My latest MoneySense Retired Money column takes a more in-depth look at the Hub blog that ran earlier this month. For the full Retired Money version that ran on Friday, click on the highlighted text here: How much money do you need to retire in Canada? Is it really $1.7 million?

Both look at the widely publicized BMO poll that found Canadians now need $1.7 million to retire on average. The figure used to be $1.4 million but inflation has made it a bit tougher. Here’s the CNW newswire release from Feb. 7th.

As I mention in the MoneySense column, the Hub version was written off the top of my head and published as part of the initial news cycle. With an extra week to go to expert sources, the updated column is more nuanced and has more accurate returns projections and calculations where the first version consisted of guesstimates.

Of course, generalizations are always dangerous and that goes double for retirement planning, especially over the kind of 40-hour time horizon involved. It’s one thing to be a Millennial investor just starting out on the retirement journey and quite another to be a boomer like myself, looking back at portfolios begun three or four decades earlier. As the original Hub version commented, $1 million isn’t what it used to be. Even so, even maxing out your RRSP contributions each year will take some doing: as I wrote after my quick guesstimate, if you divide $1.7 million by 40 you get $42,400 a year that needs to be contributed each and every year, or almost twice the maximum RRSP contribution permitted even if you’re a top earner.

If you’re fortunate enough to be one half of a couple, $850,000 per spouse seems a lot more achievable. And if you have a Defined Benefit pension plan, you may not need anything else, whether from an RRSP, TFSA or non-registered savings. If you hang in to a gold-plated DB pension plan for 40 long years, odds are it alone will be the equivalent of $1 million, and possibly backstopped by taxpayers and indexed to inflation to boot.

But if you begin investing early, you won’t need to save anywhere close to $1.7 million because of investment returns that are tax-deferred inside an RRSP. Because of the time value of money, even the modest 4% compounded annual investment returns will over the course of 40 years get you to the promised land.

The Hub blog assumed investment returns of 4% per annum either from fixed income (4- or 5-year GICs) or from high-yielding dividend-paying stocks, like Canada’s bank stocks, utilities or telecom majors. In the MoneySense column, wealth advisor Matthew Ardrey of TriDelta Financial assumes a more hopeful 5% return across those asset classes.

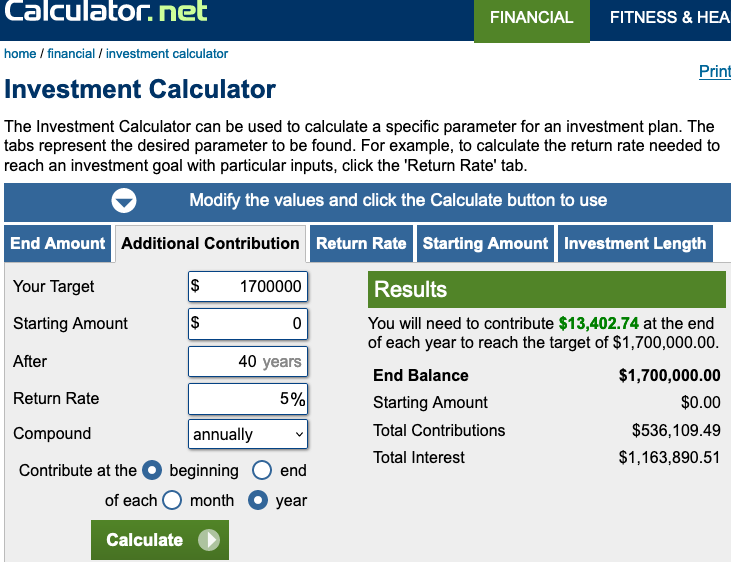

Using the retirement calculator Calculator.net, used by BMO (www.calculator.net), if you can earn a conservative 4% a year, you’d need to contribute only $17,202 (rounded) at the end of each year to reach $1.7 million after 40 years. That breaks down to $688,074 in total contributions and another $1,011,926 in interest payments.

And if you can do better than 4%, you could contribute even less and make up the difference in investment returns: at 5% a year, you’d need to contribute only $13,403 (rounded) at the end of each year to reach $1.7 million after 40 years. That breaks down to $536,110 in contributions and $1,163,891 in interest.

P.S. MyOwnAdvisor doesn’t think most need to save $1.7 million

As a postscript, I note that on his Weekend Reads feature, MyOwnAdvisor also tackled this question of $1.7 million, which ran after I had already submitted my MoneySense column on the same topic. You can find Mark’s take here, but here’s his bottom line:

Do you really need $1.7 million to retire?

I highly doubt it.

Or, maybe.

I dunno.

“It depends.”

It depends on you. I mean that!