Things appear to be looking up for members of Defined Benefit [DB] pension plans in Canada, despite inflation and rising fears of a looming recession.

In the third quarter, Canadian defined benefit (DB) pension plans continued to improve, according to the Mercer Pension Health Pulse (MPHP), released on Monday.

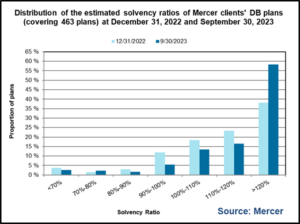

The MPHP, which tracks the median solvency ratio of DB pension plans in Mercer’s pension database, finished the third quarter at 125%, up from 119% last quarter. At the beginning of the year, the MPHP was at 113%, as shown in the chart above left.

This strengthening appears somewhat counterintuitive, as pension fund asset returns were mostly negative in the quarter, Mercer said in a news release. Over the quarter, bond yields increased, which decreases DB liabilities. This decrease, along with a fall in the estimated cost of buying annuities, “more than offset the effect of negative asset returns, leading to stronger overall funded positions.”

Plans that use leverage in the fixed-income component of their assets will not have seen this type of improvement, it added.

Of plans in its database, at the end of the third quarter 88% were estimated by Mercer to be in surplus positions on a solvency basis (vs. 85% at the end of Q2). About 5% are estimated to have solvency ratios between 90% and 100%, 2% have solvency ratios between 80% and 90%, and 5% are estimated to have solvency ratios less than 80%.

“2023 so far has been good for DB pension plans’ financial positions,” said Ben Ukonga, Principal and leader of Mercer’s Wealth practice in Calgary [pictured on right],” “However, as we enter the fourth quarter, will the good news continue to the end of the year?”

The global economy is still on shaky grounds, Mercer says. “A recession is not completely off the table, despite continued low unemployment rates. Inflation remains high, potentially back on the rise, and outside central banks’ target ranges.”

Geopolitical tensions also remain high, reducing global trade and trust and fragmenting global supply chains – which further reduces global trade. And the war in Ukraine “shows no sign of ending – adding economic uncertainty atop a geo-political and humanitarian crisis.”

Mercer also questions whether recent labour disruptions at U.S. auto manufacturers will be resolved quickly, with Canadian workers expecting large wage increases, leading to further inflationary pressures.

Interest rates may stay at high levels

Mercer also worries that central banks globally may continue to keep benchmark interest rates at elevated levels.

“Given the delayed effect of the impact of interest rate changes on economies, care will be needed by central banks to ensure their adjustments (and quantitative tightening) do not tip the global economy into a deep recession, as the full effects of these actions will not be known immediately. As many market observers now believe, the amount of quantitative easing during the COVID-19 pandemic was more than was needed.”

Most Canadian DB pensions are in favourable financial positions, with many plans in surplus positions, the release says: “Sponsors who filed 2022 year-end valuations will have locked in their contribution requirements for the next few years, with many being in contribution holiday territory (for the first time in a long time).”

Most Canadian DB pensions are in favourable financial positions, with many plans in surplus positions, the release says: “Sponsors who filed 2022 year-end valuations will have locked in their contribution requirements for the next few years, with many being in contribution holiday territory (for the first time in a long time).”

That said, it added, DB plan sponsors should not be complacent: “Markets can be volatile, and given that plans are in surplus positions, now more than ever is the time for action, such as de-risking, pension risk transfers, etc. These actions can now be done at little or no cost to the sponsor.”

Mercer also said DB plan sponsors should “remain cognizant of the passing of Bill C-228, which grants pension plan deficits super priority over other secured creditors during bankruptcy and insolvency proceedings.”

“Looking ahead, with interest rates expected to remain high in the short to medium term, plan sponsors should be reviewing their risk tolerances, the risks they are exposed to, and taking steps to hedge or transfer the risks they do not want,” said Ukonga. “Or else, they will be kicking themselves when the goldilocks environment DB plans are experiencing comes to an end.”

