Special to the Financial Independence Hub

Planning the income for seniors often has the coolest opportunities to increase after-tax income.

The government pensions, CPP [Canada Pension Plan] and OAS [Old Age Security], are full of opportunities, because:

- Seniors often have flexibility in taking taxable and non-taxable income.

- OAS is subject to several “clawbacks” in addition to income tax.

To see these opportunities, you need to think creatively about pensions, tax and investments.

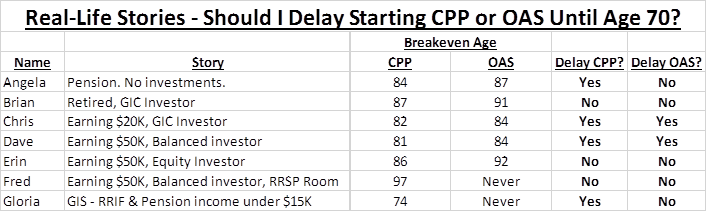

For example, in my recent article “Should I start my CPP early? – Real-Life Examples,” I found the single most important factor in whether to take CPP early before age 65 is how you invest.

Here you will see that the single most important factor in deciding whether to delay CPP after age 65 is: Will you withdraw more from your investments if you delay starting?

A quick review of the facts:

Delayed CPP Rules

- The maximum CPP benefit in 2016 at age 65 is $1,092.50 per month, or $13,110 per year.

- You can delay starting up to age 70 and you get 8.4% more for every year after age 65. If you start at age 70, you get 42% more for life, so the maximum is $18,616 per year.

- New rules in 2012 allow you to start CPP even if you are still working.

- If you are over 65 and still working, you can choose whether or not to pay into CPP.

- Your 8 lowest earning years since age 18 (plus years when you had kids under age 7) are “dropped out” in calculating how much CPP you get.

Delayed OAS Rules

- The maximum OAS benefit in 2016 at age 65 is $578.53 per month, or $6,942 per year.

- You can delay starting up to age 70 and you get 7.2% more for every year after age 65. If you start at age 70, you get 36% more for life, so the maximum is $9,442 per year.