By Kathleen Anderson, Director, Client Portfolio Manager, ClearBridge Investments

(Sponsor Content)

Considering how much COVID-19 has dominated our thoughts over the past 18 months, it is important to remember the significant challenges the world was facing prior to the pandemic. Aging demographics, growing inequality, and of course, the massive threat of climate change remain major concerns for global leaders, and that holds true in the investment industry too.

Sustainable investing and a focus on the environmental, social and governance (ESG) ratings of companies has become an important consideration for investors in recent years. Our firm, now part of Franklin Templeton following its acquisition of Legg Mason last year, was a signatory to the UN’s Principles for Responsible Investment in 2008, and first introduced ESG-integrated portfolios in 1987. Back then, responsible investing was a niche part of the industry, but attitudes have shifted considerably in the years since. At ClearBridge Investments, ESG factors are fully integrated into all our investment strategies after we formally introduced ESG ratings in 2014.

That includes the new strategy available to Canadian investors, Franklin ClearBridge International Growth Fund and Franklin Clearbridge Sustainable International Growth Active ETF (FCSI).1

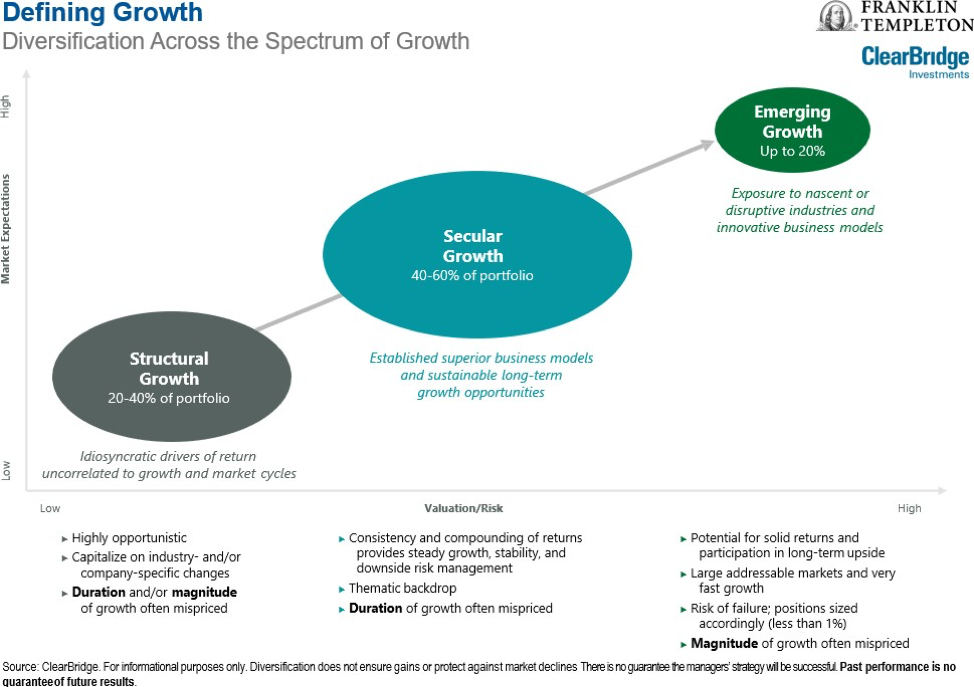

With this actively managed solution, the portfolio managers target international stocks they believe are mispriced by markets, and use a fundamental, bottom-up approach to invest in quality businesses across the growth spectrum (Structural, Secular, Emerging) (see chart below). Quality in this case means companies with strong balance sheets and good management, offering unique products or services, or having strong niche positions locally or globally. Portfolio construction is also governed by a strict buy and sell discipline, with all capitalization, sectors and regions represented among the fund’s 40–70 names.

The case for looking outside of North America is also strong right now as the vaccine rollout gathers pace internationally. As always, history offers us some guidance.