Returns differ with Asset Classes

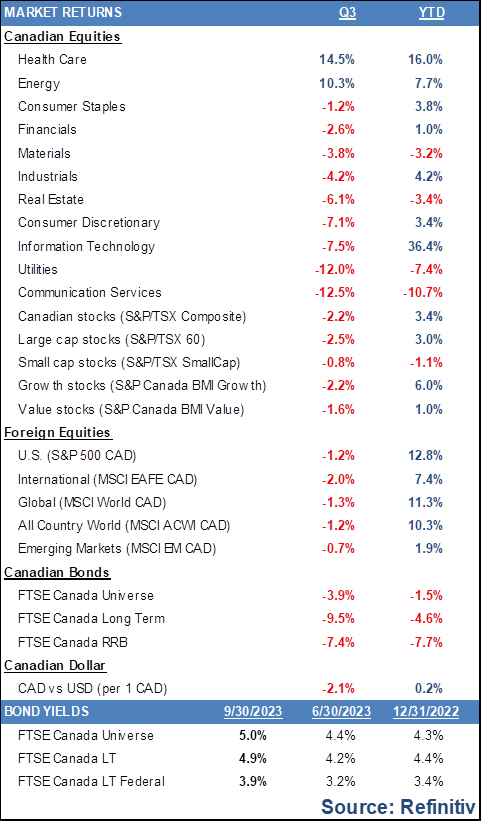

Mercer says a typical balanced portfolio would have posted a return of -4.9% over the third quarter of 2023. “The global economy showed signs of slowdowns with declining manufacturing production, downgrade of U.S. government debt and rising energy prices. Persistent core inflation remained a risk with global central banks signalling higher for longer interest rates.”

Mercer says a typical balanced portfolio would have posted a return of -4.9% over the third quarter of 2023. “The global economy showed signs of slowdowns with declining manufacturing production, downgrade of U.S. government debt and rising energy prices. Persistent core inflation remained a risk with global central banks signalling higher for longer interest rates.”

Global equity markets delivered “moderately negative” returns over the quarter after a strong performance in the first half of 2023: “Economic growth has declined across the major markets, with the pressure of tight monetary policy and slowing consumer demand beginning to take hold.”

Headline inflation ticked up slightly in North America but dropped significantly in the UK and Eurozone. “Core inflation generally continued to soften for most regions. Labor markets appear to be cooling off, but generally remain strong. Output growth has slowed globally, and forward-looking Purchasing Managers’ Indices suggest continued weakness. Consumer confidence continues to weaken with growing signs of consumer distress, such as rising credit card and auto-loan delinquencies.”

Emerging markets also experienced negative returns, Mercer added: driven by lower returns from China due to evidence of a protracted economic slowdown leading to weak consumer spending and a distressed property sector.

“Bond returns were generally negative as yields rose, and the yield curve remains inverted as interest rates broadly increased over the quarter. Global commodity returns finished the quarter in the positive, mostly driven by increasing oil prices. Energy prices have moved higher after OPEC announced cut to production. REITs also posted negative returns as high rates continued to impact valuations and office occupancy rates remain compressed.”

Most Canadian equity sectors posted negative returns, except for Energy and Healthcare, as the chart above illustrates. “Concerns regarding exposure of Canadian household debt to higher interest rates, softening labor market and wage growth remain.”

Commodities & Emerging Markets

Commodities broadly outperformed over the quarter, while the Information Technology sector saw declines along with trends in Artificial Intelligence subsiding. The Canadian debt market “experienced large swings in yields as inflation expectations and interest rate changes detracted from performance. The yield curve remained inverted and elevated across all terms with mid and long-term maturities impacted the most. This led to especially large pricing impacts in long-term fixed income, erasing all gains made previously year-to-date as valuations adjusted to new real rates. The Canadian dollar depreciated against the US dollar, strengthening foreign equity returns in Canadian dollar terms.”

Mercer says the underperformance of emerging markets (EM) relative to developed markets (DM) equities “continues to frustrate investors in 2023. While DM performance was driven by the rally of a few US large cap technology stocks, in EM China’s re-opening and policy responses have disappointed.”

Despite the weakness, the case for EM allocation persists.” said Venelina Arduini, Principal at Mercer Canada. “EM outside of China tackled inflation early and can now cut rates to support their economies. Meanwhile in China, spare capacity and the absence of inflation provides the opportunity for authorities to engage in large scale fiscal policy support. These fundamental drivers are also supported by relatively attractive valuations and light positioning.”