By Erin Allen, CIM®, BMO ETFs

(Sponsor Blog)

Introduction

The importance of asset allocation in investment management cannot be understated. Pioneering research by Brinson, Hood, and Beebower attributed over 90% of a portfolio’s performance variability to asset allocation decisions, making it the most important determinant in long-term investment outcomes1.

ETFs are remarkably effective market access tools, offering investors precision, liquidity, and cost efficiency to enhance portfolio construction.

This article explores asset allocation in depth, focusing on how Asset Allocation ETFs can serve as evidence-based approach for building resilient and diversified portfolios.

Theoretical Foundations of Asset Allocation: Modern Portfolio Theory (MPT)

Harry Markowitz’s (1952) Modern Portfolio Theory (MPT) laid the groundwork for efficient portfolio construction2, pointing out the benefits of diversification to manage risk levels. According to MPT, an optimal portfolio balances risk and return by combining assets with low or negative correlations, thereby reducing overall portfolio volatility2. This is the idea of diversification with which we are likely more than familiar, not putting all your eggs in one basket. While some investments go up, others will go down, thereby mitigating losses.

MPT allows investors to find an optimal asset mix that reflects both their return aspirations and their risk tolerance, minimizing the prospect of unexpected outcomes.

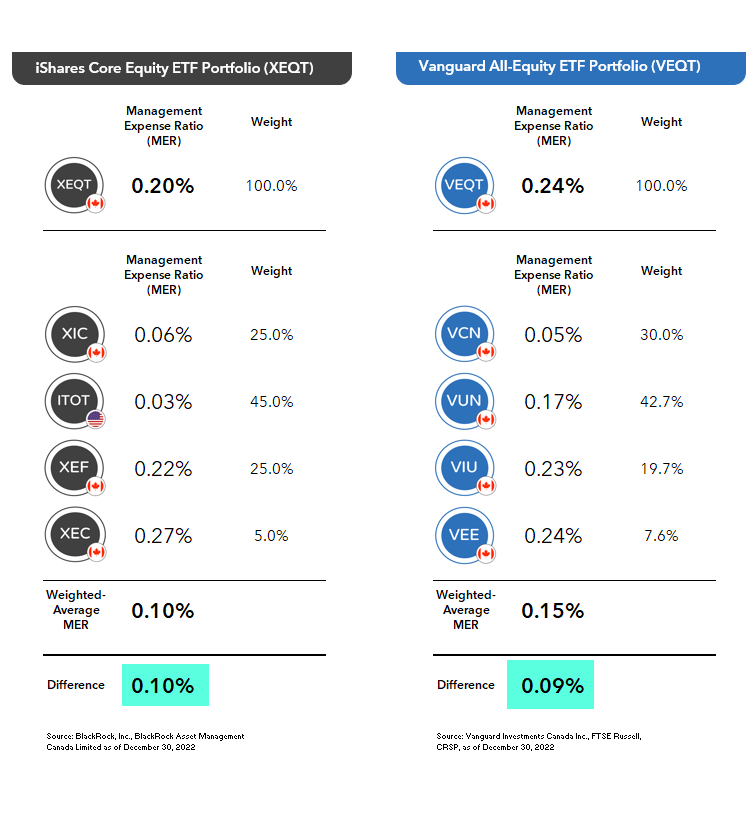

BMO’s suite of Asset Allocation ETFs, such as the BMO All Equity ETF (ZEQT), enables investors to achieve broad global diversification — a key principle of MPT — by providing exposure to multiple geographies and sectors within a single vehicle. Regular rebalancing helps to align your portfolio with your personal risk tolerance and types of assets needed to meet your financial goals.

Asset allocation decisions must align with an investor’s risk tolerance and time horizon. Younger investors with longer time horizons may favor equity-heavy allocations, while retirees may prioritize income and capital preservation through fixed-income or conservative balanced strategies.

The key here is that individual investor needs are unique, and ETFs provide the tools for investors to create the optimal portfolio for their needs or, in the case of asset allocation ETFs, to choose from a pre-set mix ranging from conservative all the way to 100% equity.

A Note on Diversification

Diversification determines the level of volatility in your portfolio. A paper by S&P Dow Jones Indices research team titled Fooled by Conviction, showed that Between 1991 and May 2016, the average volatility of returns for the S&P 500 was 15%, while the average volatility of the index’s components was 28%.3 Looking at the variability between one stock and 500 is an extreme example, but it illustrates the important point that if the typical active manager owns 100 stocks now and alters to holding only 20, the volatility of his portfolio will likely increase.

Behavioral Finance and Asset Allocation

Behavioral biases, such as loss aversion, confirmation bias or overconfidence, often lead investors to deviate from their optimal asset allocation strategy.4 Common mistakes include choosing portfolios that may be too conservative to meet their financial needs, panic selling, following the latest meme trend, or failing to strategically rebalance their portfolio over time.

It’s not about timing the market; it’s about time in the market that pays off in the long run.

Rebalancing a portfolio is another potentially daunting task for investors. You have to remember to do it on a monthly or quarterly basis, but there’s also the emotional/psychological aspect which can often get in the way. Rebalancing is essentially selling your winners and adding to your loser. Not an easy thing to do, though we all know to buy low and sell high, as the old adage goes.

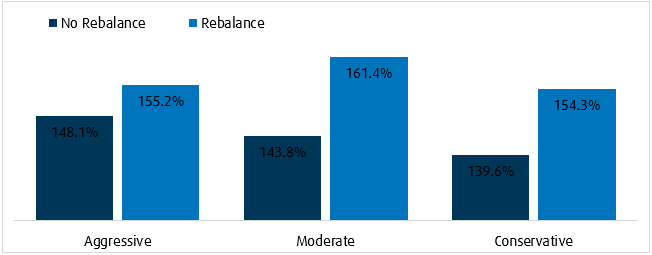

Allen Roth did a study around the benefit of rebalancing over time5. In a moderate or balanced portfolio, you can see that it added close to 20% to returns over a year period of almost 20 years. Although there is no guarantee rebalancing will add to your returns going forward, history has shown that it is effective, and it is an important risk control measure.

Investment Performance 12/31/99 – 12/31/17

Total Returns with/without Rebalance

Boosting Returns with Rebalancing, Allan Roth and etf.com, 2018 – For illustrative purposes only

An automated rebalancing facility, such as the one embedded in BMO’s Asset Allocation ETFs, can help mitigate the risks of a portfolio that becomes concentrated due to a failure to rebalance, ensuring portfolios remain aligned to their predetermined asset mix and risk levels.

A Passive Approach to Investing

Asset allocation ETFs take a strategic approach to portfolio construction, using passive index-based investing tools to build the underlying portfolio. Passive investing brings the benefits of being lower cost, efficient, diversified, and transparency to a portfolio. Here is a common misconception that is easily negated with SPIVA (Standard and Poors Index versus Active) research (SPIVA | S&P Dow Jones Indices). The evidence shows that active managers are highly cyclical but can add alpha or outperformance. In the majority of cases, however passive out-performs because it does not make predictions or assumptions. As is often said, the market, or its index, is a giant weighing machine that tracks capital movements over an economic cycle.