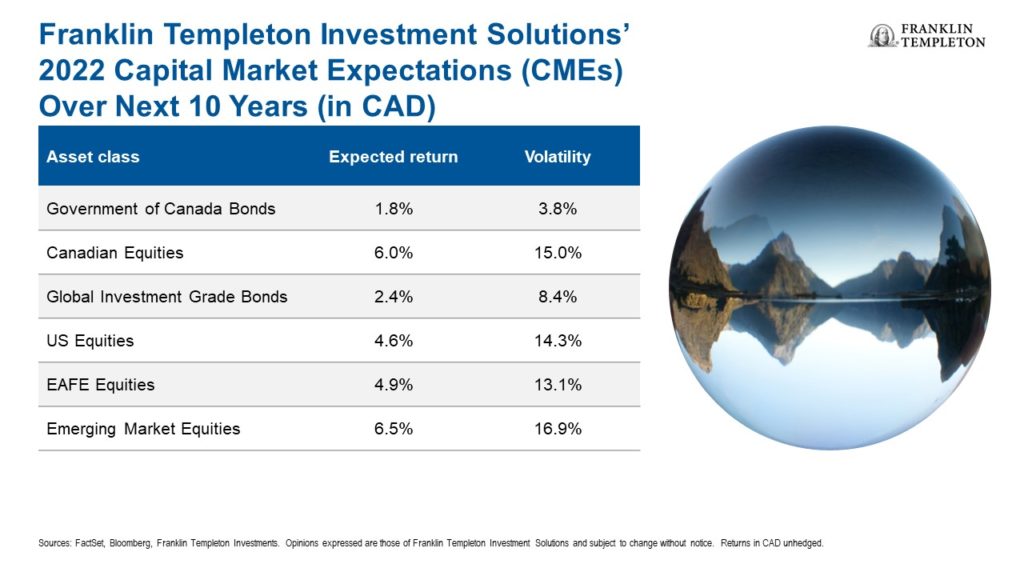

Investors should expect North American and international equities to continue to outperform bonds over the next ten years, according to senior portfolio managers for Franklin Templeton Investment Solutions. As the accompanying chart illustrates, expected returns for equities the next 10 years range from a 4.6% for US stocks to a high of 6.5% for Emerging Markets stocks. Canadian stocks are expected to do almost as well, at 6%, and EAFE equities will also outperform US stocks, with retiring expectations of 4.9%.

Investors should expect North American and international equities to continue to outperform bonds over the next ten years, according to senior portfolio managers for Franklin Templeton Investment Solutions. As the accompanying chart illustrates, expected returns for equities the next 10 years range from a 4.6% for US stocks to a high of 6.5% for Emerging Markets stocks. Canadian stocks are expected to do almost as well, at 6%, and EAFE equities will also outperform US stocks, with retiring expectations of 4.9%.

Returns for bonds are more modest: Franklin Templeton projects 1.8% return for Government of Canada Bonds and 2.4% for Global Investment Grade Bonds. The chart shows the volatility, topped by Emerging Markets at 16.9% and Canadian equities at 15%.

The forecasts were provided Tuesday at a virtual webinar at the Franklin Templeton 2022 Global Investment Outlook.

3% Global Growth should keep pace with Inflation

Over the next 7 to 10 years, the firm expects 3% annual global growth, roughly keeping up with inflation, said CFA William Yun, executive vice president for Franklin Templeton Investment Solutions. Over that time, equities should outperform fixed income and non-US equities should outperform US equities, he said.

Looking to Canada, Canadian stocks should have slightly higher expected returns, albeit with greater volatility, said Senior Vice President Ian Riach. The outperformance will be because of lower “more reasonable” valuations for Canadian stocks, he added. “We are quite positive on the Energy and Financial Services sectors.”

In October, US inflation reached a 30-year high of 6.2%, Yun said and data coming out this Friday may be in the 6% range, all of which is “a far cry from pre-Covid” levels of inflation. As a result, the firm expects inflation to be somewhat beyond “transitory,” and likely to persist at least for the next two or three quarters.

However, Yun expects inflation to moderate to 5% by mid 2022 and to fall to around 3% between mid-year and the end of 2022. Long-term it should settle at around 3%.

The biggest risk is Wage pressure, said Riach: wage growth is rising in certain sectors at the lower end but less so at the higher end.

Expect 2 or 3 small rate hikes in 2022

Riach doesn’t see interest rates at the short end rising significantly from current levels and expects no more than two or three rate hikes at most in 2022 from the Bank of Canada. Generally, he doesn’t expect the Bank of Canada to act too far ahead of the US federal reserve. Nor does it wish to derail the recovery: hence “we don’t think rates will rise too much.”

