By Mark Seed, My Own Advisor

Special to the Financial independence Hub

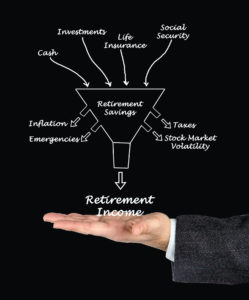

You could argue beyond the how much do I need to retire question, this need comes up next: how to generate retirement income.

Rightly so.

I mean, we all want to know how best to use our retirement incomes sources wisely. Those retirement incomes sources are necessary to help fulfill income needs, while being tax efficient; income to provide some luxuries now and them, or to potentially deliver generational wealth should that be your goal.

My retirement income plan and options

I’ve been thinking about my income plan, or at least my semi-retirement income plan, for some time now.

I captured a list of overlooked retirement income planning considerations here.

Yet I can appreciate not everyone writes about nor thinks about this stuff.

There are obvious ways to generate retirement income but I suspect some might not appeal to you for a few reasons!

Option #1 – Save more

I doubt most people will like this option but it’s probably necessary for many Canadians: you’re going to need to save more than you think to fund your retirement. This is especially true if you have no workplace pension of any kind to rely on and/or you haven’t assessed your spending needs. More money saved will help combat inflationary pressure, rising healthcare costs and longevity risk. Which brings me to option #2.

Option #2 – Work longer

If you didn’t like option #1, you might not like this one! Working longer into your 60s or potentially to your 70s might be the reality for a good percentage of Gen X and Y. Part of the reasons these cohorts will need to work longer is because many Boomers remain in the workforce so they can fund their retirement. Some Boomers are continuing to work because they enjoy it. Some are continuing to work because they absolutely have to.

Option #3 – Spend less

The 4% rule remains a decent rule of thumb – it tells us we should be “safe” to withdraw approximately 4% of our portfolio with a minimal chance of running out of money.

Using 4%, a retiree would need $1-million invested to produce a steady income of $40,000 a year. Spending less, will absolutely help portfolio longevity and give stocks in your portfolio a longer time frame to run.

Our initial retirement income plan has us leveraging a mix of income streams in semi-retirement:

- Part-time work – to remain mentally engaged – in our 50s.

- Taxable but tax-efficient dividend income.

- Strategic RRSP withdrawals.

I’m not quite “there” yet in terms of other incomes streams, including TFSA withdrawals and exactly when to take those, but I’m working through that.

Generating retirement income

When it comes to you, options abound. You might have similar income streams or other ideas altogether. Remember, personal finance is personal.

I’ve had the pleasure of working with a few advice-only planners on this site and I’m happy to bring back Steve Bridge, a CFP from Vancouver for his detailed thoughts on this subject. Steve works as an advice-only financial planner with Money Coaches Canada (no affiliation with My Own Advisor). You can find him on that site for his services and you can follow him often on Twitter like I do at @SteveMoneyCoach.

Steve, welcome back to chat about this important subject!

Always a pleasure Mark. I love what you do here and I follow your journey.

Steve, you work with a lot of clients on this very subject. Typically speaking, most aspiring retirees already know the merits of using their RRSP and TFSA for wealth-building. However, what other income sources should folks consider?

Mark, there are quite a few different potential sources of retirement income and, like all things in personal finance, they vary widely from person to person.

Being in Ottawa, you might know quite a few people who work for the federal government and have defined benefit (DB) pension plans (these are growing increasingly rare in the private sector). Teachers, police, and other occupations may also have a DB plan. This can be a large source of retirement income, and in some cases, may be all you need! These pensions pay a set amount each month after retirement (the amount is based on a formula) for the rest of your life, or for a guaranteed number of years depending on which option you chose.

Mark, you shared some insights on pension plans in this post so I won’t get into all the details with your readers today. We can save any detailed discussions on pensions for a future post together.

Another common source of retirement income is a Locked-In Retirement Account (LIRA, also sometimes called a locked-in RRSP). A LIRA is a registered pension plan from a former employer that must be converted to a Life Income Fund (LIF), before the money can be withdrawn. LIF accounts have both minimum and maximum percentages (based on age and province) that can be taken out each month/year. In many cases it is advantageous to withdraw the maximum each year as it can take a long time to completely empty these accounts (plus, the entire amount remaining in the account is taxable as income at the last spouse’s passing). Alberta allows a 50% unlocking and subsequent transfer to an RRSP or RRIF, while BC does not. In Ontario, 50% can be unlocked as long as the funds are in a Schedule 1.1 life income fund (LIF).

