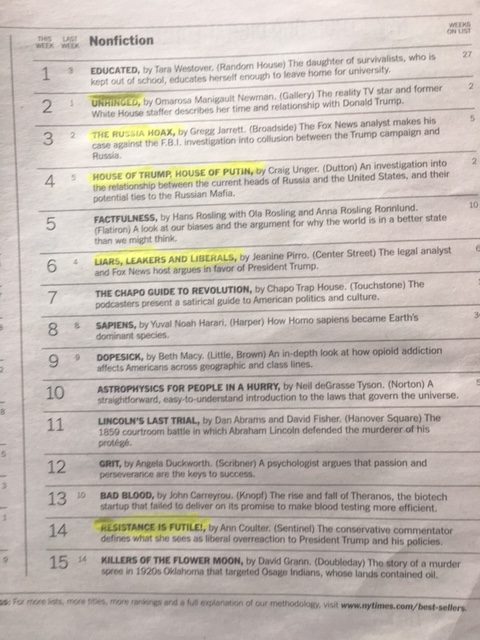

As my latest MoneySense Retired Money column recaps in depth, roughly half of the top ten New York Times bestselling non-fiction books are about the Donald Trump presidency. You can access the full column by clicking on the highlighted headline here: How Trump’s policies are affecting my investment choices.

Soon after the 2016 election that brought Trump to power, my financial advisor and I would exchange emails about the latest books: initially biographies and warnings and then in the last year the current glut of books about the actual presidency and the administration.

I’m normally a fan of biographies and love him or hate him, it’s hard to ignore the life of Donald Trump, considering that everything he says or tweets can impact us all. Yes, he may or may not be a threat to the looming Retirement of the baby boom generation of which he is on the leading edge, but his hair-trigger temper and proximity to the nuclear codes gives us something more to fear than merely our financial survival.

Some of the books I mention do give some insights into the implications of this presidency for the global economy and stock markets. Others are mere political diatribes from the left or the right, while still others are more salacious tell-alls. Stormy Daniels, I’m looking at you! (The book is titled Full Disclosure.)

As the column mentions, there are a number of books written by rabid left-wingers who are convinced Trump is a serial liar and a treasonous sellout to Russia president Vladimir Putin, but there are also several written by conservatives and republicans who are more sanguine about it all. In the latter camp I’d include Conrad Black, Ann Coulter and David Frum, plus a few titles from FOX news personalities who are obviously sympathetic with “The President,” as they like to refer to him.

Crazy crazy or Crazy like a fox?

Adjacent is the cover of the book that’s grabbed most of the world’s recent attention: Bob Woodward’s Fear. Ironically, the book is so even-handed that I didn’t feel as fearful as some of the more over-the-top titles, notably Keith Olbermann’s Trump is F*cking Crazy (That’s the way the title actually appears in print; it’s subtitled This is Not A Joke), or Bandy Lee’s The Dangerous Case of Donald Trump, a collection of essays by psychiatrists who believeTrump is actually crazy crazy as opposed to crazy like a fox.

Adjacent is the cover of the book that’s grabbed most of the world’s recent attention: Bob Woodward’s Fear. Ironically, the book is so even-handed that I didn’t feel as fearful as some of the more over-the-top titles, notably Keith Olbermann’s Trump is F*cking Crazy (That’s the way the title actually appears in print; it’s subtitled This is Not A Joke), or Bandy Lee’s The Dangerous Case of Donald Trump, a collection of essays by psychiatrists who believeTrump is actually crazy crazy as opposed to crazy like a fox.

I found James Comey’s A Higher Loyalty, to be a bit too self-serving for my liking but he does provide plenty of insight into Trump’s character during Comey’s brief tenure with him, not to mention all the pre-election controversy involving Hilary’s emails.

David Frum’s Trumpocracy: is fairly even-handed, better than Michael Wolff’s Fire & Fury, which was a quickie largely ripped from the headlines and therefore mostly old news. While largely respectful and balanced (at least compared to Olbermann and the like) Frum makes a case for the Republican party to heal itself. Conrad Black’s A President Like No Other I found to be surprisingly pro-Trump and I found it a good counterweight to all the blatantly anti-Trump books.

If all you ever read about Trump was from hysterical Liberals, you’d have long since been in cash or even a money-losing net short position. While Black doesn’t dwell on the financial implications, I was left feeling comfortable about maintaining a balanced portfolio for as long as Trump is in charge. Black has at least met Trump in person and even done business with him in the past. There you can read seemingly praiseworthy descriptions about Trump like this: “desperate cunning, unflagging determination, unshakeable self-confidence, ruthless Darwinian instincts of survival, and a sublime assurance that celebrity will heal all wounds.”

If all you ever read about Trump was from hysterical Liberals, you’d have long since been in cash or even a money-losing net short position. While Black doesn’t dwell on the financial implications, I was left feeling comfortable about maintaining a balanced portfolio for as long as Trump is in charge. Black has at least met Trump in person and even done business with him in the past. There you can read seemingly praiseworthy descriptions about Trump like this: “desperate cunning, unflagging determination, unshakeable self-confidence, ruthless Darwinian instincts of survival, and a sublime assurance that celebrity will heal all wounds.”

As for my own conclusions, I tend to believe Trump will survive the first term so don’t expect anything too dramatic until then. Emerging Markets and China are already in a bear market but Canada seems to have largely dodged the NAFTA fallout. With US markets still near all-time highs, my inclination is to keep portfolios balanced both by asset class and geography: if Trump can continue to defy the odds and the US market claws ever higher, I’d be gradually taking partial profits and rebalancing into areas already badly hit by Trump: notably Emerging Markets and China and, if it comes, Canada.

Keep in mind the markets have been confounded by Trump since Day One: except for the first half day after his unexpected electoral victory in 2016 – when many feared his very election would trigger a stock meltdown – Trump has been a boon to at least the US market. Whether it follows that they would fall if he were to leave is unknowable. But that goes for life in general and especially the future of financial markets.

Here are some of the other Trump books mentioned in the full MoneySense article but not mentioned above, with links for those who want more information:

Assholes: A Theory of Donald Trump