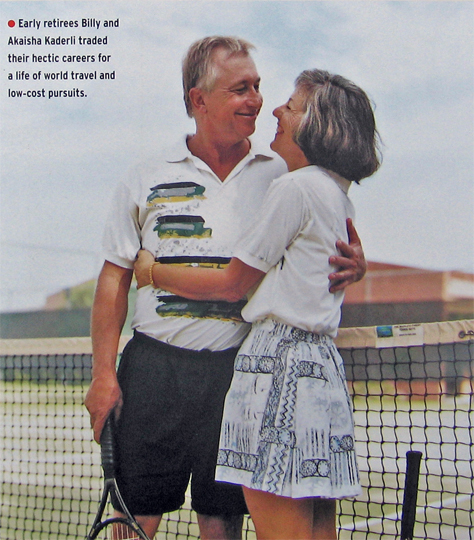

Earlier this spring, I was interviewed by Billy and Akaisha Kaderli, the globe-trotting early retirees who run the RetireEarlyLifestyle.com website and authors of several books on Early Retirement.

You can find that interview on both our web sites: here’s the version from the Hub: RetireEarlyLifestyle.com interview on Financial Independence & the “Findependent” lifestyle.

And here is the same interview at RetireEarlyLifestyle.com.

Turnabout is fair play so today, I play interviewer and Billy and Akaisha are on the hot seat to answer.

Jon Chevreau: What do you think of the term FIRE [Financial Independence/Retire Early)? You made it there in your early 30s but can Millennials, Gen X and GenZ expect to replicate your success, given the high cost of housing and everything else?

Billy & Akaisha: FIRE is a great marketing acronym filled with energy and intrigue. There was no such term when we left the working world in 1991, 33 years ago. There really wasn’t even the mental concept of being “financially independent” except for perhaps well-paid athletes, actors and trust fund babies.

We called ourselves Early Retirees, but we never retired from life, just from the conventional idea of working until age 65 or when Social Security kicks in. We had other plans for ourselves like travel, volunteer work, creative projects and continuous learning. We’ve always been productive and we like that feeling of pursuing our passions.

As for whether or not Millennials, Gen X and Gen Z can expect to become financially independent, we would say yes.

It’s a matter of discipline, focus, being aware of one’s financial choices, and most definitely finding a partner who is on the same financial page.

We have explained many times in our books and on our website that the four categories of highest spending in any household are Housing, Transportation, Taxes and Food/Dining/Entertainment. Pare down your personal infrastructure or modify your cash outlay in those categories and you will find money to invest towards your future life of freedom.

So yes, we say it can still be done.

JC: How many countries have you now visited around the world and how long do you tend to stay in any one location? Related question: do you maintain a home base in the United States and how long (and which seasons?) do you stay there each year?

Billy & Akaisha: For some reason we have never cared to count the number of countries we have visited or lived in. We travel for ourselves, not to tick off boxes or to compete with other travelers.

We have visited all throughout Europe, lived in many Asian and Pacific Rim countries, visited and lived in Canada, most of the United States, all throughout Mexico, Central America and Northern South America, and have sailed throughout the Caribbean Islands.

In the early decades of our vagabonding, we’d be gone years at a time. We made trips back to the U.S. yearly to see family for a few months at a time, but then we’d get our backpacks and world maps out again and hit the road.

We utilized Geo-arbitrage long before there was a name for that hack and found it to be one of the best financial moves we have ever made.

We do still own a manufactured home in a resort in Arizona. But while on this topic, we’d like to say that living in an Active Adult Resort Community in the U.S. has been one of the most affordable and socially satisfying options for housing we have implemented.

That being said, we have many Readers and Friends who prefer to house sit all over the world and that is their gold standard of housing choice to keep costs down.

These are two examples of modifying the category of Housing to positively affect your budget.

JC: I believe you took Social Security early. How much do you think average would-be retirees will be depending on that source of income?

Billy & Akaisha: In our case we planned our retirement as if we would not receive Social Security. We structured our portfolio to produce our needed income on its own. Now that we receive it, between dividends and SS we do not need to touch our portfolio, thus letting it grow.

In terms of other people’s dependence on SS, that will be determined by the way they organized their portfolio and the amounts they contributed over time. In our opinion, investing without depending on Social Security makes sense. That way when you receive it, you will have extra cash flow.

JC: How confident are you in its long-term viability?

Billy & Akaisha: We are very confident that Social Security will continue. We know about the funding issues; however, this is simply a math problem that can be solved.

JC: I know Billy is a veteran investor who has long believed in stocks as an asset class, especially the S&P500. Does Akaisha share that view or is she more conservative? How do you as a couple reconcile different investment perspectives, if they exist?

Billy: Since I was in the business, Akaisha feels confident to let me run our investments. I’m able to present complicated investment ideas simply, so she is able to follow my line of thinking. We keep things simple using Index ETFs and she is instructed that if anything happens to me, not to make any changes. We both are conservative investors and believe in the strength of the U.S. economy.

JC: What’s your take on annuities, given today’s rising interest rates? What age do you think retirees should consider starting to annuitize?

Billy: In my opinion, annuities are great for the sales people. Remember, I used to be one.

Annuities are loaded with fees and commissions. If you must have one use Vanguard.

However, I believe that investors would be better off annuitizing their portfolio on their own. That way they keep 100% control of their assets with much less cost.

JC: What do you think of William Bengen’s 4% Rule?

Billy & Akaisha: We retired before the 4% rule was created.

I figured out that if we spent less than we made per year, the remaining money would compound and reward us in the future, which it has.

We believe that as the 4% rule is constructed, an investor needs to modify it to reflect their personal spending, longevity and market conditions. Like in our case since we started taking social security, we have not needed to sell anything and spend way less than 4%.

