Special to Financial Independence Hub

In the realm of personal finance, understanding where your money goes is essential for financial success. Tracking expenses provides valuable insights into spending habits and empowers individuals to align their finances with their goals. Whether you’re a seasoned budgeter or just starting your financial journey, mastering expense management is key.

Most people have multiple financial institutions, credit cards, store cards, etc., making expense tracking complicated. It’s also easy to lose track of automatic subscriptions that renew on a monthly basis, like that local gym you joined but have got out of the habit of using.

Luckily, there are tools available to simplify our ever-increasing complex financial lives. For many years Mint was a popular budgeting tool owned by Intuit. But as of March 23, 2024, Mint is being decommissioned, leaving many people searching for a free replacement.

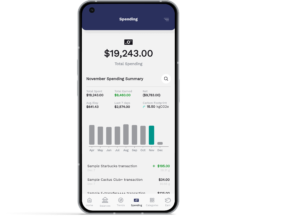

One tool that has recently launched as a replacement for Mint in Canada is Wilbur, a free budgeting app that automatically connects to your bank account. In addition, Wilbur allows people (at no obligation) to answer surveys for a little extra side cash.

The personal finance experts at Wilbur have put together the following series of tips to help people get a handle on their finances.

1.) Assess Your Accounts

Begin by reviewing your financial accounts, including bank statements and credit card transactions. Take note of recurring expenses and identify patterns in your spending. Understanding your financial habits lays the groundwork for effective expense tracking. Wilbur has a handy feature in that it automatically identifies those recurring subscriptions, giving you the necessarily information to plan for the payment or simply cancel it to save money!

2.) Categorize Your Expenses

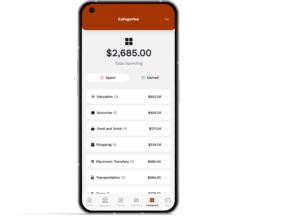

Organize your expenses into categories to gain clarity on your spending habits. Categories may include essentials like housing and utilities, as well as discretionary spending on entertainment and dining out. Utilize features in apps like Wilbur to automatically categorize transactions and simplify the process.

Organize your expenses into categories to gain clarity on your spending habits. Categories may include essentials like housing and utilities, as well as discretionary spending on entertainment and dining out. Utilize features in apps like Wilbur to automatically categorize transactions and simplify the process.

3.) Craft Your Budget with Wilbur

Once you’ve categorized your expenses, create a budget that reflects your financial priorities. Allocate funds for necessities, wants, and savings/debt repayment using the 50/30/20 budgeting method. Use the budgeting app to track expenses and set budgeting goals for each expense category.

4.) Consider a Side Gig

If you find you’re not making ends meet, find a side hustle. A survey by H&R Block in March 2023 found that 28% of Canadians had some kind of side gig. Side hustles are found everywhere, even in the Wilbur budgeting app. Wilbur offers the opportunity to earn between $1 and $5 by answering a survey, simply by clicking a link from within the app. It’s a convenient way to monetize a spare 10 minutes of your day. Clearly not going to get rich off it, but in today’s inflationary times, every little bit counts.

5.) Continuously Review and Adjust

Expense management is an ongoing process that requires regular review and adjustment. Periodically revisit your budget to assess your progress and identify areas for improvement. Look for opportunities to reduce expenses and increase savings, keeping your financial goals in mind.

In conclusion, effective expense management is essential for achieving financial stability and reaching your long-term goals. By utilizing tools like Wilbur and adopting proactive tracking methods, you can take control of your finances and pave the way for a brighter financial future. Start tracking your expenses today and embark on the path to financial wellness with confidence.

Mike Rodenburgh is Co-Founder of SquareKnot Analytics, the maker of Wilbur Budget. He has spent his career working in the marketing research industry, most recently as Executive VP of Ipsos in Canada. Wilbur is Canada’s newest 100% free budgeting app, empowering people to save money by tracking their expenses and managing their finances. Wilbur also creates the opportunity for people to earn a little side money by answering consumer surveys for cash.

Mike Rodenburgh is Co-Founder of SquareKnot Analytics, the maker of Wilbur Budget. He has spent his career working in the marketing research industry, most recently as Executive VP of Ipsos in Canada. Wilbur is Canada’s newest 100% free budgeting app, empowering people to save money by tracking their expenses and managing their finances. Wilbur also creates the opportunity for people to earn a little side money by answering consumer surveys for cash.

Mike has been in the marketing research industry for over 25 years and has held senior executive positions in client services, product development, and business development. He is an award-winning researcher, and was awarded MRIA’s “Best in Class” award in 2003 for the best overall research study in Canada, and “Best Paper” at the November 2012 ESOMAR Digital 3D Dimensions conference in Amsterdam. He is a Certified Marketing Research Professional (CMRP) and has an undergraduate degree in Political Science from McMaster University.