By Bradley Komenda

(Sponsor Content)

Harvest Portfolios Group launched a global bond ETF in January 2020 to complement its equity ETF offerings.

The Harvest US Investment Grade Bond Plus ETF (HUIB:TSX) is managed by Boston-based Amundi Pioneer Asset Management, a subsidiary of Amundi Asset Management, a leading global manager based in France. In a Q&A, Bradley Komenda, the ETF’s portfolio manager, discusses how Amundi’s value investing approach helps guide its strategy. Mr. Komenda joined Amundi Pioneer in 2008 and is also Senior Vice President and Deputy Director of Investment Grade Corporates at the firm.

Financial Independence Hub: What is the demand for these bonds for the Canadian investor?

Bradley Komenda: Canadian bond market opportunities are pretty narrow and heavily weighted towards energy and financials. Because there is a lot of demand for these bonds, yields are less attractive than in the US.

This bond ETF gives you breadth. It is Canadian dollar hedged, but with access to top quality US, European and Global issuers. Expectations of further fiscal stimulus will all be supportive of the corporate bond market, so we think that this is where we want to be.

Q: What is Amundi Pioneer’s approach?

A: We are value investors. We invest in credits that we think over a one to three-year time horizon are going to generate a superior return. By value investing, I don’t mean buying the cheapest securities. It means trying to identify the securities that have the best risk adjusted return potential.

Q: How do you assess risk?

A: We look at risk in three ways. We look at nominal risk, which is how much we have invested in a single issuer. Then we look at the maturity of the bonds. We know that if we buy a one-year bond, it is a lot less risky than buying a 30-year. And then we look at duration times spread, (DTS) which is a way to measure the credit volatility of a bond.

Q: Where is the Harvest US Investment Grade Bond Plus ETF on the risk spectrum?

A: From an overall portfolio perspective, this bond ETF is rated low risk, and within the fixed income universe, I’d say it’s medium.

If you want lower risk, you can do a couple things. You can buy government bonds, but after inflation your purchasing power will be eroded even with longer duration bonds.

If you go for a short-term ETF, or cash, you’re going to struggle to get a yield similar to inflation. So, this ETF is for someone with patience, a one to three-year time horizon and a willingness to accept short-term volatility but with the expectation of attractive returns relative to risk-free or very short bonds.

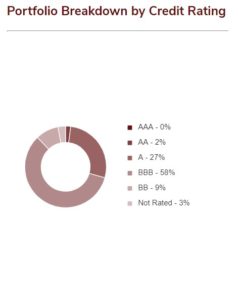

A: HUIB is concentrated in the Triple B space (BBB) or higher. The breakdown is roughly 60% BBB, 30% A or higher and 10% Non-rated.

Q: Who is the core investor for this bond ETF?

A: Anybody who wants exposure to fixed income. That’s because it has a negative correlation to stocks which means they move in different directions. If you buy a high yield fund, you’re going to get more yield, but you’re going to have a positive correlation to stock market movements.

Q: Investors worry about liquidity. How easy is this ETF to sell?

A: It’s highly liquid. We had a liquidity crisis in the corporate bond market in March of this year. The Fed stepped in and now is backstopping things by purchasing bonds as needed. It means the draw down we saw in March and early April is unlikely to occur again.

Q: What is the relative advantage of this ETF?

A: This ETF is part of our investment grade corporate bond strategy.

We have US $13.5 billion under management in this area, which allows us to be nimble in our asset allocation and security selection while our largest competitors can’t offer the same level of flexibility. That said, we are part of $1.7 trillion organization, so we have resources commensurate with other large managers. We are also able to rotate among sectors when we see opportunities. We did that earlier this year.

Q: How well-known is Amundi for its ESG policies?

A: Our parent has a proprietary system for measuring environmental, social and governance (ESG) scores. We rate over 8,000 companies. For example, in banking, we put a bigger weight on governance. For a mining company, we’ll put a bigger weight on environmental. We exclude such things as controversial weapons or human rights violations.

A: Our parent has a proprietary system for measuring environmental, social and governance (ESG) scores. We rate over 8,000 companies. For example, in banking, we put a bigger weight on governance. For a mining company, we’ll put a bigger weight on environmental. We exclude such things as controversial weapons or human rights violations.

We have 18 analysts whose sole focus is ESG ratings. They dig in and try to understand what’s driving the scores, and whether the company is taking action to improve their ESG standing.

Q: What is your interest rate outlook?

A: We think rates should drift slightly higher, but not meaningfully.

Q: What about inflation?

A: Our view is that inflation will ultimately percolate, but it is more of a longer run concern. The Fed’s bigger fear at the moment is deflation. The Fed has indicated that we will need inflation at 2 ½ per cent for a persistent period of time before they act. We think that is unlikely in the near term.

Q: In this uncertain environment should investors change their investing strategy?

A: If you have a 10-year horizon, I don’t think it warrants a significant shift. It’s a balancing act, but rates are so low that even if we get a slight drift higher in rates, we’re talking about borrowing costs that are supportive of economic expansion.

Brad Komenda is Senior Vice President, Portfolio Manager, based in Boston. He specializes in high grade and crossover analysis covering cash bond and CDS investments across Amundi Pioneer’s fixed income portfolios. Brad has been in the investment industry since 1993. Prior to joining Amundi Pioneer in 2008, Brad spent ten years as an Investment Grade and High Yield Analyst at Columbia Management. He began his career with General Electric Capital and Assurance as an investment grade and high yield research associate where he worked for five years. He holds a BA in Accounting and Business Administration from Central Washington University (1991). He is a CFA® charterholder.

Brad Komenda is Senior Vice President, Portfolio Manager, based in Boston. He specializes in high grade and crossover analysis covering cash bond and CDS investments across Amundi Pioneer’s fixed income portfolios. Brad has been in the investment industry since 1993. Prior to joining Amundi Pioneer in 2008, Brad spent ten years as an Investment Grade and High Yield Analyst at Columbia Management. He began his career with General Electric Capital and Assurance as an investment grade and high yield research associate where he worked for five years. He holds a BA in Accounting and Business Administration from Central Washington University (1991). He is a CFA® charterholder.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. Harvest ETFs are not guaranteed, their values change frequently and past performance may not be repeated. Tax, investment and all other decisions should be made with guidance from a qualified professional. Certain statements included in this communication constitute forward-looking statements, including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Investment Fund. The forward-looking statements are not historical facts but reflect the Fund’s, Harvest and the Manager of the Fund’s current expectations regarding future results or events. These forward looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although the Fund, Harvest and the Manager of the Fund believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. The Fund, Harvest and the Manager of the Fund undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.