International equities outpaced U.S. stocks the decade before the financial crisis

The U.S. has been the undisputed global leader on equity performance since the Global Financial Crisis of 2008. Prior to that, international equities outperformed the U.S. for close to a decade, showing that geographic leadership tends to persist over a long period.

One factor to consider is the performance of the greenback — since the late 1970s periods of sustained U.S. dollar strength have aligned with U.S. equity outperformance. With that in mind. weakness in the U.S. dollar throughout the COVID-19 crisis may be an indicator of a shift in equity market leadership as international equities tend to outperform during periods of dollar weakness.

Looking to Europe, the period since 2008 has certainly proven challenging for the EU, but there are some positive signs for the world’s largest trading bloc. The joint issuance of Eurozone debt during the COVID-19 crisis has created a more integrated fiscal union, boosting the euro’s long-term prospects, and this could act as a catalyst for lower risk premiums with European assets. The rise of China is another important element dictating global growth, particularly when you consider that in 1995, China had two Fortune 500 companies compared to the U.S.’s 148; today, China has 124 while the U.S. has declined to 121.2

Global diversification is at the foundation of the ClearBridge International Growth strategy. The pandemic has truly been a global crisis and the recovery will need to have similar reach. While equity markets have performed well since the drawdown of early 2020, economies overall have been hit hard, so it’s imperative that the coronavirus can be brought to a point where rolling lockdowns are no longer necessary. When that occurs, and the signs are looking positive, there will be huge growth potential across a host of sectors and businesses. Finding those opportunities is central to the investment strategy of Franklin ClearBridge International Growth, and through that, achieving our goal of delivering consistent returns for investors over the long term.

Kathleen Anderson, Director, Client Portfolio Manager, has been with ClearBridge Investments for 25 years. Having graduated from Loyola College in 1996 with a BA in Marketing, she joined Legg Mason Capital Management (later ClearBridge Investments) in 1996 as a wholesaler and went on to become managing director at the firm.

Kathleen Anderson, Director, Client Portfolio Manager, has been with ClearBridge Investments for 25 years. Having graduated from Loyola College in 1996 with a BA in Marketing, she joined Legg Mason Capital Management (later ClearBridge Investments) in 1996 as a wholesaler and went on to become managing director at the firm.

ClearBridge Investments is a global equity manager with US$184 billion in assets under management as of March 31, 2021. With headquarters in New York, the firm is a wholly-owned subsidiary of Franklin Resources, but operates with investment independence. A leader in ESG investing for decades, the investment team is committed to delivering long-term results through active management and investment solutions that emphasize differentiated stock selection.

- Effective June 7, 2021, ClearBridge Investments, LLC (“ClearBridge”) replaced Franklin Advisers, Inc. as the sub-advisor to Franklin ClearBridge International Growth Fund (formerly Templeton International Stock Fund) and Templeton Global Advisors Limited is no longer a portfolio advisor to the Fund.

- Data as of Dec. 31, 2019, latest available as of March 31, 2021. Source: World Bank. Past performance is not a guarantee of future results. Investors cannot invest directly in an index, and unmanaged index returns do not reflect any fees, expenses or sales charges.

This commentary is for informational purposes only and reflects the analysis and opinions of ClearBridge Investments as of June 24, 2021. Because market and economic conditions are subject to rapid change, the analysis and opinions provided may change without notice. The commentary does not provide a complete analysis of every material fact regarding any country, market, industry or security. An assessment of a particular country, market, security, investment or strategy is not intended as an investment recommendation nor does it constitute investment advice. Statements of fact are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Commissions, trailing commissions, management fees, brokerage fees and expenses may be associated with investments in mutual funds and ETFs. Please read the prospectus and fund fact/ETF facts document before investing. Mutual funds and ETFs are not guaranteed. Their values change frequently. Past performance may not be repeated. ClearBridge Investments, part of Franklin Templeton Investments Corp.