Diana used to come to work with bags around her eyes. Her co-workers would always ask her if she was alright, and if everything was okay at home. Diana was tired of being sick, and she was also tired of people asking questions about her personal life. Diana had many sleepless nights, and it was now showing on her face.

There were a number of things that were contributing to Diana’s sleepless nights. Problems at work and home were among those issues. She was also struggling with credit card debt. Diana had managed to accumulate a credit-card balance of more than $10,000.

Diana had a good credit score and a good-paying job, so she did not expect to end up in credit-card debt. She had used her credit card to pay for a getaway with her husband to the Caribbean. As readers of the Financial Independence Hub know, using a credit card as a borrowing tool can lead to trouble quickly.

Diana believed she could pay off the debt before interest was charged to the card. However, a crisis happened and she had to cover an unexpected dental expense and a leak. Diana’s expensed trip to the Caribbean caused her to carry a credit-card balance that she was now struggling to pay off.

Diana was now living the personal finance nightmare: stuck in high-interest credit-card debt.

Diana’s new debt made life extremely difficult. She felt like she was in a sinking boat with no lifeline. She was feeling out-of-control, stressed and anxious. Diana struggled to budget in the minimum payments every month, but they never seemed to make a dent on the balance.

It is easy to understand Diana’s predicament when you take a look at the math involved.

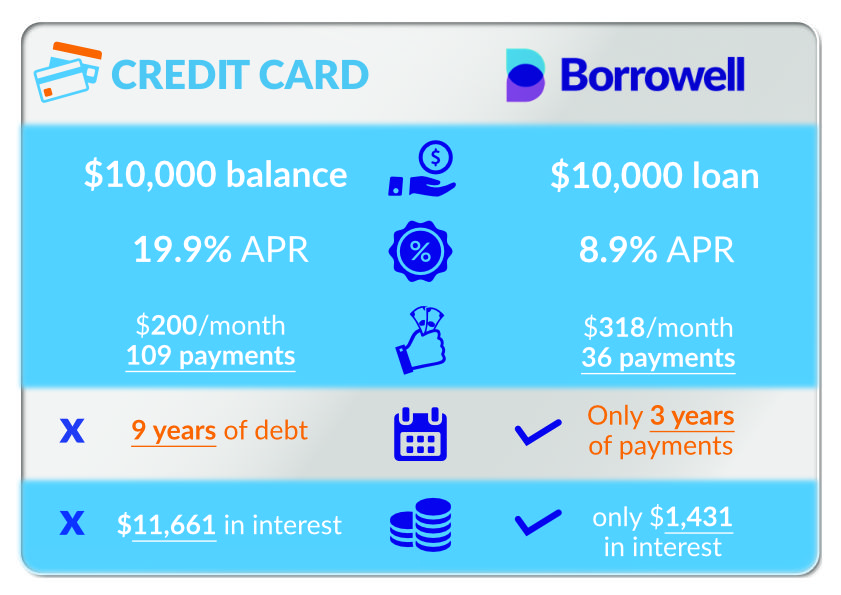

Diana’s credit-card balance was $10,000, with an annual percentage rate of 19.9 per cent. The minimum payments were around $200 per month. The minimum payment would go down as the balance on the card decreases. Therefore, it would take Diana approximately nine years to pay off the card. She would also spend a total of $11,191.

While Diana was at work, she read a blog post on Borrowell. She found out that Borrowell offers loans to people in Canada who have good credit. She discovered that getting a low-rate term loan would help her get out of debt much faster. Here are some of the key things she learned:

Term Loans Vs. Revolving Credit

Diana learned about the differences between revolving credit and term loans. Revolving credit, such as a credit card, is a good option if it is used responsibly and paid off before the high interest rates kick in. However, term loans have fixed monthly payments for the duration of the loan. You will always know how much you have to pay each month and how long you have to pay it.

Higher Monthly Payments At A Lower Interest Rate Will Help You Get Out Of Debt Faster

One of the reasons Diana opted to take out a loan from Borrowell was because she was surprised to find out how quickly she could get out of debt. She had the option of choosing a three- or five-year term. She chose the three-year term, which allowed her to get out of debt three times faster. Also, she paid only $1,500 in interest.

Diana was paying $200 a month on her credit card. She took out a $10,000 loan with Borrowell and made $318 per month. By making just $118 more in monthly payments, she was able to get out of debt in just three years. If she would have continued to make the minimum payments on her credit card, then she would have spent nine years paying it off.

Diana did have to live on a tighter budget so that she could afford to make the higher payments every month. However, budgeting and making the higher minimum payment is definitely a smart move. Diana now has the peace of mind that comes along with being debt-free.

If you are struggling with credit-card debt, then it is important for you to research the options you have. There are a number of options that will not only help you get out of debt faster, but they can also help you save a lot of money in interest. Borrowell is a company that can help you get out of debt faster.