Again Mark, you covered the topic of LIRAs and how you’ve invested in your LIRA here.

There are a few more key retirement income sources we should mention. As of February 2021, the maximum amount someone can receive at age 65 from the Canada Pension Plan (CPP) is $1,204 per month. This payment is based on how much you (and your employer) contributed to the plan during your working years and the average Canadian receives around half of the maximum, or about $600 per month ($7,200 per year).

Most of your readers probably already know that CPP can be taken as early as 60 and as late as 70 (see below for more). I know you’ve touched on this subject a few times – including this case study.

Another source of retirement income is Old Age Security (OAS). This is based on residency, so that anyone who has lived in Canada for 40 years or more from ages 18 to 65 will receive the maximum OAS of $615 per month ($7,380 per year) – current to the time of this post. Anyone who has lived in Canada for at least 10 years during that timeframe will receive a percentage of the maximum (e.g., 10 years = ¼ of the maximum).

Finally, another key income source for folks is income from a rental property. Retirees might also have income from the sale of corporation, drawing from a corporation and an inheritance.

Definitely a lot of moving parts for some people Steve! So, given many Canadians are increasingly striving to retire without the aid of a workplace pension, what advice do you typically have for clients? Is there a self-assessment exercise / budgeting exercise you would ask folks to consider??

Critical questions Mark.

One of the most important exercises anyone can go through is to figure out how much they might want to spend in retirement. As George Foreman said, “The question is not at what age I want to retire, it’s at what income.”

Figuring out how much you think you will spend in retirement is worth putting some time into. Consider:

- Fixed monthly costs (e.g., cell phones, internet, car insurance)

- Variable monthly costs (groceries, gas, eating out, etc.)

- Annual costs (property tax, car insurance, memberships, accounting fees, etc.)

- Random monthly/annual costs (clothes, gifts, travel)

- Costs that happen every few years (home furnishing, appliances, home repairs, maintenance, renovations, car replacement, etc.).

Including future expenses, or expenses that come up once in a while is important, as it will avoid being caught unprepared. For example, $50,000 in home repairs/renovations/upgrades, etc. that are done every five years would mean including $10,000 per year for these expenses ($50,000 per year divided by 5 years = $10,000)

Once you know your approximate retirement spending goal and your sources of retirement income, you are in a good position to determine whether you are on track or not. Is there a gap? If there is, what do you need to do to close that gap? Could you save more? Spend less? Work longer? Lower your retirement spending goal? Take more investment risk?

Having a long-term plan sounds critical Steve and I know we’ve discussed the elements of a comprehensive financial plan previously that thousands of my readers have appreciated.

Given the common sources of income, and budget self-exercises above Steve – what key factors should go into taking CPP now or OAS now, meaning as early as possible?

More bar room fights have been started on the topic of when to take CPP and OAS than anything else in this country. This decision depends on your specific situation, but for many (perhaps most) people, delaying these until age 70 will give them more money in the long run.

Reasons to take CPP before age 65 may include:

- If you really need the money to live off

- You have a shortened life expectancy

- You are collecting a survivor CPP

- You had a lot of drop-out or years of not contributing and are retiring early.

Your CPP article above was fantastic and touched on very important points.

Thanks for that.

Steve, what experiences do you have with clients who’d rather “take the money and run” early (with CPP and OAS) given they are bird-in-hand people? It seems there are a number of emotional decisions beyond math decisions when it comes to taking CPP and OAS early.

When it comes to financial planning, I tell my clients that there is a financial answer and a behavioural/emotional answer; deciding when to take CPP and OAS falls squarely into that category. I prepare the numbers, we’ll have a good conversation around the pros and cons, and in the end my clients get to make the final choice – the way it must be.

It’s kind of like going to the doctor and hearing advice you might not like, but that is actually in your best interest.

People should absolutely do the math and if they are unsure of when they should take CPP or have a complicated situation, then hiring someone like Doug Runchey (in your CPP article) to do the calculations for them is an excellent investment.

Some conventional financial planning wisdom has mentioned in a number of articles to keep RRSP money “until the end” – re: do not withdraw from the RRSP until you are forced to. This conventional wisdom seems flawed to me. What are your thoughts on withdrawing money from your RRSP “early”?

This is a case where it is quite often in your favour to go firmly against conventional wisdom. I come across this thought/recommendation quite often and the reasons given (often by another financial professional) raise my blood pressure.

There are a few big advantages to drawing down RRSP/RRIFs before ’the end’ (age 71/72, when it becomes mandatory).

