(Sponsor Content)

While many equity markets have performed well year to date, the last few months have not been as kind to fixed income investors. Last quarter, fixed income markets recorded some of the worst returns in 40 years as central banks and governments worldwide continued to rack up a mountain of debt in ongoing support of the global economy and consumers during the COVID-19 pandemic. But don’t despair; as Franklin Bissett fixed income portfolio manager Darcy Briggs points out in this Q&A, the market still offers value — if you know where to look.

Q: How would you describe the current environment for Canadian fixed income?

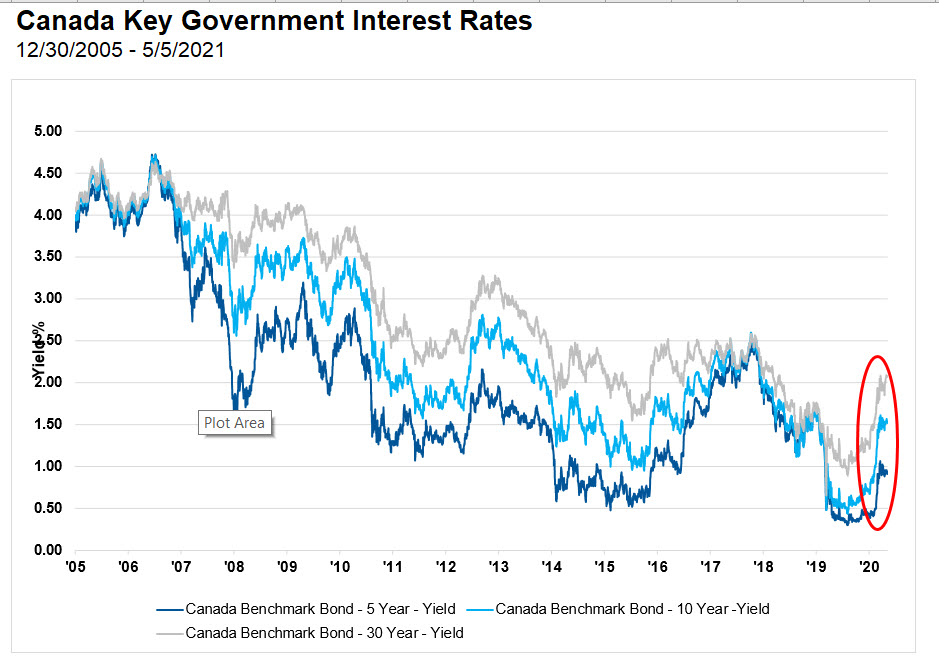

After seeing significant returns in Canadian fixed income last year, we expect more subdued performance in 2021. Given the year’s starting point of very low interest rates and tight credit spreads, we see corporate credit as offering the best risk-adjusted return opportunities in the current environment. As active, total return managers focused on generating income and capital gains, we know bond selection will remain important this year. Small interest rate moves can lead to significantly different outcomes for different fixed income sectors. Uncertainties remain high, and we are seeing a wide range of forecasts on how the balance of 2021 will unfold. Although interest rates have been up as much as 100 basis points so far this year, we think they may have overshot, as happens from time to time. We would not be surprised if they drifted lower later in the year. Realistically, we expect the path ahead to be a little messy.

Source: FactSet, Franklin Templeton

How so?

This recession/quasi-depression was prompted by a dramatic health crisis and the resulting government-mandated shutdown; it was not caused by normal business cycle dynamics. While fiscal and monetary policy have prevented a full-blown financial crisis, those tools have limited ability to solve the current recession. We believe it will end once the pandemic subsides and the economy fully opens, functioning in a more familiar pre-pandemic way. Vaccines are key to the pace of progress.

Markets will have to work their way through a lot of distortions. Remember, it was the second quarter last year when everything halted, markets swooned, and numbers hit dramatic lows. Comparing year-over-year data featuring ultra-low 2020 figures, markets could easily shoot to the high side. It is also going to take time to establish what sticks. There will be an initial rush of reopening economic activity and with that, we may see a rerating of growth and a passing inflation scare. But once those months of initial enthusiasm subside, what will the economic baseline and future prospects look like? What does the path to dealing with the debt overhang and unwinding fiscal and monetary stimulus look like? Keeping such factors in mind, we think investors should expect some volatility as the year progresses.

Q: Where are you finding opportunities in the Canadian fixed income space?

Looking at Canadian corporate credit, where stay-at-home sectors like communications and media really outperformed during the lockdown, a rotation to “reopening” bonds such as commodity and energy issuers is underway.

For example, factoring pre-pandemic conditions and the multi-year transition to other energy sources into our analysis, we remain constructive on debt investments of Canadian energy companies over our investment horizon. There is not a lot of associated exploration or development risk. Costs are fixed, and as expected demand ramps up, there will be increased incremental cash flow, making their bonds more attractive from a credit standpoint. We are also finding attractive opportunities in high yield bonds, recently introduced limited recourse capital notes (LRCN), as well as the preferred share and global loan markets. It is worth noting, the latter three have defensive properties in an environment of higher-trending interest rates.

Q: What should investors consider going forward?

A: Be mindful of narratives, whether related to market stories like GameStop, Bitcoin, or the pace of change in energy sources. We live in the “Age of Spin”, where narrative can drive valuations or a change in narrative can cause violent market gyrations However, investors will ultimately be rewarded by remaining disciplined and focused on fundamentals.

Franklin Bissett Investment Management, a part of Franklin Templeton, manages several fixed income mutual funds and ETFs, including:

- Franklin Bissett Core Plus Bond Fund and ETF

- Franklin Bissett Short Duration Bond Fund and ETF

- Franklin Bissett Corporate Bond Fund

- Franklin Bissett Investment Grade Corporate Bond ETF

- Franklin Bissett Canadian Bond Fund

- Franklin Bissett Canadian Government Bond Fund

- Franklin Bissett Money Market Fund

- Franklin Bissett Canadian Core Bond Fund

Darcy Briggs, CFA, CPA, CGA, FRM, is a senior vice president, portfolio manager with Franklin Bissett Investment Management and has been with the organization since 2005. Mr. Briggs shares co-lead responsibilities of Franklin Bissett Income Strategy Development and Implementation, including Franklin Bissett Canadian Short Term Bond Fund (2009), Franklin Bissett Corporate Bond Fund (2012), Franklin Bissett Canadian Bond Fund (since inception), Franklin Bissett Canadian All Cap Balanced Fund (2013), Franklin Bissett Core Plus Bond Fund (2015), Franklin Bissett Canadian Government Bond Fund (since inception), Franklin Bissett Monthly Income and Growth Fund (since inception) and Franklin Liberty Canadian Investment Grade Corporate ETF (since inception).

This commentary is for informational purposes only and reflects the analysis and opinions of the Franklin Bissett Investment Management fixed income team as of May 17, 2021. Because market and economic conditions are subject to rapid change, the analysis and opinions provided may change without notice. The commentary does not provide a complete analysis of every material fact regarding any country, market, industry or security. An assessment of a particular country, market, security, investment or strategy is not intended as an investment recommendation nor does it constitute investment advice. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.