Stock prices to be fuelled by Earnings Growth

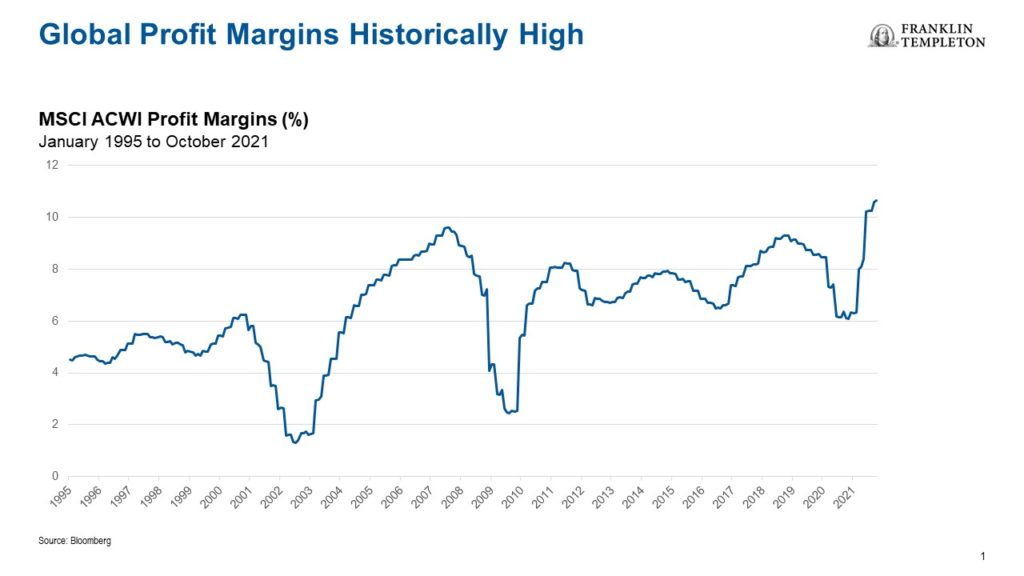

Since 2020, stock prices have been fuelled more by earnings growth than liquidity, Yun said, and showed the slide below, which demonstrates Global Profit margins are historically high when looked at between January 1995 and October 2021.

With more than $1 trillion in savings worldwide, there is pent-up demand, he added. Other positives for the market coming from the corporate side include more Capex spending, more M&A activity and share buybacks. As a result, Franklin Templeton is “still positive on equities overall.”

Here in Canada, corporate earnings growth is also positive, especially in the resources and financial sectors, Riach said. However, debt held by Canadian consumer is less healthy than their US counterparts.

Risks the next 18 months

The main risks to the outlook over the next 12 to 18 months is inflation rising or staying at current elevated levels, Yun said. Other risks include rising interest rates, further setbacks with Omicron or other Covid variants and with that the risk of more lockdowns, Yun said. Such an environment is a good one for active management, Riach said.

Trends in ESG

The second half of the Outlook webinar featured an in-depth look at new developments in ESG [Environmental, Social and Governance] investing by Professor Alex Edmans, of the London Business School.

Franklin Templeton has certainly made ESG Investing front and centre. See this recent Hub blog about how ESG also impacts investing in Fixed Income markets.

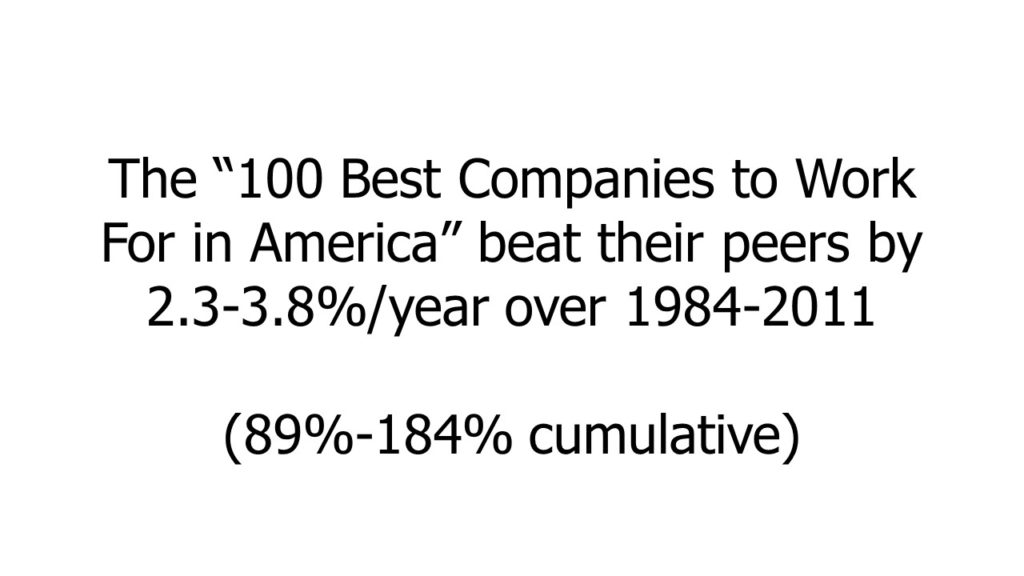

Generally, Professor Edmans made the case that investing in ESG is good not just for the world at large, but for investors too. Here’s one slide backing that up: