My latest MoneySense Retired Money column looks at the dilemma many retirees and would-be retirees face these days: that with sky-high stock prices and interest rates seemingly bottoming and headed up, there’s no such thing as a truly “safe” investment. Click on the highlighted headline for full column: Is the All-Weather portfolio the answer to the shortage of “safe” investments?

Even supposedly safe bonds, bond funds or ETFs largely suffered losses in 2021 as interest rates seemed poised to rise: now that various central banks are starting to hike rates, such pain seems destined to continue in 2022 and beyond.

Yes, short-term bank savings accounts and GICs seem relatively safe from both stock market meltdowns and precipitous rises in interest rates, but then there’s the scourge of inflation. Even if you can get 2% annually from a GIC, if inflation is running at 4%, you’re actually losing 2% a year in real terms.

But what about those Asset Allocation ETFs that have become so popular in recent years. This site and many like it are constantly looking at products like Vanguard’s VBAL (60% stocks to 40% bonds) or similar ETFs from rivals: iShares’ XBAL or BMO’s ZBAL.

The nice feature of Asset Allocation ETFs is the automatic regular rebalancing. If stocks get too elevated, they will eventually plough back some of the gains into the bond allocation, which indeed may be cheaper as rates rise. Conversely, if stocks plummet and the bonds rise in value, the ETFs will snap up more stocks at cheaper prices.

But are these ETFs truly diversified?

True, any one of the above products will own thousands of stocks and bonds from around the world. They are geographically diversified but I’d argue that from an asset class perspective, the focus on stocks and bonds means they are lacking many other possibly non-correlated asset classes: commodities, gold and precious metals, real estate, cryptocurrencies, and inflation-linked bonds to name the major ones.

The Permanent Portfolio and the All-Weather Portfolio

I’ve always kept in mind Harry Browne’s famous Permanent Portfolio, which advocated just four asset classes in four 25% amounts: stocks for prosperity, long-term bonds for deflation, gold for inflation and cash for recessions.

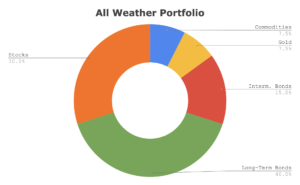

A bit more complicated is the more recent All-Weather portfolio, from American billionaire and author Ray Dalio, founder of Bridgewater Associates. You can find any number of variants of this by googling those words, or videos on YouTube.com. There’s a good book on this, Balanced Asset Allocation (by Alex Shahidi, Wiley), which makes the All-Weather portfolio its starting point.

Chapter 2 is titled “Your portfolio is not well balanced.” There, Shahidi writes that “You think your portfolio is well balanced, but it is not.” The conventional 60/40 stock/bond portfolio “is not only imbalanced but it is exceedingly out of balance.” The problem is the conventional balanced portfolio is 99% correlated to the stock market, Shahidi argues.

A typical Dalio All-Weather portfolio is only 30% in stocks: mostly US stocks. He has 7.5% in commodities, 7.5% in gold, and the rest in a combination of long-term and short-term US treasuries, and/or TIPS, or Treasury Inflation-Protected Securities, an asset class that Dalio’s firm, Bridgewater, helped the US government to develop in the first place in the mid 1990s. In the linked article, gold is played through the GLD ETF, commodities through the GSG ETF [some choose DBC], and US stocks through the VTI ETF [variants include SPY or a global stock ETF]. A 40% US long-term bond weighting is through TLT and 15% in intermediate term US bonds through IEI.

TIPS, Real Estate, Crypto and Utilities

Dalio himself tends to have much more in TIPS: inflation-linked bonds. The Canadian equivalent of TIPS are Real Return Bonds. We’ll look at these this in an upcoming MoneySense Retired Money column.

Canadians will want more Canadian exposure than Dalio’s US-oriented All Weather portfolio, especially in taxable portfolios. There are plenty of suggestions on the web for ETFs to play commodities and gold. For TIPS, you can hold the Vanguard Short-Term TIPS ETF (VTIP) or Canadian-dollar hedged short-term TIPS ETFs from BMO, iShares and others.

Some investors may want to go further and add real estate or REITs ETFs, possibly at the expense of stocks or commodities. Some argue that Utilities can substitute for commodities for those wary of that asset class. And of course, younger investors may gravitate to cryptocurrencies, perhaps at the expense of some or all of the 7.5% gold holding in the All-Weather portfolio.

Thanks for the insights! I like the idea of the All Weather portfolio and would like to add more gold to my holdings, but I have my reservations. Gold hasn’t really acted like an inflation hedge over the last year, and those that have used Bitcoin for ‘digital’ gold have seen 50% swings in value – you’d have been better off with the 2% GIC and suffering the 2% loss of purchasing power!

There’s always gold mining ETFs if you don’t like gold bullion funds. XGD, for example, and ones from Horizons and BMO.