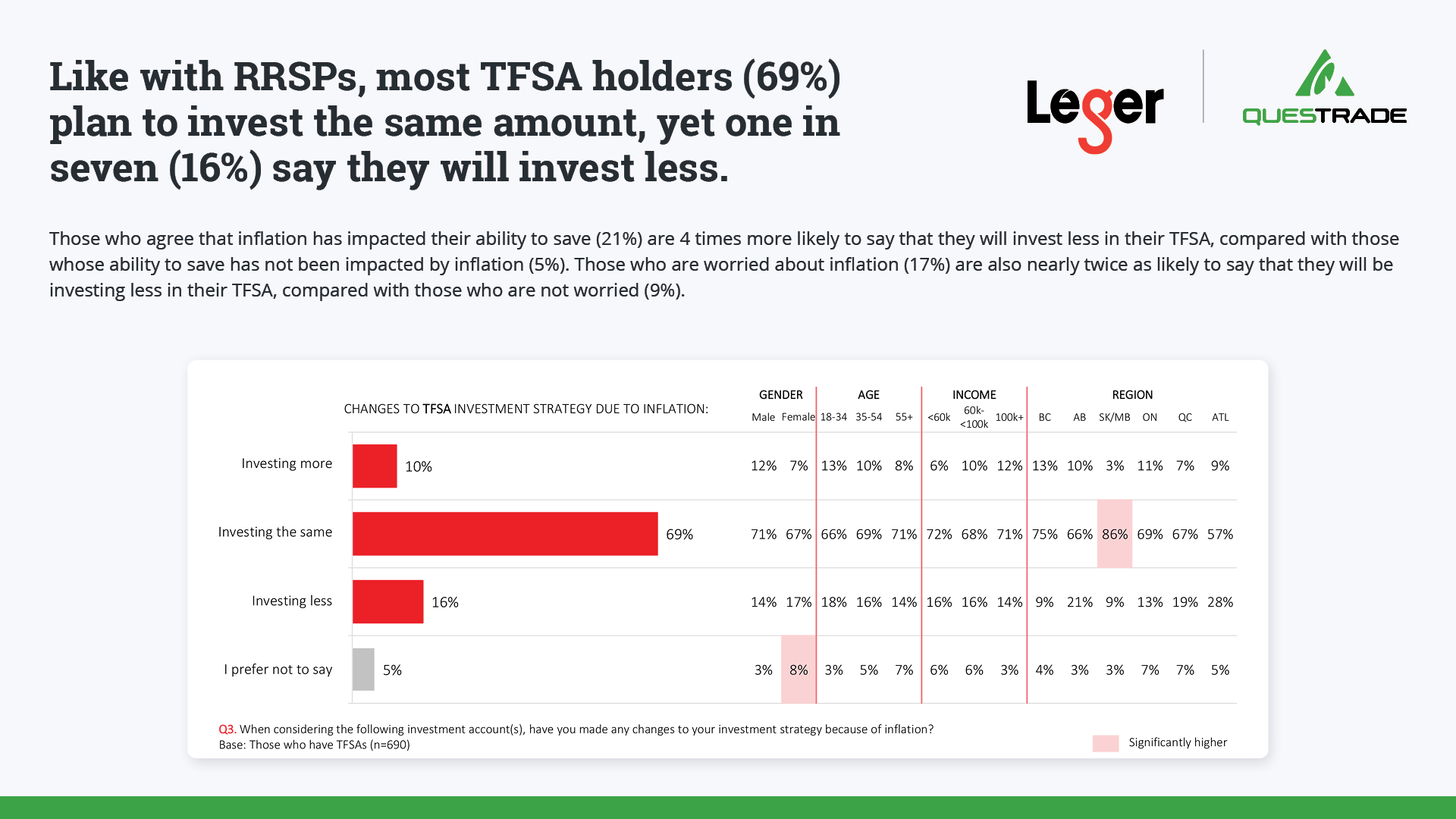

The pattern is similar with TFSA intentions: 69% of those with TFSAs plan to invest the same amount this year, and 10% intend to invest more (of course, the 2023 limit of $6,500 is more to begin with, compared with the 2022 limit of $6,000). Even so, 16% expect to invest less in their TFSAs this year, and another 5% prefer not to say. 46% plan to max out this year’s TFSA contribution, versus 42% who will contribute less than the maximum.

With which institutions do Canadians invest?

For those with investments, Canada’s banks still dominate: 41% invest “through an advisor at a bank,” while 32% are Do-it-yourself investors or use robo-advisors. Of course, most DIY investors may also be using the discount brokerages of the banks or other financial institutions, including independents like Questrade. The survey doesn’t appear to break those numbers out.

The online survey of 1521 Canadians aged 18+ was completed between November 25–27, 2022, using Leger’s online panel.