Now at age 70, our risk is not spending enough.

JC: How much of a concern is health care for U.S. retirees? Do you believe in products like Long-term Care Insurance, Disability Insurance and other ways of preparing financially for our later years?

Billy & Akaisha: Our website focuses on providing options to very good questions such as these and we don’t think there is a one-size-fits-all. The answers vary depending on a person’s needs, wants and their risk tolerance, and each person must consider what is right for them. What fits best for our lives might not be the right choice for someone else.

That being said, in our decades of world travel we have seen very good medical care availability in foreign countries. We understand that most people are not inclined to utilize Medical Tourism, especially if they have children in school and if they live a traditional lifestyle.

We also think that this mindset about healthcare in general, limits people in very real ways. We have written about this extensively on our website and in our books.

For instance, Long-Term Care Insurance.

We have a Reader who purchased a Long-Term Care Plan when she was in her 30s and she is now in her mid-60s. During this time the premiums she has paid have risen ridiculously, while the plan’s coverage has significantly shrunk. What she thought she was purchasing at age 33 is not even close to what will be covered now that she is 65, and closer to needing it.

Not only that, but the reputable insurance company she was with had financial problems.

Recently she was given the option of paying another increase in premiums for 2 more years in order to get a lump sum payout at the end of these 2 years, or not pay the increase in premiums and get nothing at all.

So basically, she has been paying for over 30 years for a plan that is virtually useless to her today. She decided to pay the raised premium, take the payout at the end of the 2 years and then invest it at that time.

We think had she invested that money from the beginning and kept it separate and only for health care purposes, she would have fared far better.

In terms of Assisted Living, it is no secret that these adult home care facilities are very high priced.

According to the Genworth 2021 Cost of Care Survey, the median cost of a private room in a nursing home in the States is over $108,000 annually. Depending on where you live in the States, the annual cost of a home health aide is anywhere from $45,000 to $83,000, and annual Assisted Living costs can run from $36,000 to nearing $80,000.

Using the above figures, you are looking at spending hundreds of thousands of dollars for a couple to spend their final years in an assisted living facility or a nursing home, and a considerable amount of money is needed for in-home care if you choose to go that route.

Instead of $3,000 to $8,000 per month for assisted living in the US, one can find assisted living care in Mexico for about $24,000 – $36,000USD per year which includes rent, meals, laundry, WiFi, cable TV, transport and many times, a fitness room, a swimming pool and a nurse on site.

One example is the Blue Home located in Jocotepec, Mexico.

Or Alicia’s Convalescent Complex in La Floresta, Mexico

As another affordable option, some creative Gringos have planned ahead by building a casita on their land where a live-in caregiver can be on their property 24/7. These property owners give their help a place to live, a salary, plus meals. In return – depending on what expertise is required – the owners of the property get housekeeping, shopping, prepared meals, laundry and daily care.

One can also have a nurse or doctor come by the home regularly for check-ups, help with bathing, and medicine monitoring.

An idea for those renting apartments is to rent two apartments, one for themselves and one for their daily caregiver. Once again, lodging, meals and a salary are given in exchange for the assistance received.

For the amount of money one would spend in the United States, that same amount would purchase significant levels of comfort and care here in Mexico.

We realize not everyone is inclined to move overseas. Then again, not everyone can or wants to spend their assets to afford US pricing either. And some, for one reason or another, do not have family they can rely on to care for them when they age.

We recommend doing a bit of research. Even though it’s a difficult subject to broach, knowing there are affordable alternatives can bring peace of mind on this topic.

JC: You’ve been travelling since your 30s: do you ever foresee a time when your travel bug will go away, and if so, where would you make your home base? (US or elsewhere??)

Billy & Akaisha: Neither of us see a time when we will want to stop traveling, and we just completed over six weeks of “independent boots-on-the-ground” travel with nine home travel bases in southern Italy and Sicily. However, we realize that at age 70, nature will take its course.

While nothing is written in stone, we don’t see ourselves moving back to the States for several reasons (the general need for a car, the expense of assisted living and the complexity of U.S. healthcare as examples). Most likely, we’ll stay in our current location of Mexico where weather is great, price of living is affordable, and health care access is reasonable. Quality of life is very good.

JC: You continue to run a web site and write books. Do you still engage in other part-time forms of work that happen to bring in income? Do you ever plan to stop or slow down a bit more?

Billy & Akaisha: We consider our website and book writing – while it does bring in some income – to be our volunteer time and one of our passion projects. While it does take a commitment, when it starts to feel like work, we’ll stop it. Our retirement doesn’t depend on any income that the website generates. However, we surely enjoy the opportunity of meeting great people around the world who follow us and the platform for telling our stories. This is what keeps it fun and rewarding for us.

JC: You have thousands of subscribers (feel free to give us an exact amount if you wish): have you ever held an event where some of your community can physically meet, either in the US or abroad? Or have you used discussion forums or Zoom or similar technology to connect with this community?

Billy & Akaisha: In the “olden days” when we lived in Thailand, we had about 30 people spontaneously show up looking for us. Of course, their coming was preceded by emails letting us know they would be in town, and expressing desire to get together.

None of them knew each other, and every other night for a month, we’d hold a happy hour at our hotel Gazebo above the pool. People would come and go, meet each other, have discussions on finance, dreams of their future lives, and exchange personal contact information. Many of them went on to retire early, and you would most likely recognize their names in the ER or FIRE community.

Since then, of course we have done Zoom meetings, held interviews provided by other finance blogs, and have personally met with our Readers in various countries around the world.

It’s been a most satisfying and enriching life.

JC: Hard to argue with that! Thanks for sharing that life with your readers and ours!

Billy & Akaisha: Our pleasure!