Special to the Financial Independence Hub

Don’t let Geopolitical Strife destroy your Investment Resolve.

This month, I was planning to write about financial planning for small- to mid-size business owners, including ways to optimize your personal and corporate tax planning. I believe many of you will find the information useful, so I promise to publish that soon.

But not now. Not after Putin invaded Ukraine. It feels wrong to go about business as usual while most of us are asking important questions about this geopolitical crisis.

By no means do our financial concerns detract from the greater, human toll. That said, if I can help you remain resolute as the world justifiably severs Russia’s access to capital markets and the global economy, perhaps we can both do our part to restore justice in Ukraine.

So, let’s talk about geopolitics and investing during wartime. Here are my key takeaways:

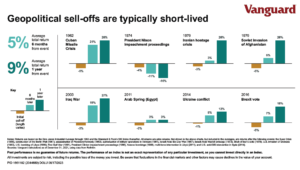

Big picture, geopolitical events’ impact on financial markets are usually short-lived

To help you keep your financial wits about you, consider Vanguard’s historical perspective on how the U.S. stock market has responded to other geopolitical crises over the past six decades. As Vanguard’s chart depicts in the article Ukraine and the Changing market environment, the turmoil has typically translated into initial sell-offs. But markets have also exhibited remarkable resilience, delivering returns in line with long-term averages as soon as six months later. That’s not to predict the same outcome this time, but it reinforces the wisdom of betting for vs. against the market’s staying powers.