My latest MoneySense Retired Money column takes a look at how a new Government program can be used by young people to save up tax-effectively for a first home: including the children of retirees and the almost-retired. For the full column, click on the highlighted text: How retired parents can use the FHSA to help their adult children.

The new First Home Savings Accounts [FHSA] should be operational by April 1, 2023. At least two regular bloggers who often appear here on the Hub have weighed in with summaries of the program. Dale Roberts’ take appeared on his cuthecrapinvesting blog on March 1st. Mark Seed’s myownadvisor blog ran a summary of the key points on March 4th.

For MoneySense and Retired Money, I took a bit of a different take, seeing as the column’s focus technically is on Retirees and near-retirees. These days, that category consists primarily of aging baby boomers like myself, but of course many of us have adult children who may have been slow to jump into the real estate market with home prices in places like Vancouver and the GTA soaring in recent years during the long spell of almost-free money. That era has of course ended with the Bank of Canada gradually raising rates over the past year, which has also helped to push home prices down to slightly more reasonable levels.

Whether they become even more reasonable remains to be seen but of course the positive of slightly lower prices is offset by higher mortgage rates so it’s a bit of a Hobson’s choice. You can wait and hope for the proverbial “blood in the streets” to hit home prices and make the plunge into ownership then, but there’s no guarantee that will happen.

Either way, if Ottawa is providing another tax-optimized way to save up a down payment, why not take advantage of it? We already have the RRSP home-buying program [HBP] and there’s no reason why TFSAs can’t also be used for the same purpose. What’s nice about the new FHSA is that not only does it tax-shelter investment income but it also provides a tax refund on contributions, similar to how RRSPs do so. (as the above blogs note, there are differences however.)

The Home Savings plan we all dreamt of

As quoted in the MoneySense column, CFP and RFP Matthew Ardrey, Wealth Advisor & Portfolio Manager with Toronto-based TriDelta Financial provides the following enthusiastic thumbs up for the new program: “The FHSA is the home savings plan we were all dreaming of when we first got the HBP. Combining the best aspects of the RRSP, tax deductions for contributions, and the TFSA, tax-free qualifying withdrawals, this can be a game changer for the next generation of homebuyers in Canada.”

One gambit that immediately came to my mind when the FHSA was originally announced was that you should be able to take money from a TFSA, contribute it to the FHSA, then direct the resulting tax refund to replace some of the withdrawn TFSA funds. “I see nothing that would prevent you from doing that,” Ardrey says, “You can take money out of a TFSA for anything and the room regenerates the next year.”

CFP/RFP Aaron Hector, a Private Wealth Advisor, with Calgary-based CWB Wealth, agrees: “You could absolutely withdraw money from your TFSA, and use it to fund your FHSA, then use the refund to replace a portion of the money that was withdrawn from the TFSA. As long as you are not over-contributing to your TFSA, of course.”

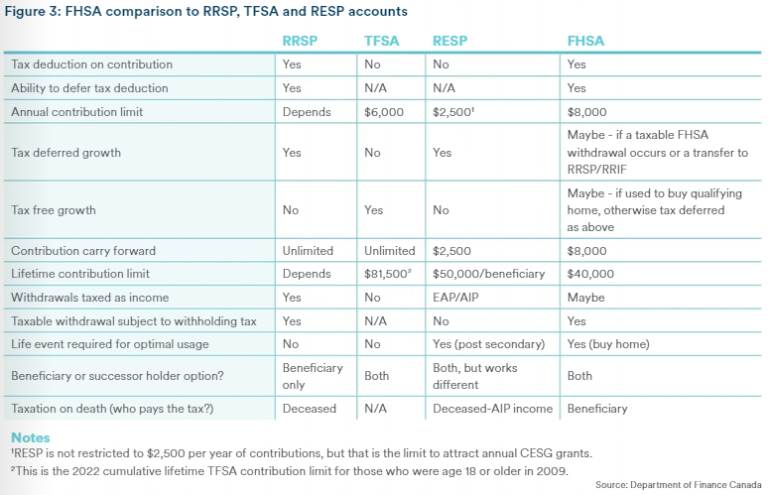

The following chart created by Hector appears in the two earlier blogs as well as in the MoneySense column. It nicely summarizes the differences and similarities between the RRSP, TFSA and FHSA, and also throws in the RESP for good measure though I find that a bit of a distraction. Note that the TFSA annual contribution limit is now $6,500 rather than $6,000. Note under the FHSA column the “Yes” that is attached to both contribution tax deductions and ability to defer the tax deduction, and the distinctions between Tax deferred growth and truly Tax free Growth, the latter a key feature of the TFSA.