By Paul MacDonald (Sponsor Content)

The healthcare sector has been in the spotlight as Big Pharma turns its financial and scientific resources towards a solution to the Covid-19 pandemic. Their efforts to develop a vaccine have put drug companies in a global spotlight and changed perceptions about them.

Beyond a pandemic vaccine, other positive forces are at work in the sector, during a challenging and unusual year. As lockdowns have eased, pent up demand for delayed treatments has been strong. Election year rhetoric south of the border has all but disappeared, making investors optimistic about the prospects for drug companies.

These trends have helped healthcare stocks rebound from their spring lows and the momentum should continue, says Paul MacDonald, Chief Investment Officer at Harvest Portfolios Group Inc. In a Q&A, Mr. MacDonald talked about healthcare’s long term energizers, the philosophy behind the Harvest Healthcare Leaders Income ETF (TSX:HHL) and how the ETF is benefitting from the trends.

Financial Independence Hub: Why have healthcare companies outperformed this year?

Paul MacDonald: Healthcare is what we call a superior good, which means we need it in good times and bad. That affords the sector some positive characteristics in recessions.

For example, between February 28 and April 30, 20201 broader markets were down, but healthcare was the best performing subsector in the midst of all that. The S&P 500 was down 1.12% between those dates, but healthcare was up 8.35% and has continued to advance higher since then. So it did what one would expect it to do.

What are the sector’s long-term energizers?

There are three. The first is aging populations in developed countries, which means an increasing demand for drugs and surgical procedures. This, in turn, is driving technological advances in medical devices, equipment and drugs. The third is that emerging markets are maturing, which means higher demand for basic services, including healthcare insurance.

These are ongoing and noncyclical forces.

How have attitudes changed?

We have seen Big Pharma commit a massive amount of resources towards a solution to Covid-19. That investment has the potential to change our lives for the better and has helped shift the overly negative sentiment towards them.

Coming into the year, things were different. Bernie Sanders’ proposal for a medicare for all cast a shadow over the sector. From a Canadian perspective universal healthcare makes sense, but attitudes in the U.S. are different. Their system is extraordinarily complex, with many vested interests and is resistant to radical change. Joe Biden is more of a centrist on healthcare policy so that eased concerns.

How else has the pandemic affected the sector?

Medical devices were hard hit as elective surgeries were cancelled, which has left a lot of pent up demand. If you think about it, as things recover what will you do first, buy a new TV or get your hips done? I would think hips would be top of the list. So the med techs are seeing activity pick up.

You also like managed care companies

Managed care is not something that we have in Canada. It’s effectively big U.S. insurance companies focused strictly on healthcare. These are massive companies. UnitedHealthcare Group, which is in our ETF, has a market cap of US $296 billion as at September 14, 2020. They manage insurance plans, have physicians and pharmacies they work with and offer employee health and wellness plans.

They also administer Medicare and something called Medicare Advantage, which allows you to upgrade your Medicare plan. The growth rate of their earnings per share is in the mid teens. At the same time you’ve got attractive 16 and 17 times for multiples.

So we really like the business. It has a great growth profile.

A top holding is AstraZeneca

Yes. AstraZeneca is a front runner for a Covid-19 vaccine in collaboration with Oxford University. The data looks very promising and there is a Phase 3 study underway. But it also has a diversified business, including a robust oncology platform.

Yes. AstraZeneca is a front runner for a Covid-19 vaccine in collaboration with Oxford University. The data looks very promising and there is a Phase 3 study underway. But it also has a diversified business, including a robust oncology platform.

Another example is Pfizer. It is working on a different vaccine, but it would be in the top three or four.

How does the Harvest approach the sector?

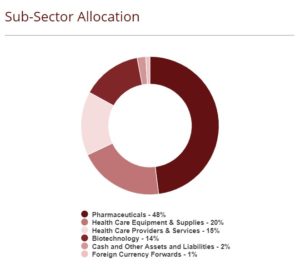

We look at healthcare as a pie and want to make sure we have exposure to each one of the pieces: medtech, biotech, services, insurance. Our universe is the largest global healthcare companies with a minimum market capitalization of US$10 billion.

As at August 31, 2020, 48% of the HHL’s holdings are in pharmaceuticals, 14% in biotechnology, 20% in healthcare equipment and supplies and 54% are healthcare providers. The ETF is equally weighted portfolio of about 20 large-cap global Healthcare companies.

As at August 31, 2020, 48% of the HHL’s holdings are in pharmaceuticals, 14% in biotechnology, 20% in healthcare equipment and supplies and 54% are healthcare providers. The ETF is equally weighted portfolio of about 20 large-cap global Healthcare companies.

They must have options trading so we can take advantage of our covered call strategy. This strategy generates income by foregoing a little bit of the upside.

What has been the big surprise this year?

I would have to say animal health. This is an area people are spending money as they return to their vets. One of our holdings is Zoetis Inc., which is involved in pet health. It has been the best performer year-to-date. It has two divisions. One is pets and companion animals and the other is livestock.

They also had a successful product launch of a drug that does fleas, tics and worms in one drug. It has exceeded expectations

How would you sum things up?

When people look at what we do, they have to ask themselves do they want large cap healthcare exposure and do they also want income? We have both and a covered call strategy which helps generate added cash flows.

1 Bloomberg total return

Paul MacDonald, CFA, serves as the Chief Investment Officer and Portfolio Manager for Harvest Exchange Traded Funds. Paul joined Harvest in January 2013 as Vice President of Investments and previously has over 16 years experience in the investment business. Paul was previously Vice President and Portfolio Manager at a Canadian asset manager where he was responsible for the management of investment portfolios, managed a Lipper Award winning Fund and was involved in developing several tax efficient fund structures.

Paul MacDonald, CFA, serves as the Chief Investment Officer and Portfolio Manager for Harvest Exchange Traded Funds. Paul joined Harvest in January 2013 as Vice President of Investments and previously has over 16 years experience in the investment business. Paul was previously Vice President and Portfolio Manager at a Canadian asset manager where he was responsible for the management of investment portfolios, managed a Lipper Award winning Fund and was involved in developing several tax efficient fund structures.

Disclaimer Commissions, management fees and expenses all may be associated with investing in HARVEST Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently and past performance may not be repeated. Tax, investment and all other decisions should be made with guidance from a qualified professional. Certain statements included in this communication constitute forward-looking statements, including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Investment Fund. The forward-looking statements are not historical facts but reflect the Fund’s, Harvest and the Manager of the Fund’s current expectations regarding future results or events. These forward looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although the Fund, Harvest and the Manager of the Fund believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. The Fund, Harvest and the Manager of the Fund undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.