- You can save yourself a lot of tax in your lower (or no!) income years. The ideal situation is to start drawing down any RRSP assets before you start to take CPP and OAS. Once you add in OAS and CPP (no matter when you choose to take those benefits), along with other retirement income sources, you will likely be paying more tax. Why not get RRSP/RRIF money out early when you are in a lower tax bracket and pay less tax? Even if you don’t need the income, get the money out from your RRSP/RRIF accounts and put that money into a TFSA or non-registered investment account. These early retirement /low-income years are also a good time to be removing money from LIF accounts.

- Any money left in these accounts at your passing will be taxable as income to your estate. Forget probate, this is a much bigger threat to your wealth. If someone has $1,000,000 in their RRSP/RRIF, waits until age 72 to start drawing from it and passes at age 73, they will lose almost half of their money to tax. If they have drawn as much as reasonable as early as possible, the final tax bill is much less. Yes, RRSPs/RRIFs rollover tax-free to your spouse when you pass– I am referring here to when the last spouse passes away, or when a single person dies. It can be a major estate cost.

- Those of us without a defined benefit (DB) pension or LIF can get the pension tax credit. If you convert part or all of your RRSP to a RRIF at age 65, the first $2,000 of withdrawals will qualify for the pension credit. Folks with a DB plan or LIF will already be getting this credit and can’t ‘double-dip’.

- Also, for those without a DB pension or a LIF, RRIF income can be used for income-splitting once you hit age 65.This can lower your income tax payable if you have a spouse/common-law partner.

One of the best things people can do is come up with a strategic drawdown strategy that looks at all retirement income sources.

(Mark – I considered that here with it comes to my RRSP.)

You can then determine when to take money from RRSP/RRIF accounts and how much to take each year. For this kind of help, I recommend working with an advice-only financial planner who doesn’t sell products. (I may be a little biased here but it’s true!)

Great insights.

Steve, I recognize you don’t want to be in the specific product advice business but I wanted to ask: what are your personal thoughts on total return / all-in-one ETFs to simply draw down over time?

These products seem great for asset accumulation in particular and can help retirees simplify the draw down plan as well, although there is some strategy involved there.

I wrote about some of my favourite all-in-one ETFs here.

I recall MoneySense recently had a take on Vanguard’s retirement income fund: VRIF and its 4% payout.

I am a personal big fan of all-in-one-ETFs. Globally diversified, low-cost, and automatically rebalancing – what’s not to love?! I think drawing from these along with a cash/GIC wedge is a solid strategy – you just have to watch the asset allocation, so you don’t get hit with sequence of returns risk at the wrong time.

You wrote about your plans to have a cash wedge here which I think is a great start in the right direction.

My personal situation is a bit unique. I have no company pension and my CPP will be limited (I spent quite a few years working/travelling overseas), so I am relying solely on my personal savings and investments.

At this point, I have most of my money in a globally diversified portfolio of index exchange-traded funds (ETFs), as well as some Dividend Reinvestment Plan (DRIP) stocks.

My rough plan at this point for retirement is to sell off some ETFs and DRIP stocks as I go, and also have a decent cash/GIC wedge in case markets go south for a couple of years. The cash wedge would allow me to sleep soundly knowing I could see my way through a short to medium-length correction. I’ll probably do some part-time work as well, which could be adjusted up and down as necessary.

Even a fee-only planner has to have a plan Steve! Finally, what’s the #1 piece of advice you can offer for folks trying to figure out how much they will need in retirement? Seems everyone wants to know their retirement number….

Your retirement spending number is a really important number to come up with, so I would say put some time into it. Sit down (with their partner if they have one) and start with your current monthly/annual expenses. Then think about or discuss how you see spending your time in retirement and what might be different from your current life. Leave it for a few days, come back to it and then review it again. Repeat as needed.

I would avoid the shortcut rule of thumb that says you will need 70% of your pre-retirement income once you stop working. I have had clients who need just 33% of their pre-retirement income, and others who expect to ‘need’ 125%!

Knowing your target retirement spending is the basis for a proper financial/retirement plan.

Simple yet effective Steve. Thanks so much.

We covered A LOT of material today but that was the goal. I wanted to share my own insights and those from an advice-only planner that sees these concerns and questions every single day.

I have no doubt I’ll be writing more about my own retirement income dreams and plans over time, so do stay tuned for future articles.

For additional reading on the 4% rule, retirement, income in retirement and more check out these links. I look forward to your comments as always.

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on March 15, 2021 and is republished on the Hub with his permission

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on March 15, 2021 and is republished on the Hub with his permission